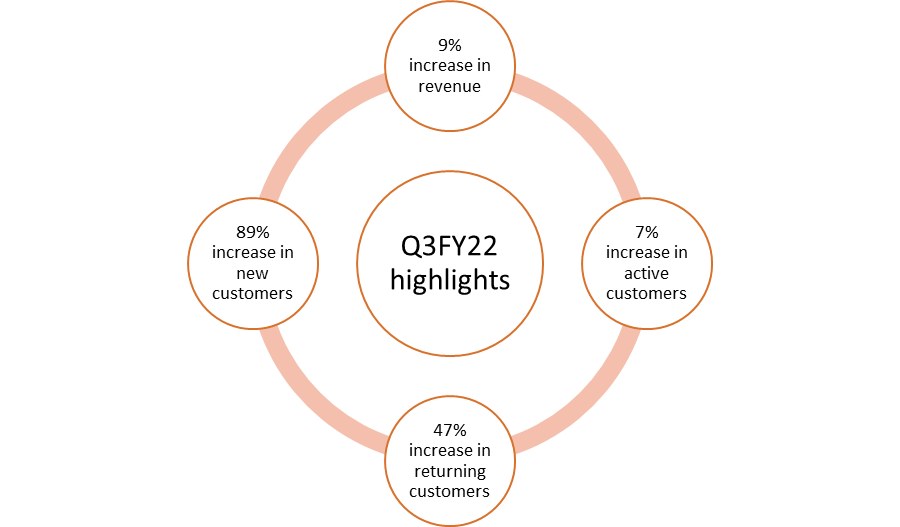

Highlights

- Adore Beauty has reported 9% increase in the third quarter revenue.

- The ASX-listed fashion retailer said that its 47% customers have ordered again in 12 months.

- Adore Beauty might launch private label products in coming days.

Shares of the Adore Beauty Group Limited (ASX:ABY) have garnered investors’ attention as the company shared the quarterly results for the year ending 31 March 2022 (Q3FY22). The online cosmetic retailer has shared a strong set of numbers in the reopening environment.

The stock of Adore Beauty was spotted trading 2.41% higher at AU$1.72 per share at 10:35 AM AEST. However, since its listing on the ASX in October 2020, the shares have declined by 75%.

Adore Beauty’s management estimates suggest that it is a leading pureplay online retailer in Australia in the beauty segment.

Suggested reading: BTH, MP1: Why have these ASX shares hit their 52-week lows?

Key financial metrics of the Adore Beauty’s Q3FY22

Image source: © 2022 Kalkine Media®

Adore Beauty’s revenue increased to AU$42.7 million in the three months, 9% higher than the previous year. Compared to the past two years, the revenue has grown by 26%. The active customers have surged to 880k in 12 months till 31 March 2022, up by 7% over a year.

Adore Beauty said that those customers who are ordering again have grown by 47% on the prior corresponding period (pcp). The company added that the growth was driven by its intent to enhance retention. Not only this, but the company also reported an 89% increase in the new customer growth compared to the previous year.

Adore Beauty informed that it has ended the quarter with a solid balance sheet that can support the growth opportunities and strategies.

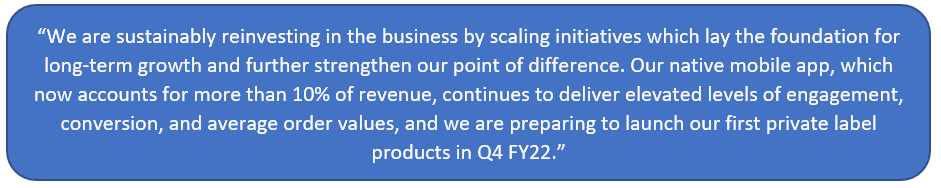

The mobile application also evolved as a money machine for the company as it contributed more than 10% of revenue in the third quarter. Moreover, the loyalty program accounted for over 60% of revenue, demonstrating the strength of the loyalty program.

Tennealle O’Shannessy, CEO of Adore Beauty, said that loyalty-focused initiatives had enabled the company to turn new customers into returning customers.

What are the growth plans of Adore Beauty?

O’Shannessy gave a brief idea about Adore Beauty’s future strategy as she said:

Private label products are generally manufactured by a third party and sold under the retailer’s name. According to the basic concept of private label products, Adore Beauty would be responsible for looking after the packaging, design and other specification of the product.

Image source: © Kantver | Megapixl.com

Adore Beauty is operating in the growing market of AU$11 billion market. To ensure that it is amongst the customers' top priority, it is enhancing its authentic content. During the third quarter, Adore Beauty launched another podcast named Makeup School. The podcasts, YouTube presence, millions of podcast downloads and strategic partnerships have contributed to the brand awareness.

Must read: ASX 200 to open higher; Wall Street rises on upbeat tech earnings