Summary

- Fitch Ratings revised the rating outlook of US life and health insurance sector from stable to negative in May this year.

- The Pandemic Risk Insurance Act is on the horizon, which is aimed at minimizing the impact that a re-occurrence of COVID-19 and potential pandemics would have on the US economy.

- Chubb Limited has urged the US government and insurance companies to work together to cover potential business-interruption losses from future pandemics.

The emergence of COVID-19 crisis has ignited a debate over the importance of public private partnership in the insurance industry to mitigate the risks associated with the pandemic. Introduction of the Pandemic Risk Insurance Act in May 2020 by Congresswoman has further sparked the discussions regarding role of public sector in cushioning private insurers from devastating effects of the pandemic.

With insurers playing a crucial role amid COVID-19 to support households and businesses manage losses, insurance players are at risk of suffering liquidity constraints and cash crunch. The unprecedented challenges being thrown up by the pandemic could potentially stimulate demand for insurance claims while also expanding lawsuit over payout disputes.

According to Fitch Ratings, North American insurance companies face key vulnerabilities and possibly unforeseen downside risks from pandemic fallout, including increased mortality risk, potential issuer defaults and elevated claims. The credit rating agency revised the rating outlook of US life and health insurance sector from stable to negative in May this year, highlighting its risk exposure to volatility in capital markets.

Besides, the credit rating agency perceives the US life sector’s 2020 outlook vulnerable to macroeconomic uncertainty, late-cycle credit market conditions and slowing economic growth.

Insurance Stocks Underperformed S&P/500

In June this year, the American Property Casualty Insurance Association warned that the coronavirus pandemic could cost insurers USD 255 billion to USD 431 billion a month in case they are required to compensate businesses for income losses and expenses incurred amid virus lockdowns. This could wreak havoc in the insurance industry, making insurers insolvent.

The COVID-19 driven shutdowns have already delivered a massive blow to insurance stocks amid mounting investors’ concerns over potential liabilities of insurance players.

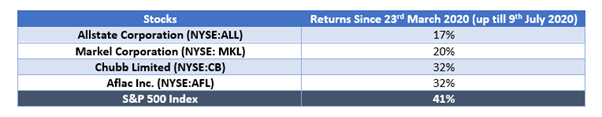

Consequently, several insurance stocks have underperformed the broader S&P/500 index in reviving from March 2020 crash, including Allstate Corporation (NYSE:ALL), Chubb Limited (NYSE:CB), Markel Corporation (NYSE:MKL), and Aflac Inc. (NYSE:AFL).

Riding against the tide, MetLife, Inc (NYSE:MET) has delivered a return of about 50 per cent since March 2020 crash. The life insurance company has lately declared a common stock dividend of USD 0.46 per share for Q3 2020, payable on 14th September 2020.

Can Public-Private Partnership Mitigate Potential Risks?

Congresswoman Carolyn Maloney drafted a Pandemic Risk Insurance Act (PRIA) 2020 in May this year, which would enable insurers to cover pandemic-linked business interruption claims with the US government offering cover of up to 95 per cent of losses experienced by insurers in particular instances.

The public-private partnership between the US government and private insurers is aimed at minimizing the impact that a re-occurrence of COVID-19 and potential pandemics would have on the US economy. While a legislation to establish PRIA remains under review, insurance players have demanded the US government to compensate businesses suffered by viral outbreaks.

Akin to the US, the German insurance industry has also lately established a public-private partnership model to offer protection against potential pandemics. The initiative has been launched against the backdrop of significant economic impact produced by coronavirus outbreak.

Chubb Urges for Public-Private Partnership

NYSE-listed insurance player, Chubb Limited has urged the US government and insurance companies to work together to cover potential business-interruption losses from future pandemics. Recognising the needs of small and medium enterprises, the Company has proposed a Pandemic Business Interruption Program that can be executed prior to the next pandemic.

The program’s total capacity is estimated at ~USD 1.15 trillion, comprising an aggregate limit of USD 400 billion for medium to large-sized businesses and $750 billion for small businesses.

The Company pointed out that some risks, including pandemics and nuclear accidents, generate very huge losses that are non-insurable in the private insurance market in the absence of significant government support. The objective of the Company’s proposed program is to deliver immediate cash to small businesses so that they can resume paying employees and ongoing business expenses, thus limiting economic disruption.

With US insurers largely dismissing claims for losses triggered by COVID-19 lockdowns, the public-private partnership can potentially help in easing the burden of private insurers in difficult junctures. On the flip side, the move can also widen the debt of the US government, which is already spending multi-billion dollars to aid corporates and households from virus crisis.