Keybridge Capital Limited (ASX: KBC) is an investment and financial services group with a diversified portfolio of listed and unlisted investments/loan assets in the US private equity, New Zealand life insurance, property and funds management sectors. In addition to that, Keybridge also has strategic holdings in Molopo Energy Limited (ASX:MPO), Metgasco Limited (ASX: MEL), HHY Fund (ASX: HHY), and Yowie Group Ltd (ASX:YOW).

The Groupâs market capitalisation stands at around AUD 12.13 million and it has ~ 166.14 million shares outstanding. The KBC stock last traded on 15 July 2019 at AUD 0.071. In addition, the KBC stock has delivered impressive returns of 46% for the last three months and 10.61% on YTD basis.

However, on 16 July 2019, Keybridge Capital announced that the securities of the Group have been suspended from quotation under Listing Rule 17.3, pending enquiries by the Australian Securities Exchange. The securities would remain suspended until the outcome of these enquiries and an announcement by KBC regarding the composition of its board, are both released to the market.

Lately, Keybridge Capital has been all muddled up with various developments occurring at the same time.

Litigation against Aurora Corporate Pty Ltd- Recently on 1 July 2019, the company announced to have commenced litigation against Aurora Corporate Pty Ltd in relation to a Share Sale Agreement dated 27 June 2016 whereby Aurora Corporate acquired Aurora Fund Management Limited from Keybridge.

Despite the terms agreed for the sale agreement, Aurora Corporate failed or refused to pay Keybridge the Adjustment Amount and Deferred Consideration totalling $ 264,964.54; and to provide any of the monthly statements concerning Aurora Fundsâ NTA position not having fallen below $ 500,000.

Accordingly, Keybridge has filed a Writ in the Supreme Court of Western Australia, as reported on 16 July 2019, claiming:

- The sum of $ 264,964.54 plus interest as per the terms agreed during the deal at 12% pa (being approximately $ 74,000 to 10 July 2019);

- Specific performance of Aurora Corporateâs obligation to provide the monthly statements on Aurora Fundsâ NTA position; and

- Interim, interlocutory and final orders for the appointment of a Receiver over Aurora Corporateâs shareholding in Aurora Funds.

Termination of Investment Management Agreement- In addition to the above, Aurora Funds Management Limited, terminated its Investment Management Agreement dated 30 June 2016 for the HHY Fund, providing five business daysâ notice on 11 July 2019 to Keybridge. Accordingly, Aurora would take on the investment management responsibilities and duties for the Fund, without charging the management fee, resulting in reduced expenses for the Fund.

Leadership Changes - Also on 11 July 2019, Keybridge Capitalâs Board announced to have removed John Patton as Chairman with effect on 10 July 2019 while he would continue as a Non-Executive Director of the Company. Simultaneously, the Board appointed Non-Executive Director, William Johnson, as Chairman, effective the same day.

Earlier on 27 June 2019, Keybridge announced the appointment of Farooq Khan as an Alternate Director of Simon Cato, to be effective from 26 June to 18 July 2019. Mr Cato is a nominee of major shareholder, Bentley Capital Limited (ASX:BEL), on the Keybridge Board. Mr Cato and Mr Khan are both Directors of Bentley.

Also, as reported on 29 May 2019, Mr Nicholas Bolton resumed his service as Chief Executive Officer of Keybridge. Mr Boltonâs service as Managing Director (since 2014) was interrupted because of an order made by ASIC in November 2015, which has since expired prior to the resolution of an ongoing appeal1.

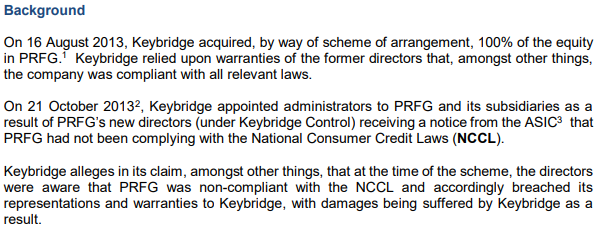

Proceedings Against PR Finance Group â On 4 July 2019, Keybridge informed the stakeholders that on 28 June 2019, it had commenced proceedings in the Supreme Court of Victoria against PR Finance Group Limited and caused a simultaneous action to be taken against the former PRFG directors by the companyâs liquidator, for total damages exceeding $ 5 million.

Source: Companyâs announcement dated 4 July 2019

Takeover Bid by WAM Active - Also, on 28 June 2019, Keybridge publicly acknowledged the WAM Active Limitedâs (ASX:WAA) intention to make a conditional takeover bid (off-market) for Keybridge at 7.5 cents per share and is currently reviewing the same. WAM Active, domiciled in Australia, is a close-ended equity mutual fund launched and managed by MAM Pty Limited. The fund primarily invests in public equity markets of Australia.

If the bid is successful, WAM Active will reportedly acquire at least 50.1% of KBC.

Takeover Bid for Yowie Group Ltd- Keybridge updated on its conditional off-market takeover bid for all of the fully paid ordinary shares in Yowie Group Ltd (ASX:YOW) for a consideration of 9.2 cents each, as announced on 13 March 2019. Yowie is a brand licensing company which develops and sells consumer products worldwide.

Keybridge stated that Yowieâs March 2019 Quarterly Cashflow Report had demonstrated disappointing results with a significant operating loss, ~ 50% fall in operating revenue from the previous quarter and a decline in the cash position (from USD 18.751 million to USD 16.982 million).

Since the defeating conditions as laid out by the company for the bid, had been breached, Keybridge advised that it would not be proceeding with the Bid.

To recap, when Yowie Groupâs shares were sagging in early 2018, three funds linked to infamous corporate raiders Farooq Khan and Nick Boltonâ Keybridge Capital, Bentley Capital Limited and Aurora Funds Management Limited â bought in Yowie. Since that time, it has been observed that the three players had been collaborating and utilising their combined 23% interest in Yowie to gradually eliminate its board members and thus, gain control of the company.

Subsequently, Aurora Funds Management launched another takeover bid for Yowie in May 2019, presenting an offer of 9 cents of Aurora script per Yowie share. Auroraâs bid is expected to open on 19 July 2019 and would be live till August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.