Cannindah Resources Limited (ASX:CAE) has recently reported multiple drilling successes at its flagship Mt Cannindah project. CAE has also witnessed notable developments at its Piccadilly Project.

Given the significance of the results, CAE believes that Mt Cannindah will offer a substantial amount of the target area to explore in coming months.

Let us look at how CAE fared in the June quarter.

Drilling results from Mt Cannindah drilling

The ongoing drilling at the Mt Cannindah Project is expected to locate new areas of interest, extend the existing JORC resource area along with testing the continuity of high-grade copper zones.

Significant intercepts of copper mineralisation have been delivered through current drilling at the project. Assays have been completed for hole 21CAEDD011 and the results are impressive, including [email protected]%CuEq in hole 2, [email protected] for 21CAEDD003, and [email protected]%Cu for 21CAEDD004.

Source: CAE Announcement 29/07/2022

Further, there are several other holes that were completed by CAE and partially completed that are awaiting assay.

CAE looks to continue drilling at the project in the near term to continue to establish the consistency of the copper grade and develop a better understanding of the JORC resource along with extending the size of the same.

Furthermore, CAE is looking to follow up on the possibility of the connection between mineralisation at Mt Cannindah and Cannindah East through future holes.

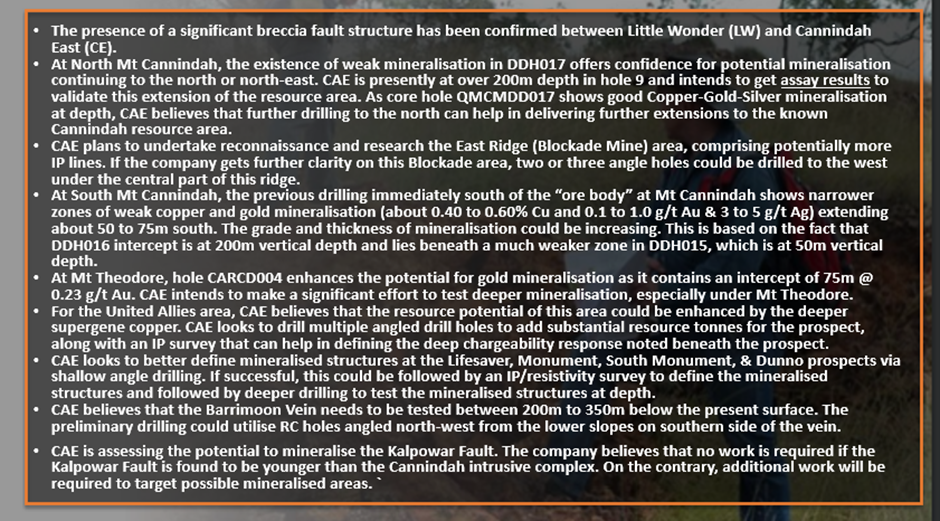

Key developments across various Mt Cannindah prospects

Advancements at the Piccadilly Project

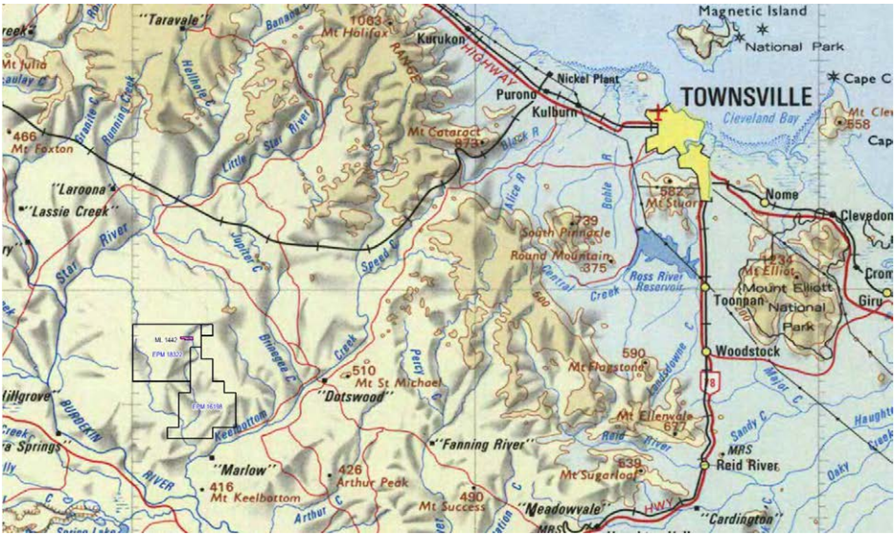

CAE believes that EPMs surrounding the mining lease at Piccadilly (ML 1442) have undergone significant exploration work. This is encouraging as CAE can review this data and complement it with the data secured from exploration conducted within the area to date.

Moreover, recent work undertaken by CAE has revealed that the mineralised area is much bigger than initially thought and runs across significant widths. CAE now has the right to explore the area for an additional 5-year period with the renewal of EPMs 16198 and 18322.

Source: CAE Announcement 29/07/2022

CAE is keen on planning the exploration of this prospective target, which is believed to share similar geochemical zoning patterns to major North Queensland intrusive-related gold systems such as Kidston, Mt Leyshon, and Mt Wright.

EPM Percy Marlow

CAE’s EPM Percy Marlow is adjacent to the Piccadilly project and comprises granted EPMs 18322, 16198 and ML1442.

The company plans to use proven surface geochemical exploration methods for its exploration approach in the area. Also, initial exploration work will be directed to drill test the targets that could have been improved through electrical geophysics (IP and EM).

Given the pre-existing knowledge base and data sets, CAE believes that there is a high possibility for it to discover the economic benefit to the Queensland region.

CAE strengthens its cash position

CAE raised AU$1 million via a placement to finance the drilling work. The company believes that it is adequately funded for its proposed and present programs across both projects.

As at the end of the June quarter, CAE remained debt-free, and the company’s cash balance stood at AU$0.86 million.