In this article, we would discuss two stocks from the Industrials & HealthCare sector, respectively. These two stocks attracted traction from the investors on 19 July 2019. Letâs have a look at the possible reasons behind the escalated investor interest.

YPB Group Limited (ASX: YPB)

YPB Group Limited (ASX: YPB) is based in Australia, a product authentication and consumer engagement solutions provider. The group leverages its proprietary smartphone-enabled technology suite, which allows customers to authenticate the originality of the product. Besides, it provides an opportunity for brands regarding consumer engagement.

Authentication Technology (Source: Companyâs Investor Presentation, December 2018)

YPB Group and Halo Labs Signs an Agreement

On 19 July 2019, YPB Group reported that a Master Supply Agreement (MSA) had been signed with Halo Labs Inc. (NEO: HALO, OTCQX: AGEEF, FRA: A9KN). Accordingly, the company would deliver authentication solutions, and the YPB Connect consumer engagement platform to Halo Labs. Also, MSAâs initial term is defined for twelve months with automatic renewal, if both the parties do not pitch for the non-renewal.

About Halo group

As per the release, Halo is Canada based cannabis-focused company with specific expertise in oils and concentrates along with a presence in the USA. Also, it started the operations in Oregon, which are now extended to Nevada and California with sales capacities. Besides, Halo manufactures products for a number of market segment and geographies, and it is looking to expand the cannabis products, delivery systems with innovations.

Reportedly, the company has cannabis clients for delivery systems (hardware), which were signed in 2018. Interestingly, Halo is the first client with high-volumes, faster growing cannabis consumables and within consumables â oil and extracts is an area of expertise for the company, which are the fastest growing segments.

Revenue Under the MSA

As per the release, YPB Groupâs revenue under the agreement would comprise of two parts. First, the charges would be levied based on the per unit volume for authentication and labels. Second, the charges would be levied monthly throughout the span of the agreement on Connect consumer engagement technology, which would be SaaS based. Also, YPB Group anticipates volume pricing component would enable the company to take part in Haloâs growth; however, an estimate of the contract value is uncertain due to the pace of Haloâs growth.

Besides, YPB Group believes Halo would turn out to be an important client for the company; it is anticipated that Halo would integrate the technology adopted from YPB Group on the delivery systems products and consumables products, starting by the end of Q3 2019 period.

John Houston, Executive Chairman of YPB Group, stated that he is delighted by the prospect of YPB supporting Halo to keep an eye on the investment in the brand building, which is not impacted by the fakes. Besides, he said that the company would support Halo to improve the value and loyalty of customer base through personalised engagement directed to its customerâ smartphones. Further, he acknowledged that YPBâs pace has slowed down in the cannabis sector since the initial flurry in H2 2018. He concluded that cannabis remains an opportunity for the business, and the new agreement with YPB represents a revitalised momentum in the sector.

On 19 July 2019, YPBâs stock last traded at A$0.007, up by 16.667 per cent from the previous close. Over the past one-month period, the return of the stock has been of -7.69 per cent.

Ellex Medical Lasers Limited (ASX: ELX)

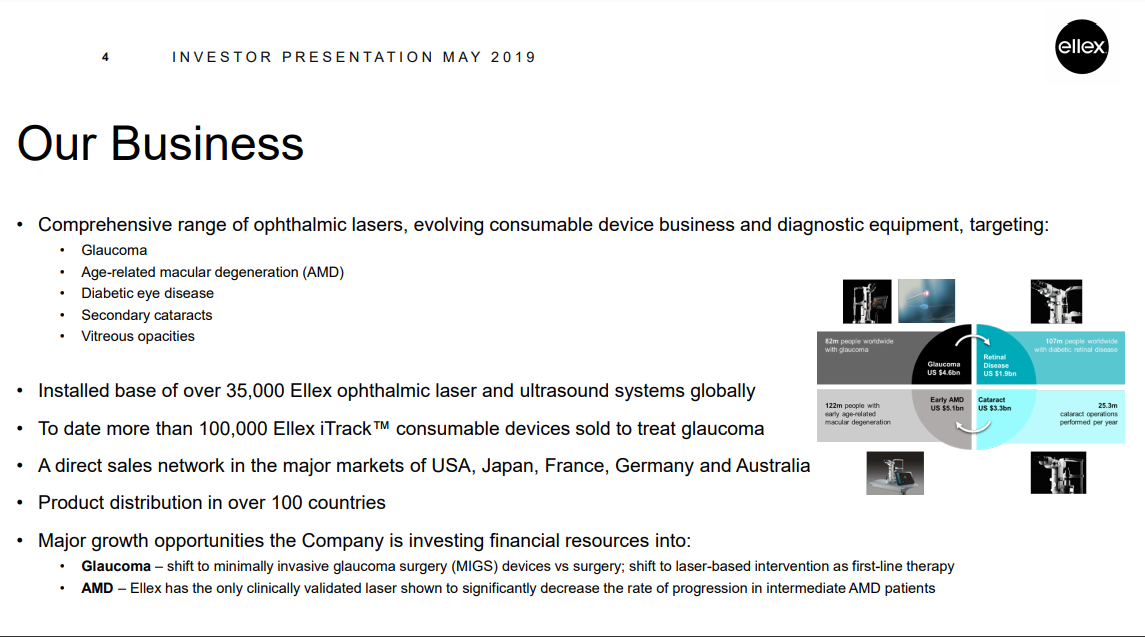

Ellex Medical Lasers Limited (ASX:ELX) is an Australian company with business interest in designing, developing, manufacturing and distributing medical accessories used by eye surgeons to treat eye diseases. The company is based in Adelaide, Australia, and provides devices that treat age-related macular degeneration, retinal disease, glaucoma, secondary cataract and vitreous opacities.

Business Overview (Source: Companyâs Investor Presentation, May 2019)

Organisational Updates

On 19 July 2019, Ellex Medical Lasers Limited released two announcements - an appointment of Company Secretary, Interim CEO and trading update.

Accordingly, Ms. Kimberley Menzies would be appointed as the Company Secretary at the upcoming board meeting. Also, she joined Ellex Medical in late 2015, currently serving under the capacity of Group Financial Controller responsible for the companyâs global finance function. Besides, prior to appointment in Ellex Medical, she has served as a senior auditor for the company for 8 years.

Reportedly, Ellex Medical also appointed Ms. Maria Maieli as the Interim Chief Executive Officer (CEO) of the Company, effective 19 July 2019. Also, she was appointed as the Company Secretary since January 2013. Besides, Mr. Ged Wallace (Ex-CEO) had notified the company about his resignation, and the company had accepted the resignation effective immediately.

Further, Ms Maieli has demonstrated over 25 years in senior financial management in private and public companies, and she has been an employee of the company since 2011. Previously, she has been engaged with international sales subsidiaries to deliver strategy, corporate compliance, governance and risk management. Moreover, she holds a Masters in Professional Accounting and is a Certified Practising Accountant (CPA).

Chairman of Ellex Medical, Mr Victor Previn, stated that the board appreciated Mariaâs decision to accept the capacity of CEO role at Ellex. He also said that she is known to complexities involved in the business global and regional levels, and she has also managed various operations, including sales. He concluded that the board and other senior executives would support her in this role.

Trading Update

Ellex Medical also provided an update related to preliminary unaudited financial results for the year ended 30 June 2019. Accordingly, the group sales witnessed an increase of 3 per cent against the same period prior year; this was underpinned by 36% jump in Ellex iTrack® sales (in USD terms), and the second half sales performance of Ellex iTrack® in the US was up 41% (in USD terms) on prior corresponding period (pcp). Besides, the overall performance of iTrack® grew 29% to $14 million.

Reportedly, the Lasers & Ultrasound business saw a slump by 3% to reach $66 million against prior corresponding period; Ellexâs core glaucoma SLT laser range Ellex Tango⢠and Tango Reflex⢠achieved sales growth of 9% to $26 million against pcp within Lasers & Ultrasound. Besides, the company achieved an increase of 260% to $1.8 million over pcp through the sales of Ellex 2RT®.

As per the release, the expected expense would be ~$0.3 million excluding restructuring, and Ellex Medical expects the underlying FY19 group EBITDA loss to be around $0.7-$0.8 million. Also, the EBITDA loss from iTrack® segment is expected to be $5 million, consistent with pcp; however, over the second half, iTrack® recorded a loss of ~$1 million. Besides, the expected EBITDA from Lasers & Ultrasound segment to be ~$9 million.

It was also reported that the board would commence an executive search process to identify and appoint a permanent CEO. Additionally, the company would provide audited FY19 financial results on 29 August 2019.

On 19 July 2019, ELX stock last traded at 0.57, down by 6.557 per cent from the previous close. Over the past one month, the return of the stock has been of +10.91 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.