Australian Waste Management industry has been receiving considerable attention of investors since quite long time for the burgeoning need of developing sustainable future and creating renewable energy. Company like Clean TeQ Holdings Limited is setting its roots in high-grade cobalt sulphate and nickel sulphate production to fuel electric vehicles, whereas the peer Cleanaway Waste Management places resource recovery at the centre of its waste value chain. Letâs go into the details of these exciting business operations of some leading waste management companies of Australia.

Cleanaway Waste Management Limited (ASX: CWY)

With over 50 years of footprints in waste management industry, Cleanaway rides on its mission of making a sustainable future in Australia. The company delivers innovative set of services to reduce, reuse, recycle and safely dispose of waste at industry as well as community level.

Stock performance

Cleanawayâs stock price has been trending upside since the past five years that marks a positive change of 146.29% including a year-to-date return of +51.22% and a surge of 8.30% over the past three months.

In a day-trading session, CWY shares declined 1.21% to close at $2.450 on 18 July 2019. The price to earnings multiple stood at 42.030x with a market capitalisation of $5.07 billion.

Company Overview

Cleanaway is positioned as Australiaâs largest total waste management company that operates through its three core segments- Solids, Liquids and TES, and Health Services. The company is rapidly trailing a fleet of electric waste collection vehicles and new vehicles to comply with Euro 5 emission levels as a minimum, with the focus on reducing greenhouse gas emission intensity from its mobile fleet.

The company also enjoys a diversified exposure to Australiaâs resource recovery market. It generates over 140 million kWh of renewable energy that is roughly equivalent to power more than 28,700 homes without any release of methane into the atmosphere.

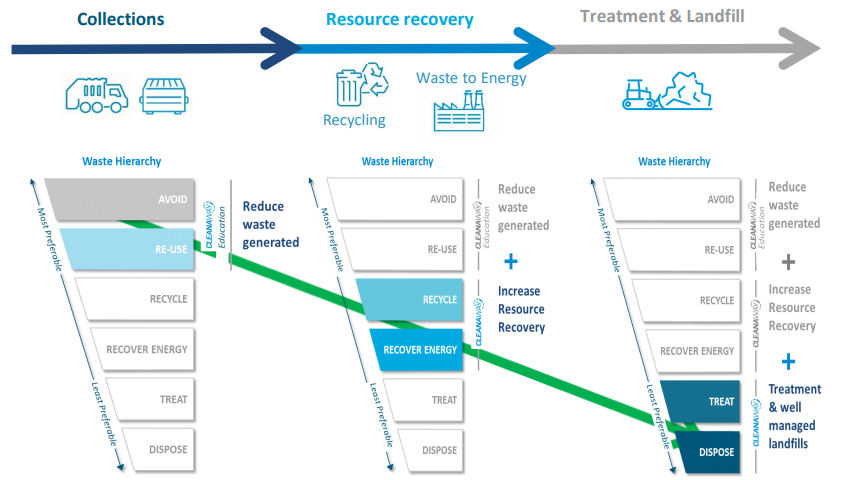

Resource Recovery sits at the centre of Cleanawayâs Waste Value Chain in which the company aims on investing in the right package of assets to maximise the resource recovery across the waste hierarchy and maximize value across the value chain through the evolving tonne.

Cleanawayâs waste value chain (Source: Company Presentation)

Further, Cleanaway is closely working with Soil and Organics Resource Facility in Dutson Downs, Victoria to supply composted soil and soil conditioner in agricultural regions of Victoria. These compost fertilised farms help farmers to grow healthier crops, enhance various produce and also graze cattle.

Financial Performance

The Group reported a statutory gross revenue of $1,149 million, up 46.4%, in 1HFY19 compared to the previous corresponding period. Statutory EBITDA increased 43.2% to $220.8 million broadly in line with the underlying earnings of the company.

On the bottom line front, the company has reported 35.1% growth in Statutory Net Profit After Tax (NPAT) to $60.8 million that led to earnings per share (EPS) of 3.0 cents, up 11.1% on 1HFY18. The Board declared an interim dividend of 1.65 cents per share, representing an increase of 50% from the corresponding period.

Forward Plan

Cleanaway has built an irreplaceable network of prized infrastructure assets to cover recycling as well as waste to energy. Going forward, the company continues to keep its focus on prized infrastructure assets through systematic implementation of its Footprint 2025 strategy.

In the past three years, CWY has invested over $150 million in greenfield prized infrastructure plus the acquisition of Toxfree.

The company expects to see the positive earnings momentum continue for the remainder of the Fiscal Year 2019 on the back of further organic growth and realisation of synergies.

BINGO Industries Limited (ASX: BIN)

BINGO Industries has strengthened its potential to put forward a tough fight in the global waste management landscape through an integration of Dial a Dump Industries (âDADIâ).

The acquisition formally completed in March 2019 is expected to act as a catalyst for BINGOâs multinational, operators in Commercial & Industrial (C&I) waste collections. DADI is the waste management services company based in New South Wales with operations across waste value chain from collections, to recycling, landfill and recycled product sales. The complementary network of DADI is to enhance the operational efficiency BINGOâs network of strategic waste infrastructure assets. Further rationale to the companyâs acquisition decision for DADI highlights the following:

Complementary post-collections assets which includes Eastern Creek Waste Facility, a recycling and landfill asset with approved capacity of up to 2 million tonnes per annum and approximate 15 year useful remaining landfill life.

Acquisition of DADI expected to deliver $15 million of annualised cost synergies from internalisation, operational efficiencies and overheads over two years with further potential revenue synergies to be realised

Opportunity to transform the future of recycling and resource recovery in Greater Sydney, with approximately 82 hectares of real estate in the Western Sydney Growth Precinct providing BINGO with the opportunity to develop a one of a kind âRecycling Ecology Parkâ

Outlook

The company remains committed to its five-year strategy with the focus on optimising its full network of waste assets in Victoria and New South Wales. BINGO eyes Fiscal 2020 to be the transformation year as it has achieved key milestones in its redevelopment program which are expected to start showing their favourable impact on the companyâs revenue. The primary benefits are projected to be driven by the synergies of DADI as well as the commencement of operations at the companyâs new recycling and landfill asset, Patons Lane.

BIN FY19 Revised Guidance (Source: Company Announcement)

However, for FY2019, the company expects its full year EBITDA to be broadly in line with the previous year against the initially stated guidance of 15%-20% growth. The revised guidance outlines a faster than anticipated softening in multi-dwelling residential construction activity, coupled with no forecasted price rise being met in FY19 and reconfiguration of the companyâs development projects.

Stock Performance

BIN stock price declined by 1.215% to last trade at $2.440 on 18 July 2019. The price to earnings multiple stood at 32.760x with a market capitalisation of $1.63 billion.

Over the past 12 months, the stock has declined by 3.97% despite an attractive upside of 47.46% recorded in the past three months.

Also Read: Is BINGO regaining traction as the stock of choice among investors?

Clean TeQ Holdings Limited (ASX: CLQ)

A company focused on metals recovery and industrial water treatment, Clean TeQ, recently kicked off the partnering process for its wholly-owned Sunrise cobalt, nickel, and scandium project based in central New South Wales.

The moment company made this announcement, it started receiving a number of inbound enquires from several parties in the electric vehicle supply chain with respect to both project long-term offtake, level ownership and other financing arrangements.

Once Sunrise gets into production phase, the project is expected to become one of the worldâs largest integrated suppliers of high purity battery grade cobalt sulphate and nickel sulphate. Both these components form key raw materials to the manufacturing of cathodes for lithium-ion batteries, required to fuel the electric vehicles.

Global growth in electric vehicles continues to be led by China, with Rest of The World markets also delivering strong increases. It was recorded that global electric vehicle sales exceeded 2 million vehicles in 2018, where China reported NEV (Neighborhood Electric Vehicle) sales of 1.26 million, an increase of 61.5% on 2017.

Stock Performance

CLQ shares traded flat today on ASX with the daily volume change of 620,289 shares as at 18 July 2019. The stock last traded at $0.365 with a market capitalisation of $272.46 million.

Over the past 5 years, CLQ stock has ballooned 592.00% despite a meltdown of 49.31% recorded in the past 12 months. In the short term, the stock has edged up by 21.67% and 1.39% with respect to past one month and three months performance.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.