Provider of revolutionary anti-counterfeit and retail engagement solutions, YPB Group Ltd (ASX: YBP) has now achieved a major technical breakthrough in the development of its smartphone technology, Motif Micro.

In an update provided on 12 September 2019, YPB Group confirmed that it had accomplished smartphone readability of a high-security verification mark under âreal worldâ settings, a world-first achievement, opening the mass consumer goods markets to YPB. Post this announcement, the companyâs stock skyrocketed by 40% on ASX by the end of dayâs trade.

What is Motif Micro?

Motif Micro is an MIT patented technology for which YPB owns the global licencing rights. The technology involves nanoparticles that can be applied to or embedded in a range of materials such as cardboards, paper, plastics and inks. and thus, all manner of product packaging that allows the smartphone to determine if the Motif Micro material is present or not.

Motif Micro Smartphone Readability Breakthrough

Last year, the Motif Micro readability was achieved on flat surfaces with the iPhone held directly against the material being read and that in itself was a major technical achievement and a worldwide breakthrough. The company has now overcome the restrictions of holding the phone flat against the surface and has achieved smartphone readability of a high security authentication mark under âreal worldâ conditions, and as per YPB Group CEO John Houston, this is a tremendous work achieved by the companyâs technical team led by Dr Paul Bisso.

As most consumer good products of interest to YPB have curved surfaces, the ability to read the tracer on a curved surface is surely increasing the commerciality of the technology as well as expanding YPBâs addressable market. For product demonstration, visit here.

YPB Group believes that the Motif Micro smartphone readability breakthrough will allow it to create a next generation digital marketing channel to every consumerâs pocket or purse. The curved surface readability is paving the way for initial commercialisation of a YES/NO authentication mark applicable to most forms of product packaging.

At the latest annual general meeting, the chairman had highlighted that the number of parties in several regions have expressed interest in working with the company to accelerate the development of the Motif Micro technology.

As previously advised by the company, the commercial launch of this solution is planned in the second half of 2019.

The company has made various key technical advances, which include:

- Successful confirmation of authentication mark with unmodified smartphone

- Smartphone readability under normal artificial lighting

- Capability to scan at a distance

- Readability even when printed on curved surfaces, such as bottle caps and labels

Major Highlights

- YPB achieved smartphone readability of a high security authentication mark under âreal worldâ conditions

- Ability to read the tracer on a curved surface to increase YPBâs addressable market

- Commercial launch of the solution is on track to meet the target of H2 2019

Curved surface readability will open the mass consumer goods market to YPB by offering brands direct consumer engagement powered by assured product authentication.

The company understands the power of authenticity to drive willing engagement and its smartphone solution empowers brands and consumers to engage over a new, low-cost digital channel.

CEO Comments

Describing smartphone readability as the Holy Grail of anti-counterfeit, CEO John Houston stated that this technology can be deployed immediately and comprehensively at negligible cost via the ubiquity of smartphones.

Peek into Motif Microâs Technology

Advanced proprietary rare earths material is used as a tracer material. A customer trained machine learning model is running on the Amazon Web Services SageMaker, thus taking the âsmartsâ for the ProtectCode app from mobile phone to cloud.

This remarkable feat is backed by machine learning. At present, the app is running only on IOS. However, with minor technical changes, the company is confident of adapting to the android platform as well.

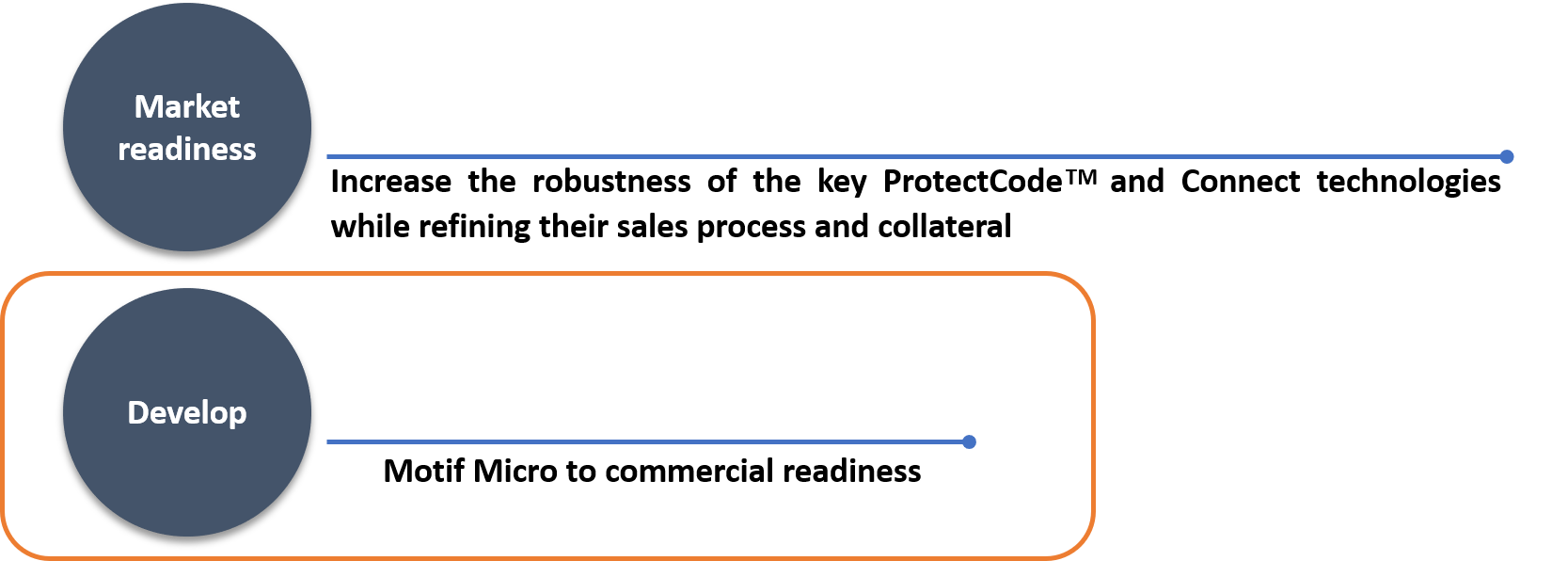

Developing Motif Micro to commercial readiness is one of the five key elements of the companyâs refreshed operating plan.

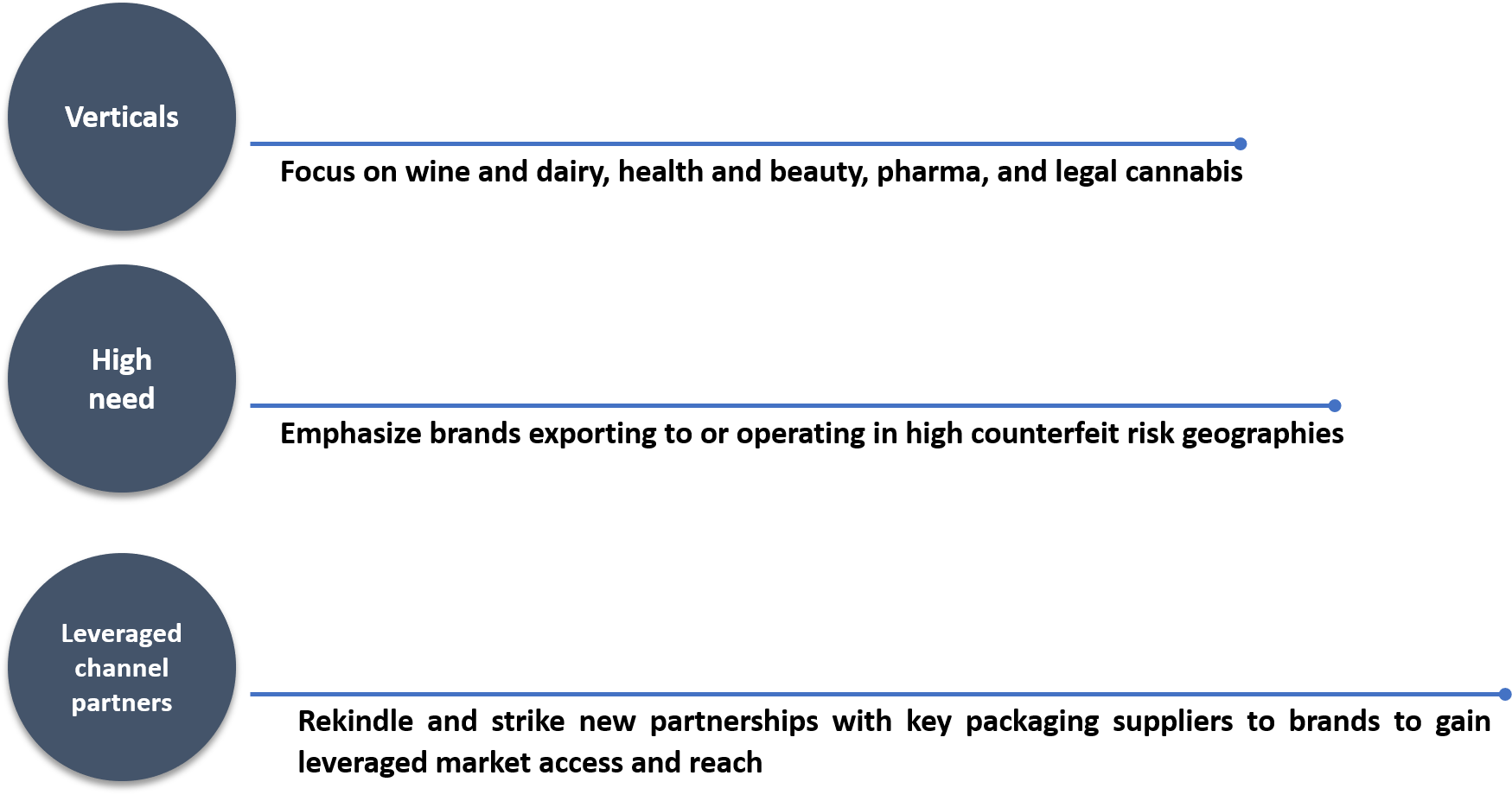

Five key elements of the refreshed operating plan:

Recently, the company made inroads into its strategy to focus on pharma and health products, as it signed a new three-year Master Supply Agreement (MSA) with leading Indonesian pharmaceutical and wellness company PT Combiphar, with the anticipation of earning revenue of around A$1million over the three-year life.

In the past few months, the company has come up with major updates, highlighting significant operational progress.

Recent Updates

- Extended and expanded its close collaboration with Combiphar by signing a new three-year Master Supply Agreement (MSA) with PT Combiphar;

- Achieved a significant milestone by reaching 100 million ProtectCodesTM issued on the YPB Connect platform

- Master Supply Agreement signed with cannabis extraction specialist Halo Labs

- Raised A$1.6 million via an over-subscribed new equity placement at 0.714 cents, a 25% discount to the 15-day VWAP

- Co-launch of Vintail with Seppeltsfield Wines

At market close on 12 September 2019, YPBâs stock settled at a price of $0.007 with a market capitalisation of circa $5.75 million.

More on YPBâs Motif Micro could be understood here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.