Highlights:

- Benchmark index S&P/ASX 200 was quoted 0.79% up to 7,104.10 points at 4:10 PM AEST on Friday (26 August 2022).

- Ten out of eleven significant sectors ended on positive note, Consumer Staples being one of the best performers, closing 1.14% strong.

Consumer stocks are considered a safe haven for investors as one would not hesitate to spend on daily consumer essentials such as personal care, home care, household and food & beverages product irrespective of the economic, political and social situation.

Consumer stocks feature Consumer Discretionary sector and the Consumer Staples sector.

Coming to the Australian market, where inflation, an increase in interest rate by RBA (Reserve Bank of Australia) and no change in wages are the burning issues, ASX 200 Consumer Staples (INDEXASX:XSJ) has posted a gain of 2.21% in last six months.

Benchmark ASX 200 ended 0.79% up to 7,104.10 points on Friday (26 August 2022). Following the broader market, ASX 200 Consumer Discretionary (INDEXASX:XDJ) ended 0.49% up to 2,931.90 points, and Consumer Staples (INDEXASX:XSJ) closed 0.999% higher to 13,081.266 points.

Meanwhile, the ASX All Ordinaries index (INDEXASX:XAO) ended 0.739% up at 7,345.8 points and ASX 200 VIX (INDEXASX:VIX) closed 5.93% up.

Ten out of eleven significant sectors ended in the green zone today. Consumer Staples sector closed 1.09% strong.

The present piece talks about the top ASX consumer stocks and their performance this reporting season. Discussed here are Wesfarmers Limited, Coles Group Limited, Woolworths Group Limited and Tabcorp Holdings Limited.

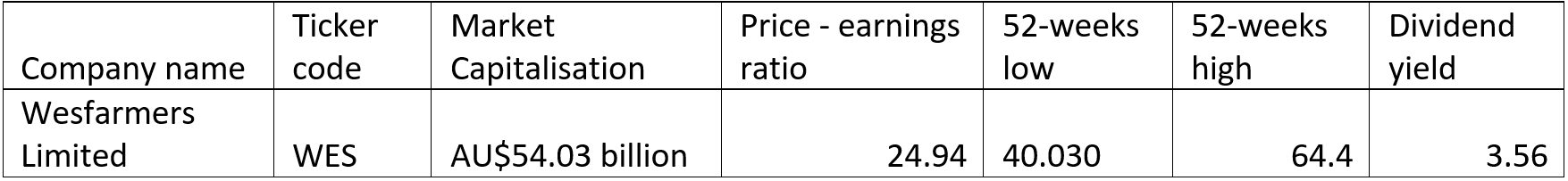

Wesfarmers Limited (ASX:WES)

Headquartered in Western Australia, Wesfarmers is a diverse corporation. It covers industrial and safety products, energy and fertilisers, chemicals, health and wellbeing, office supplies, general merchandise, and outdoor living and home improvement.

Image source: © Yurolaitsalbert | Megapixl.com

In the financial year 2022, Wesfarmers posted a statutory net profit after tax (NPAT) of AU$2,352 million, down 2.9% on the previous year. Reportedly, the company’s financial results were affected by the disruptions created by Covid-19. In the first half of FY22, the retail stores were either closed or subject to trading restrictions.

In the second half of 2022, the NPAT grew by 13.1% on the prior period as the restrictions eased. Considering the solid second-half performance, the directors of the company announced a dividend of AU$1.00 per share, payable on 6 October 2022.

On Friday, Wesfarmers shares ended 0.650% up at AU$47.950 per share.

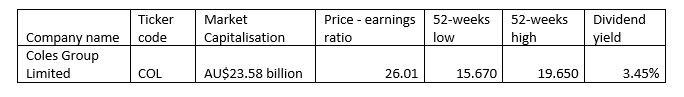

Coles Group Limited (ASX:COL)

Headquartered in Victoria, Coles is a leading retailer that operates and manages more than 2,500 retail outlets across Australia. The business of Coles includes supermarkets, online, liquor, fuel and convenience, and financial services businesses. The company also run a loyalty program called flybuys.

In FY22, Cole’s business was impacted by substantial supply chain-related challenges, especially in the international market due to Russia and Ukraine war. Flooding and increased rate of absenteeism also affected the financial results.

In 52-weeks, the sales revenue grew by 2% and net profit after tax by 4.3%. Despite the environmental challenges, EBITDA and EBIT were quite stable. EBIT dropped by 0.2%, and EBITDA surged by 90.2%.

Despite lower growth in earnings, the company declared a final dividend of 30 cents per share, 7.1% higher than the previous year. With this, the total dividend for the year reached 63 cents per share, 3.3% higher on the prior year.

Reportedly, the final dividend is expected to be paid on 28 September 2022.

On 26 August 2022, Coles shares ended at AU$17.650 per share.

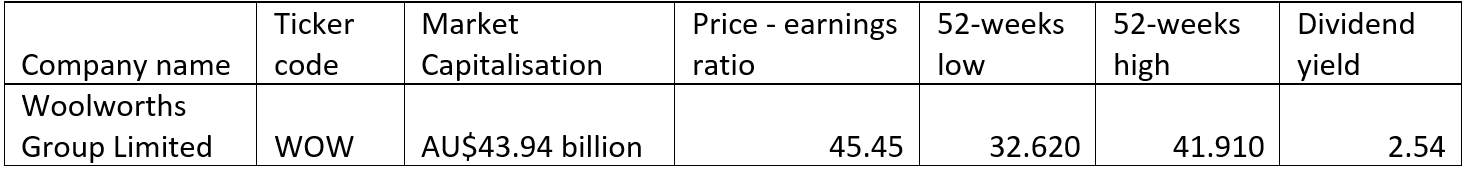

Woolworths Group Limited (ASX:WOW)

Image source: © Phper | Megapixl.com

Headquartered in New South Wales, Woolworths offers its business to consumer food services and products via eCommerce platforms and stores. Through retail platforms that include network and property, technology, and analytics-enabled platforms, the company delivers value to its partners and groups. The B2B business of Woolworths serves the export and wholesale market.

In FY22, the company recorded a 9.2% rise in group sales from the continued operations. eCommerce sales grew by 39% from the previous year to AU$6,263 million. Group EBIT fell by 2.7% to AU$2,690 million, and group NPAT surged by 0.7% to AU$1,514 million.

While sharing the full-year results, the company announced a final dividend of 53 cents per share (3.6% lower than the prior period), taking the FY22 dividend to 92 cents per share. The dividend is fully franked, and the tentative payment date is 27 September 2022.

On Friday, the stock ended 1.5% strong at AU$36.760 apiece.

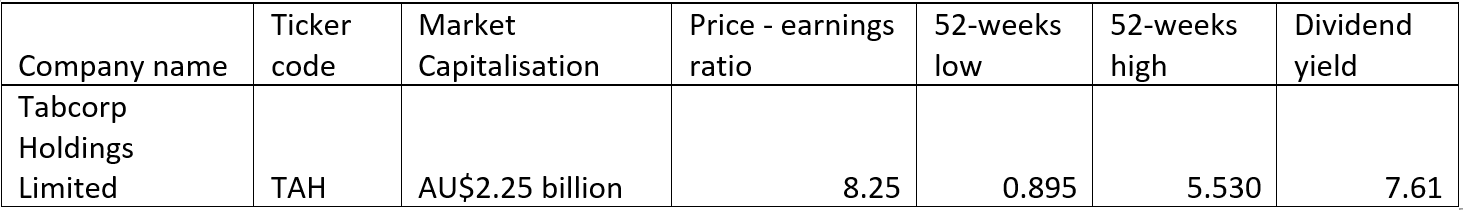

Tabcorp Holdings Limited (ASX:TAH)

Headquartered in Melbourne, Tabcorp is an ASX-listed consumer service company that offers entertainment and betting businesses. To create an immersive and exciting social experience for its customer, the company utilises cutting-edge technology. The company operates through its brand TAB, Sky Racing and MAX. TAB is a multichannel wagering brand, Sky Racing broadcast sports and racing program, and Max is a gaming service provider.

The company recently shared its full-year results for FY22. During the year, the company registered a group revenue of AU$2,373 million, 4.3% less than the previous year. Group EBITDA declined from AU$487 million in FY21 to AU$382 million. Statutory NPAT gained from AU$269 million to AU$6,776 million in FY22.

Despite a fall in the group revenue, the company announced a final dividend of 6.5 cents per share, bringing the full year to 13 cents per share. Reportedly, the tentative payment of the final dividend is on 23 September 2022.

On Friday (26 August 2022), the stock ended 0.492% higher at AU$1.020 per share.

.jpg)