The Insurance industry has been facing a difficult situation with shutdown norms and the guidelines for social distancing in the wake of the coronavirus spread. Insurance companies are already under a lot of obligation with over 252k claims worth around $4.6 billion following the natural calamities, including bushfires.

General insurance has been considered as an essential service during the current crisis and thus the industry players, despite the present challenges, will continue to help and offer services to Australians.

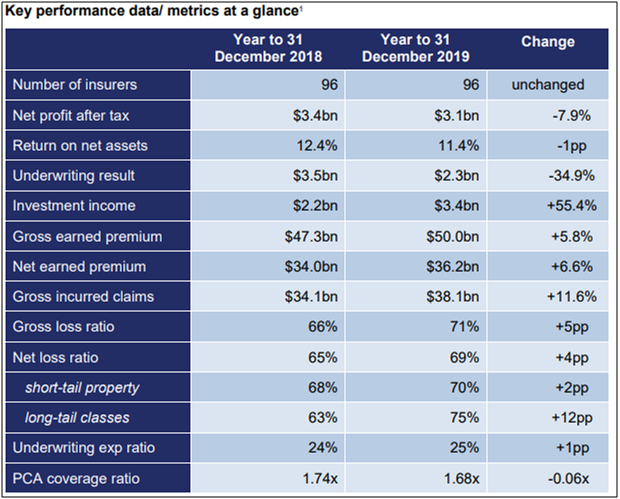

As per the Insurance Council of Australia, the industry reported underwriting profit stood at $2.3 billion in 2019, substantially lower compared to the $3.5 billion reported in FY2018. The result was adversely impacted mainly by the multiple bushfire events and the Townsville flood catastrophe during the year and growth of claims reserves in long-tail classes predominantly due to plummeting bond yields.

During the year, insurers reported increases in gross earned premium mainly from premium rate increases most notably in the short-tail, employers’ liability and professional indemnity classes of business.

The Industry PCA coverage ratio decreased from 1.74x to 1.68x in the December quarter.

Source: ARPA

In this article, we’ll throw light on four insurance stocks and their recent updates and financial performance.

Insurance Australia Group Limited (ASX:IAG)

IAGunderwrites general insurance and is also involved ininvesting activities and corporate services. The Company's segments are:

- Consumer Division (Australia): Offers general insurance products to persons and families across the country.

- Business Division (Australia):Offers commercial insurance to all the businesses in Australia under brands likeWFI, and CGU.

- New Zealand: Delivers general insurance business.

- Corporate and other:Includes activities such as corporate servicesas well ascapital management activities.

No Impact of COVID-19 on IAG’s FY20 Guidance

The Company’s underlying business performance has remained stable.However, overall year-to-date profitability has absorbed substantial adverse impacts from net natural peril claim costs and, more recently, severe investment market movements. However, the Company has kept its FY20 guidance unchanged, which exists of a reported margin in the range of 12.5%-14.5% and ‘low single-digit’ growth in GWP.

The guidance includes the expectations that there will be no material impact of foreign exchange movements in the reported margin.

The Company has also postponed its Investor Day in Sydney to 14 May 2020.

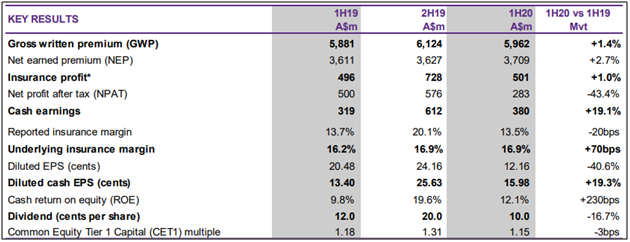

Impressive 1HFY20 Results

The Company’s underlying performance in 1HFY20 was robust and in line with expectations. The Australian segment reported solid underlying profitability while encountering the challenge of a series of severe bushfire events and New Zealand kept its record of producing a solid underlying margin while deliveringrobust GWP growth.

1HFY20 Results (Source: Company’s Report)

Stock Performance

The stock of IAG was trading at $6.370 on 31 March 2020 (at 02:10 PM AEDT), a decline of0.469% from its previous closing price, with a market capitalisation of $14.79 billion. The 52-week low price and high price are $5.000 and $8.740, respectively.The total outstanding shares were2.31 billion. The Company has given a total return of -18.37% and -18.99% in the last three months and last six months, respectively.

QBE Insurance Group Limited (ASX:QBE)

QBE Insurance Group Limited is an international general insurance and reinsurance Company which is engaged in underwriting general and reinsurance risks, investment management and management of the economic entity’s share of the NSW and Victorian workers’ compensation scheme.

QBE withdraws 2020 financial targets due to COVID-19 uncertainty

The Company has suspended its FY20 outlook due to unprecedented COVID-19 pandemic and uncertain economic and investment market outlook.

Premium rate momentum in 1QFY20 has continued following the strong trends reported in the 2HFY19. The Company’s capital position and liquidity are resilient. The Company continues to implement its plans for business continuity to guarantee the availability of its services to the customers and business partners.

Stock Performance

The stock of QBE was trading at $8.920 on 31 March 2020 (at 02:10 PM AEDT), up 3.721% from its previous closing price, with a market capitalisation of $11.25 billion. The 52-week low price and high price are $7.130 and $15.190, respectively. The total outstanding shares were 1.31 billion. The Company has generated returns of -34.05% and -31.53% in the last three months and last six months, respectively.

Suncorp Group Limited (ASX:SUN)

Suncorp Group Limited is engaged in providing banking, insurance and wealth management products and services to corporate, retail and commercial customers in New Zealand and Australia.

COVID-19 Update

The Company emphasises the wellbeing and safety of its employees and customers and following the virus spread, has allowed its employees to work from home, wherever possible. Suncorp Bank has agreed to provide relief packages to assist businesses and offer financial assistance to customers affected by COVID-19.

The Company reported a profit after tax attributable to owners of the Company of $642 million for the half-year ended 31 December 2019. Profit after tax from continuing operations declined by 6.2% from the prior comparative period. The result was impacted by lower reserve releases, an uplift in regulatory project costs, the impact of the low yield environment, the timing of natural hazards events compared to the prior comparative period and an increasingly competitive mortgage market.

A fully franked 2020 interim dividend of 26 cents per share has been determined since the balance sheet date by the directors of the Company.

Stock Performance

The stock of SUN was trading at $9.300 on 31 March 2020 (at 02:10 PM AEDT), an increase of2.198% from its previous closing price, with a market capitalisation of $11.47 billion. The 52-week low price and high price are $7.300 and $14.155, respectively.The total outstanding shares were1.26 billion. The Company has generated returns of -31.06% and -33.33% in the last three months and last six months, respectively.

nib Holdings Limited (ASX:NHF)

nib Holdings Limited offers medical insurance to residents and travel insurance to travellers in New Zealand and Australia. The Companyunderwrites and distributes private health insurance to Australia and New Zealand residents as well as international students and visitors to Australia.

nib Postpones Premium Increase

The Company has delayed its increase of premiums to provide relief to members during COVID-19 pandemic. The Company would also offer direct premium relief for members experiencing financial hardship and full coverage for COVID-19 related treatment across all products, even if currently excluded.

nib Withdraws FY20 Guidance

The COVID-19 pandemic has created profound uncertainty about the Company’s previously conveyed commercial outlook and FY20 market guidance. And the Company is not able to provide new guidance.

nib remains secure and well capitalised. As of 31 December 2019,the Company had surplus capital of $69.2 million after allowing for internal capital target, APRA prudential requirements and dividend.

Stock Performance

The stock of NHF was trading at $5.270 on 31 March 2020 (at 02:10 PM AEDT), a decline of1.495% from its previous closing price, with a market capitalisation of $2.44 billion. The 52-week low price and high price are $3.335 and $8.200, respectively.The total outstanding shares were456.08million. The Company has generated returns of -18.57% and -26.71% in the last three months and last six months, respectively.