VGI Partners Limited (ASX: VGI), a Sydney-based hedge fund manager listed on the Australian Stock Exchange in June 2019, is set to roll out a new investment strategy focused on the Asian region, according to a company letter to its investors on 5 August 2019. The new strategy, which would be accessed via a new investment company, called VGI Partners Asian Investments Limited or VG8, would bring the total number of investment strategies launched by VGI to two.

The strategy would focus on equity investments in enterprises that are either listed in the Asian region or have significant exposure to the region. The company plans to employ its investment philosophy, which is based on the key tenets of capital preservation, to the new Asian equities investment company that it applies to its existing global strategy, VGI Partners Global Investments Limited. The fund manager made the decision regarding the new investment strategy focused on the Asian region, factoring in improving governance standards in the region, according to VGI Partners Executive Chairman Robert Luciano. Moreover, several companies engaged in delivering higher quality services in Asia are becoming more investor-friendly, added Mr Robert Luciano.

Initial Public Offering for VG8: VGI Partners intends to raise a maximum of AUD 1 billion through an initial public offering for the Asian-equities focused investment company. Through the plan to cap the offer size to AUD 1 billion, VGI seeks to ensure the fund size doesnât constrain the performance of VG8's strategy. In the event of the offer raising AUD 500 million for VG8, the company plans not to undertake any follow-on raising into VG8 for at least three years.

The company would pitch at existing investors in its managed funds, as well as new investors under broker firm and general offers. The company would make offers to investors in VGIâs unlisted funds, VGI Partners Global Investments Limited (ASX:VG1) as at a record date of 2 August 2019 and VGI Partners Limited (ASX: VGI) as at a record date of 2 August 2019.

VGI plans to offer shares for VG8 at a price of AUD 2.50 per VG8 share, with the invitations to apply for the ordinary shares scheduled to be made during CY2019 (subject to market conditions). If successfully raised, the IPO for VG8 is expected to become the biggest raisings for an ASX-listed Listed Investment Company (LIC) in the history of Australia.

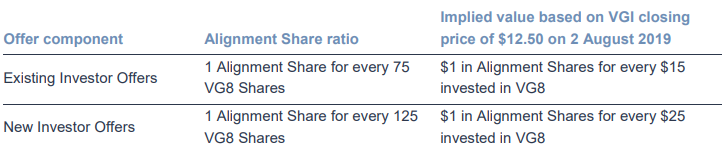

Meanwhile, VGI Partners updated the market regarding plans related to the issuance of alignment shares, under which the existing VGI investors, for VG8 shares worth AUD 100,000 would get 533 VGI partners shares with a current market value of AUD 6,663, while new investors would receive 320 VGI shares with a current market value of AUD 4,000 for VG8 shares worth AUD 100,000. The alignment shares are bonus fully paid ordinary shares, to be issued at no cost to the investor. The company plans to issue up to 5.2 million alignment shares.

Source: Companyâs Report

Source: Companyâs Report

Plans for VG8: The VGI announcement highlights how keen the company is to get into the Asian region. The company, which has recently opened a new office in Tokyo, Asia, intends to make the most of valuations in the region. In line with the core focus of the existing funds managed by VGI, VGI Partners Asian Investments Limited would seek to purchase and hold long-term investments in businesses that according to VGI hold great potential; however, they are yet to get completely valued by the market. Moreover, VG8 would focus on short selling securities evaluated to be vulnerable to a material fall in price.

VG8 would make long-term investments in companies that have a business model that is easy to understand. Moreover, it would focus on companies operating in industries with attractive structures such as monopoly, duopoly or oligopoly, as well as enterprises offering brands that are highly recognised among households. Furthermore, it would target those Asian countries that have developed capital markets, in addition to strong corporate governance, and a strong and reliable legal system. This clearly means that VG8 would direct its investments towards the markets of Australia, Japan, Singapore, South Korea, Hong Kong and Taiwan, over the upcoming years. Though VG8 would keep an eye on other Asian countries including China, India, Thailand and the Philippines, it is unlikely to focus its investments towards these countries in the coming years.

VGI plans to take a cornerstone shareholding in VGI Partners Asian Investments Limited (VG8) worth AUD 20 million. Moreover, it would make a cash payment towards all of the costs of the offer, ensuring that the opening Net Asset Value of each share in VG8 is equal to AUD 2.50, the offer price of each VG8 share.

VGI has appointed Moelis Australia as its and VG8âs financial adviser, while MinterEllison is serving as the legal adviser. Additionally, the company is in the process to appoint joint lead managers for the offer including Crestone Wealth Management Limited, Commonwealth Securities Limited, Ord Minnett Limited, Taylor Collison Limited and Wilsons Corporate Finance Ltd.

The company is likely to submit a prospectus for VG8 shares with the Australian Securities and Investments Commission (ASIC). Moreover, the prospectus would be made available in the month of September 2019 before the offer would open. All the features in the offer are subject to regulatory approval and might change before the prospectus submission with the ASIC.

About VGI Partners Limited: VGI Partners Limited, established in 2008, is a global equity manager, focusing on making investments in a relatively small number of high-quality businesses. With a team of more than 20 people located in the Australian city of Sydney, US city of New York and the Japanese city of Tokyo, the wealth manager provides capital management services for high net worth individuals and family offices, in addition to VGI Partners Global Investments Limited.

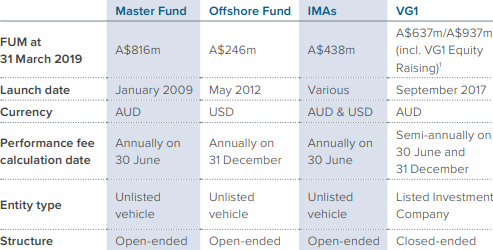

For each VGI Funds, VGI Partners Limited charges management fees and performance fees, which are the two models of revenue generation for VGI. As of 31 March 2019, VGI has funds under management of more than AUD 2.1 billion

VGI Fundsâ Summary as at end-March 2019 (Source: Companyâs Website)

In the month of June 2019, the company got listed on the Australian Stock Exchange, raising $ 75,000,000 as per the offer made under its replacement prospectus. The company issued around 13,636,364 fully paid ordinary shares at a price of USD 5.50 per share.

Stock Information: On the stock information front, on 5 August 2019 (AEST 02:20 PM), the stock of VGI Partners Limited was trading at AUD 12.500. It has a market capitalisation of AUD 838.35 million and approximately 67.07 million outstanding shares. Its 52 weeks high price stands at AUD 14.345, while 52 weeks low price stands at AUD 9.510.

VGIâs plans for VGI Partners Asian Investments Limited, which would own a concentrated portfolio of highest quality companies in Asia, shows how keen VGI Partners Limited is to get its Asian investment strategy off the ground. The new investment strategy is targeted towards providing capital growth to investors over the long term.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.