Summary

- Significant decline in investment income led to a fall in net profit after tax of the Australian Insurance industry.

- During the first quarter of CY 2020, the insurance industry was under a heavy burden with thousands of claims worth over $4.6 billion relating to bushfire losses.

- Despite the COVID-19 pandemic disruptions, QBE cemented its trading performance during Q1 FY20.

- Suncorp announced a new operating model and leadership structure to generate further improvement in its core insurance and banking businesses.

The insurance industry of Australia provides various life insurance, property and casualty, and health insurance coverage to both businesses and individuals. All Life Insurance companies registered under the Life Insurance Act in Australia are regulated by the Australian Prudential Regulatory Authority, and the interest of general insurance industry is being represented by the Insurance Council of Australia (ICA).

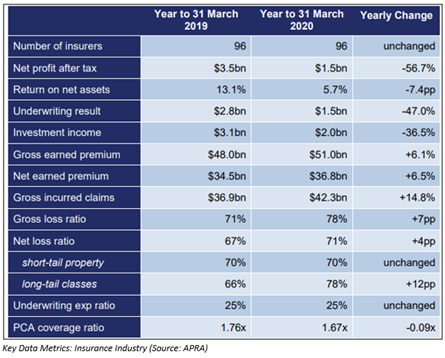

As per the March 2020 statistics of Australian Prudential Regulatory Authority, the general insurance industry of Australia made gross written premium amounting to $51 billion a year with $133.8 billion worth of total assets. For the year ended March 2020, net profit after tax of the industry amounted to $1.5 billion with return on net assets of 5.7%, which were significantly lower during the year. This was mainly because of lower underwriting results from the catastrophic bushfire as well as storm events in late December/early 2020. The decline in the results was also due to the substantial drop in investment income from the impacts of COVID-19 in the March 2020 quarter. PCA (Prescribed Capital Amount) coverage ratio of the industry witnessed a fall from 1.76x to 1.67x during the period.

RELATED: Casting an eye on Insurance Industry

How can we know which insurance company is worth looking at?

To analyse an insurance company, one can look for the following key performance indicators to get insights on the strength of the Company:

- Embedded Value: Embedded Value is a tool to assess a Life insurance Company’s value, which indicates anticipates profitability from the present underwritten policies and the current net worth.

- Persistency Ratio: This ratio reflects how long customers stay with their respective policies.

- Solvency Ratio: This metric is vital as it shows how an insurance Company’s financial situation is (good or bad) based on defined solvency norms.

In this article, we will look at the performance of three ASX-listed insurance companies with their recent updates:

QBE Insurance Group Limited (ASX:QBE)

Sydney-headquartered insurance firm QBE Insurance Group Limited provides specialty, commercial and personal products & services to its customers. Recently, the Company announced a consent solicitation to the holders of its Perpetual Fixed Rate Capital Note worth US$400 million. To provide solicitation, the Company is requesting the holders’ approval to amend the Capital Notes terms. The Company had also completed its share purchase plan on 11 May 2020.

A Look at Trading Performance of Q1 FY20:

- Insurance trading conditions across the Group has strengthened during Q1 FY20 despite the disruption caused by the COVID-19 pandemic.

- During Q1 FY20, the Company reported a group-wide premium rate increases averaged of 8% (Q1 FY19: 4%). Gross written premium for the period went up by over 9% to US$4,533 million, indicating an increase in premium rate along with robust volume growth assisted by improved retention in every division.

At the close of the session on 8 July 2020, the stock of QBE stood at $9.580 per share with a decline of 1.237%. QBE has generated returns of 1.46% and 9.60% during the last one and three months, respectively.

Insurance Australia Group Limited (ASX:IAG)

Insurance Australia Group Limited provides general insurance, which includes a full range of personal and commercial insurance products. On 4 May 2020, the Company provided a market update for the year ending 30 June 2020, wherein it stated that there is limited scope to pay a final dividend in September 2020 on the back of year-to-date investment income outcomes and its forecast FY20 insurance profit. The Board of the Company would determine the quantum of any final dividend in August 2020 in line with its normal timetable.

At the end of April 2020, the investment income on shareholders’ funds of the Company amounted to a financial loss (year-to-date) of around $280 million pre-tax, which indicates the severe corrections witnessed in the 2H Y20 in equity and credit markets. IAG’s underlying business performance was steady during the nine months ended 31 March 2020.

DO READ: How these Insurance stocks are performing amid COVID-19?

The Company has retained its existing FY20 market guidance of gross written premium growth in the low single-digit and a reported insurance margin of 12.5% to 14.5%, depending on the impact of the COVID-19 related uncertainties, the surrounding economic condition, and the direction of investment markets.

At the close of the session on 8 July 2020, the stock of IAG stood at $5.7000 per share with a decline of 1.384%. IAG has generated returns of -6.92% and -6.62% during the last one and three months, respectively.

Suncorp Group Limited (ASX:SUN)

Suncorp Group Limited is engaged in the provisioning of banking, insurance, wealth and other financial solutions to retail, corporate and commercial sectors. Recently, the Company announced a new operating model and leadership structure to generate further improvement in its core insurance and banking businesses as well as to ramp up its digital and data-driven transformation. This new model includes the following:

- Accountability for the performance of insurance to be assumed by two executives.

- Combining several Insurance (Australia) and Group functions to create a more streamlined and efficient organisation.

The Company entered the COVID-19 crisis with a significantly de-risked business and a strong balance sheet. Insurance (Australia) demonstrates an even larger proportion of its profit following the sale of the Life Insurance business.

SUN has purchased an Aggregate Excess of Loss (AXL) cover which provides $400 million of protection, for events worth over $5 million. The cover is valid when the retained cost of the events hits the $650 million mark.

For FY21, the Company expects natural hazard allowance to increase in the range $90 million - $130 million due to the lower level of P&L volatility cover compared to FY20.

At the close of the session on 8 July 2020, the stock of SUN stood at $8.900 per share with a decline of 1.549%. SUN has generated returns of -12.06% and 0.78% during the last one and three months, respectively.