Gold exploration and development company, Ora Banda Limited (ASX: OBM) has announced initial assay results from its Callion Resource Definition Drilling Program, which is primarily focussed on delineating both an open pit and an underground Mineral Resource.

A total of 46 RC holes (5,962 metres) and 15 diamond tails (1,689 metres) have been completed in Phase 1 of the Callion drilling program.

Open Pit target results returned to date include:

- 0 m @ 8.0 g/t from 76 m;

- 0 m @ 3.3 g/t from 73 m.

Hole CNRC19002 has been particularly significant in the open pit drilling program, as it returned 10.0m @ 8.0 g/t from 76 metre having targeted and successfully intersecting a high-grade shoot that remains the primary focus of the open pit cut back target.

Underground target results returned to date include:

- 8 m @ 34.4 g/t from 232 m, including 0.3 m @ 498.2g/t;

- 2 m @ 15.7 g/t from 220 m.

Of significance in the underground diamond drilling program is hole CNDD19015 that returned 4.8m @ 34.4g/t from 232 metres. The hole targeted and successfully intersected the down plunge continuation of the high-grade shoot associated with the historical main underground mining area. The overall shoot plunge continuation at depth remains a focus for future exploration works.

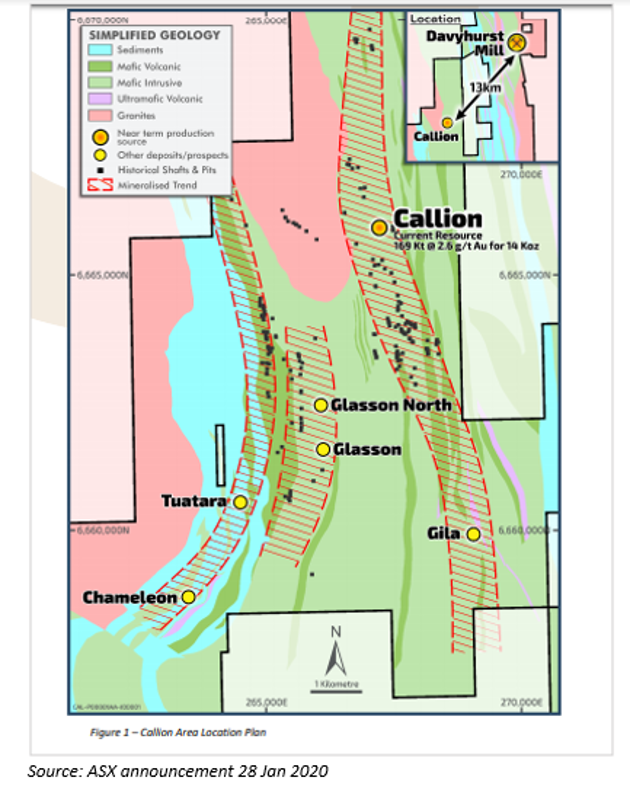

About the Callion Deposit

The Callion Deposit, located 13 km south-west of the Davyhurst Processing plant, has been mined underground by various operators since the early 1900s, with more substantial development undertaken by Western Mining Corporation during 1934-1959. Later in the 1980s, additional underground activity and open pit mining works were undertaken by the Callion JV prior to a second round of open pit development by Croesus in 2004-2005.

Currently, the Callion open pit is ~650-metre-long and ~40-metre-deep, with the underground workings extending off the southern end of the pit to a vertical depth of 220 metre below surface. The deepest high-grade diamond drill hole result recorded from Callion to date (CS6W1 – 10.5m @ 17.2 g/t) sits nearly 420 metre vertically below surface and ~200 metre vertically below the base of the existing mine workings.

The total recorded historic production for Callion stands at 280Kt @ 10.2 g/t for 91,650 ounces of contained gold (open pit - 135Kt @ 4.1g/t for 17.6koz and underground – 146Kt @ 15.8g/t for 74Koz)

Callion has a published Mineral Resource of 169Kt @ 2.6 g/t for 14,000 contained ounces of gold.

Going forward, Ora Banda’s conceptual plan for the Callion deposit includes an open pit cut back, re- establishing access to existing underground mine workings, rehabilitating existing underground mine development where required to extract a number of high-grade zones that remain within the historical mine and the development and extraction of new high grade areas below the existing mine workings.

Besides, a Mineral Resource upgrade that includes both open pit and underground potential remains a key focus for this deposit. Upgrading of Callion resource model has already commenced.

“These initial results are consistent with the Company’s development objectives for Callion. We are targeting Callion as it is historically known for its high-grade potential. We are pleased to see this is holding true in the results that have been returned. We look forward to receiving the remaining assay results and progressing with the Mineral Resource update.” -David Quinlivan, Ora Banda‘s Managing Director.

Good Read: Looking back on Gold explorer, Ora Banda Mining’s performance in 2019

Stock Performance: Ora Banda has a market capitalisation of ~ AUD 99.69 million with ~ 586.42 million shares outstanding. On 28 January 2020, the OBM stock settled the day’s trading at AUD 0.175. OBM has delivered a positive return of 17.24% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.