Highlights

- Raiden Resources has kicked off a heritage survey over its Mt Sholl Ni-Cu-Co-PGE Project ahead of a planned drilling operation.

- The survey will take five days to complete, covering the areas where drilling is planned.

- The company has already secured other permits for undertaking drilling operations over the project and provisionally secured a drill rig contractor.

- Drilling to following receipt the heritage survey report, which is expected within 10 business days following completion of the survey.

Raiden Resources Limited (ASX:RDN|DAX:YM4) has marked a major event with the start of a heritage survey over its Mt Sholl Ni-Cu-Co-PGE Project in the Pilbara region of Western Australia.

The survey is a prerequisite to undertake drilling over the project tenement area. RDN has already secured all other regulatory permits required to undertake its planned drilling campaign and provisionally secured a drill rig contractor.

The survey over the exploration licence area is designed to ensure the area doesn’t cover any aboriginal sacred sites of cultural significance for the native people. The regulation requires the exploration company to conduct an extensive survey in association with aboriginal members living in the area.

The objective is to prevent any damage to such sites holding significant cultural value for the native people.

Heritage Survey to pave the way for drilling at Mt Sholl

Raiden is working with the Ngarluma Aboriginal Corporation to conduct the survey, which will take five days to cover the areas planned to be explored during the upcoming drilling campaign.

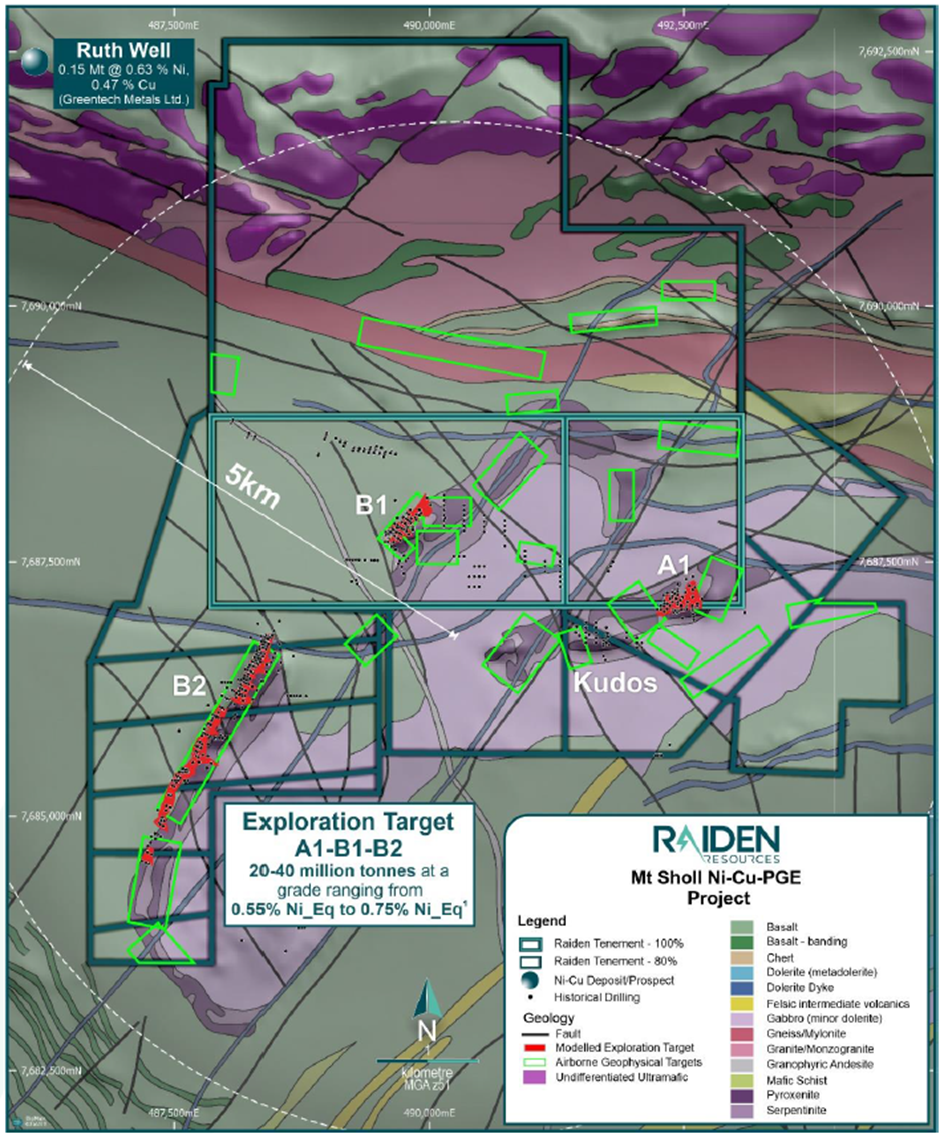

The survey will cover the A1, B1 and B2 deposits in addition to potential extensions of known mineralisation across the project tenure.

Image source: RDN update, 29 August 2022

Raiden will proceed with its drilling operations once the heritage report is received. The report will take another 10 days after the completion of the survey.

Raiden well poised to advance Mt Sholl Project

Raiden estimates that the Mt Sholl Project holds an Exploration Target of 20-40 Mt @ 0.55%-0.75% Ni_Eq. The company intends to convert the Exploration Target into a mineral resource.

Raiden plans to drill diamond holes covering 5,000m across the Mt Sholl Project, which has potential for battery metals, including nickel, cobalt, copper, and PGE metals. The previous explorers had drilled 677 holes for approximately 80,000m on the project tenement area between 1970 and 2007.

During the June 2022 quarter, the company increased its landholding by ~50% on the project. To undertake the drilling campaign and fund further exploration activities on the project, the company recently raised AU$1.83 million through a placement and options.

Raiden has received firm commitments from CPS Capital to raise AU$1,505,000 through the placement of new shares in tranches @ AU$0.007. The company will issue 215 million new fully paid ordinary shares to cover the placement.

Amid the burgeoning demand for battery metals, Raiden seems to be in a sweet spot to tap the growth opportunities offered for its Mt Sholl Project. The next leg of exploration activities on the project will depend on the results of the diamond drilling program.

RDN shares traded at AU$0.009 on 30 August 2022.