Based in West Perth, Western Australia, Sun Resources NL (ASX:SUR) is an energy sector player that is focused on identifying oil & gas development asset opportunities capable of delivering oil production in the near term. Recently the company released its full year statutory accounts to the market for the period ended 30 June 2019, unveiling details related to its Bowsprit Oil Project, financials and other business aspects.

Bowsprit Oil Project

Sun Resources secured this project in August 2017 with its partner Pinnacle Exploration Pte Ltd, an unlisted public company based in Singapore. However, in the month of July 2019, the company acquired the stake held by its partner for a complete hold on the project. As a result, the company now wholly owns (working interest) the Bowsprit Oil Project.

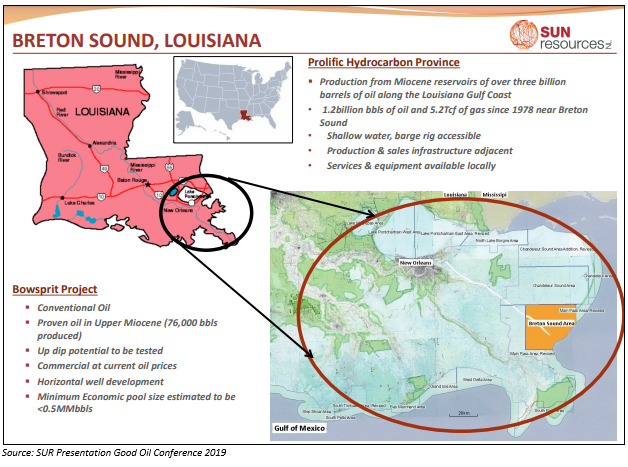

Bowsprit is a conventional oil project that is located on leases - 21754 & 21787 - in Breton Sound Area in the US state of Louisiana. According to the company, which is the operator of the leases, one firm and up to four contingent horizontal wells would develop the Bowsprit structure.

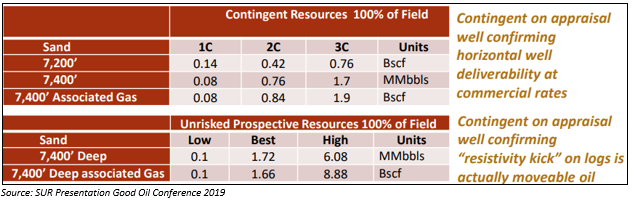

Based on public domain and purchased data, the company has performed extensive internal work for the project assessment. Sun Resources prepared a conceptual development plan, using which RISC prepared an Independent Resource Assessment of the project.

As per the companyâs plan,

- SUR would drill and test an appraisal well with a horizontal section of 1,500ft in length.

- The well would be targeted towards proving commerciality of the contingent resources in the 7400â sand as well as discovering and appraising the resource in the 7400â Deep sand.

- The well is anticipated to be drilled in the first quarter of 2020, with the cost estimated at ~ US$3.6 million.

- SUR would look for a farm in partner or other source of financing for funding the drilling program.

- First commercial oil production from the project is anticipated in the third quarter of 2020.

Consolidated Balance Sheet

At the end of the financial year 2019, the company reported total current assets of $89,694 including cash and cash equivalents of $40,136 and other receivables of $49,558, while total non-current assets stood at $794,286 including plant and equipment worth $6,029, exploration and evaluation expenditure of $775,495 and investment in unlisted shares of $12,762. As a result, total assets for the year stood at $883,980.

Cash Flow Statement

Sun Resources reported $473,173 in net cash outflow for operating activities, including $76,023 in receipts from rental income, $549,824 in payments to suppliers and employees and $628 worth of interest received.

Net cash outflow towards investing activities stood at $112,457 for FY2019, with the amount used for payments towards exploration costs. Meanwhile, net cash inflow from financing activities was reported at $543,588, with $396,088 in proceeds from issue of shares (net of costs), $172,500 in proceeds from director loans and $25,000 towards repayment of Director Loans.

As a result, cash and cash equivalents at the end of the financial year to June 2019 stood at $40,136.

Plans for FY2020

During the financial year 2020, the company intends to continue the present range of activities. Moreover, Sun Resources is expecting to take part in exploration and appraisal wells in line with its goals. The company might also boost its exploration effort and production base via farm-in or new lease acquisitions.

Few Key Developments in FY2020

- Subsequent to the year ended June 2019, SUR in July 2019 entered a deal with Pinnacle Energy International (USA) Inc for the acquisition of Pinnacle Energy International (USA) I LLC, which held a 50% working interest in SL21754 and SL21787.

Under the deal, Pinnacle would receive a cash consideration of USD250,000 that is scheduled for payment before the drilling of the first well at the project, in addition to a Royalty of 5% of gross production revenue.

The deal would terminate, and the project would revert to an equal partnership, if the transaction is not finalised by 1 March 2020.

- The company raised $150,000 from sophisticated investors, directors and management in July 2019.

- Additionally, to raise $727,000, SUR entered a mandate with specialist corporate advisory firm, GTT Ventures Pty Ltd in August 2019. The amount was raised from sophisticated investors, directors and management. The company intends to use the funds towards progressing the project, as well as complete the permitting for the first well.

Moreover, GTT Ventures would assist the company. SUR appointed Mr Patrick Glovac, a Partner of GTT Ventures Pty Ltd, as a non-executive director of the company. Mr Glovac is a well-respected mining executive and corporate financier, who is also Executive Director at TAO Commodities Limited (ASX:TAO) and Non-Executive Director at Global Vanadium Limited (ASX: GLV).

- On 6 September 2019, the company established a share sale facility to start an unmarketable parcel process.

Stock Performance

Sun Resources, which is scheduled to hold its annual general meeting on 29 November 2019, has a market cap of $3.96 million and approx. 1.32 billion outstanding shares. The stock of SUR last traded at a price of $0.003 on 30 September 2019. The stock has delivered a return of 100 per cent and 50 per cent in the last three months and six months respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.