Highlights

- Titomic has joined hands with Nèos for setting up an advanced additive manufacturing facility in England.

- The JV will pave the way to establish the world’s first such facility to supply Invar (nickel-iron alloy) components.

- The facility is being established with a view to service the aerospace, space, defence, automotive and nuclear industries of the United Kingdom and Europe.

ASX-listed industrial-scale metal additive manufacturer Titomic Limited (ASX:TTT) is all set to establish the world’s first large-scale additive manufacturing facility to manufacture and sell Invar components.

Titomic, in its latest market update, announced the signing of a joint venture agreement with Nèos International to set up an advanced joint manufacturing facility in Halesowen, England.

Nèos is a UK-headquartered engineering solutions company with multiple technology centres in the UK, Portugal, and India.

The market welcomed the latest update as TTT shares surged 16.67% to close the day’s trade at AU$0.21 on 8 June 2022. The Company has a market cap of AU$36.45 million.

Recent update: Titomic to deliver first-of-its-kind glass mould coatings system

The facility will manufacture and sell Invar36 faceplates and additively manufactured metal product solutions for specialised industrial sectors, including aerospace, space, defence, automotive and nuclear.

The facility will be used to supply its specialised products to customers based in the United Kingdom and Europe.

Data source: TTT ASX update, 8 June 2022

Titomic plans to sell its tailored and purpose-engineered Titomic Kinetic Fusion System, TKF 2200, at an estimated price of AU$2.4 million to the Nèos Titomic Joint Venture. The TKF 2200 system will use a supersonic cold gas dynamic spray of metal powders to manufacture industrial-scale metal components.

Titomic also highlighted that the facility would incorporate TKF’s advanced manufacturing and Nèos tooling technologies to achieve a world-class tooling manufacturing capability.

Titomic estimates that the Invar tooling industry is worth US$500 million per annum. The company also expects to leverage its proven TKF technology to gain significant market share. Nèos’ capabilities and decades of tooling expertise will aid Titomic in achieving its target.

Related read: Titomic (ASX:TTT) acquires European cold spray tech company Dycomet

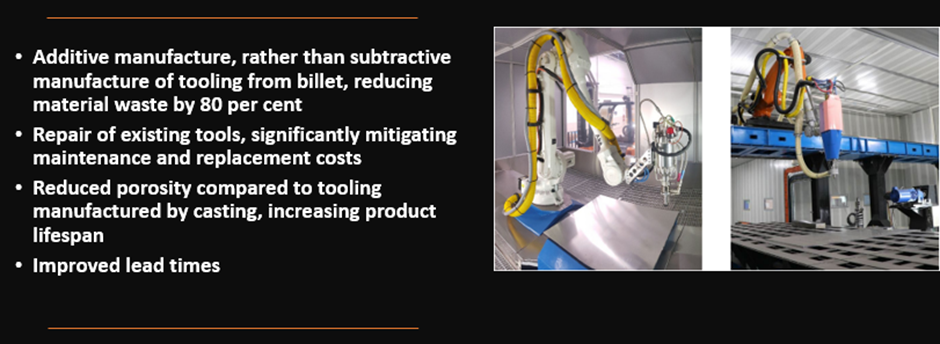

Benefits of Titomic Kinetic Fusion Invar tooling:

Image source: TTT Presentation; Data source: TTT ASX update, 8 June 2022

The joint venture will further boost Titomic's technology, making it commercially competitive. The JV signifies the strength and success of Titomic’s go-to-market strategy. For Titomic, the joint ventures remain one of the major commercial focuses for accelerating growth in key markets.

The Company anticipates more JVs on the cards in the defence sector, in line with its strategy.