Perth, Australia-based gold exploration and development company, Ora Banda Mining Limited (ASX:OBM) has had a successful calendar year 2019 in line with its plans. The company emerged in a significantly stronger position after its $30 million recapitalisation process was completed in June 2019, in addition to a large marketing campaign across the Australia, Hong Kong, United Kingdom, the United States, Switzerland and Canada.

This marked a new dawn for Ora Banda as it launched an extensive drilling and exploration program at its expansive land tenure encompassing six projects (100% owned) covering 112 tenements spanning ~1,336 km2 across a 200 km strike on the greenstone belt of Western Australia.

OBM’s Project Portfolio

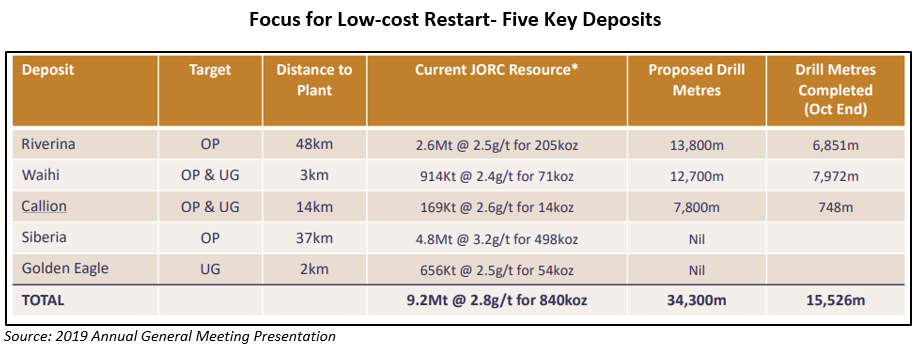

The company’s initial focus has been on five well analysed and advance deposits being Waihi, Riverina, Callion, Siberia and Golden Eagle, in different project areas.

The company also owns a gold processing facility (Davyhurst Processing Plant @1.2Mtpa), for which the recommissioning costs is as low as $ 8.5 million (EPCM basis) and the work is expected to take less than 6 months. Apart from that, there is also other conducive infrastructure present in the vicinity such as large bore field extensive road network, power line into the sites, 160-man camp, workshops, airstrip and admin buildings, to facilitate commencement of production in the near-term.

Ora Banda Mining’s current activities include infill and extensional drilling of the high priority deposits that present a great near-term production opportunity as well as a regional exploration program involving examination of other advanced prospects. Thereafter, the company plans to develop a well-defined 5-year mine plan for both open pit and underground operations.

Of the five priority deposits, drilling results from Riverina, Waihi and Siberia have particularly been fuelling Ora Banda’s momentum forward.

- Riverina: The Phase 1 of initial 6,267-metre Resource Definition Drilling Program at Riverina was recently concluded and resulted in the upgradation of total Mineral Resource to 3.8Mt @ 2.3 g/t for 278k ounces of contained gold including an open pit Mineral Resource of 3.1Mt @ 1.8 g/t Au for 183 ounces of contained gold. The program further enhanced the potential of this advanced prospect.

Presently, Metallurgical and Geotechnical studies are being progressed by the company to further build on the current knowledge base for Riverina. A Feasibility Study to assess economic viability for the proposed open pit operation is also underway while Environmental Studies are also being advanced to obtain mandatory approvals to proceed forward.

- Siberia: Ora Banda reported on 12 November 2019 that an independent and internationally recognised mining consultancy, Entech Pty Ltd, had completed a re-optimisation and design review of Siberia which includes the Sand King and Missouri open pits. Entech estimated the Open Pit Ore Reserve estimate for the two being 2,800,000 tonnes at LOM average grade of 2.3 g/t Au for 210,000 ounces Au, marking a 42% increase in the open pit Ore Reserve at Siberia on a whole, relative to the Ore Reserve estimate delivered in 2017.

- Waihi: New results were released on 22 November from the Phase 1 Resource Definition Drilling Program at Waihi that focussed on delineation and upgradation of an optimal open pit Mineral Resource and testing potential for further open pit and underground resource extensions at depth. This advanced target continues to impress with a near mine exploration program currently being planned for the same.

David Quinlivan, MD at Ora Banda had stated in an announcement that the company was highly pleased with the high-grade drilling results at Waihi and stay keen to pursue some of the significant intersections that remain open for possible mineralised extensions.

For the Callion deposit, which has a history of production results, the company has high hopes for future explorations with a proposed 1,200m of diamond drilling and ~7,800m of reverse circulation drilling being currently budgeted. Another great prospect, Golden Eagle has a present mineral resource of 656Kt @ 2.5g/t for 54koz while there is a planned drilling program for the same that will infill the current resource to upgrade to JORC 2012 standards and an initial reserve estimate will be delivered thereafter.

Ora Banda has envisioned to produce approximately 100,000 oz of gold per annuum from 2021 onward.

2019 has been a rewarding year for gold investors with gold price appreciating over 20% thus brining investors’ attention on companies engaged in the exploration/mining of this safe haven commodity.

Stock Performance: Ora Banda Mining has a market capitalisation of ~ AUD 105.56 million with ~ 586.42 million shares outstanding. On 10 January 2020, the OBM stock settled the day’s trading at AUD 0.185, zooming up 2.78% by AUD 0.005 with ~ 153,274 shares traded.

OBM has delivered impressive positive returns of 50% in the last six months and 12.50% in the last one month to kits shareholders.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.