Summary

- While a myriad of companies lost their charm during the COVID-19 pandemic, many became popular in the market within the same time frame.

- Telecommunication carrier, Telstra has been in the limelight because of its 5G expansion plan. The Company also announced the launch of Telstra Calling for Microsoft Teams.

- Zip Co reported record growth in its revenue in Q4 FY2020; signed an agreement with Respiri, an eHealth SaaS player.

- Catapult expects its revenue for FY2020 to range from US$100 million to US$101 million; achieves positive cash flow beating its estimates.

Australia has had a rather forgettable 12-month period with the bushfires that started in mid-2019 and then the ongoing COVID-19 pandemic which continues to affect world economies. While several companies were hit hard due to these events, some performed well due to the nature of their business.

On the one hand, corporations resorted to options such as withdrawing or postponing their guidance and implementing cost initiatives to ensure the sustainability of their business. On the other hand, the pandemic created opportunities for a few industries.

We will now look at some ASX-listed players that have garnered the attention of market participants of late.

Telstra Corporation Limited (ASX:TLS)

Telecommunication carrier, Telstra Corporation has been under the spotlight led by its 5G expansion plan across the nation. The most recent update is the boost in the mobile coverage in Berrys Creek.

New Mobile Site Switched to Boost Mobile Coverage in Berrys Creek:

On 21 July 2020, the Company announced that a new mobile site was switched as part of the Federal Government’s Mobile Black Spot Program. The step was taken to improve the coverage to Berrys Creek.

According to the Regional General Manager Loretta Willaton, the new site would improve the existing coverage across South Gippsland.

Launch of Telstra Calling for Microsoft Teams:

On 16 July 2020, Telstra announced the global launch of Telstra Calling for Microsoft Teams. Telstra Calling is an entirely digitised cloud solution that allows telephony services using Microsoft Teams on Office 365 for multi-national corporations.

The solution would be made available in Hong Kong and NZ in August. In October 2020, the solution would be available in UK, and then worldwide from December onwards.

Launch of world-first Enterprise-grade 5G solutions:

On 14 June 2020, the Company launched a world-first suite of Enterprise-grade 5G solutions. Telstra Enterprise customers are the first in the world who would be able to buy and implement Cradlepoint 5G wireless network edge solutions. This solution comprises of adaptors and routers engineered to provide the speed, security, reliability plus manageability needed by Enterprise 5G clients.

The solution, when coupled with Telstra’s 5G network and Enterprise Wireless service, is amongst the most comprehensive Enterprise 5G solutions in the world. Thus, it would offer a real substitute to fixed connections for businesses.

Do Read: Are these the Top 6 Stocks to look at this Season: KGN, EML, NXT, ANN, TLS, BLD

The tale of gigantic Telecommunications industry and its players: TPM, TLS, VOC, AYS

Stock Information:

TLS shares in the last six months delivered a negative return of 13.45%. However, the performance of the shares in the previous three months grew ~9. By the end of the day’s trade on 24 July, TLS shares settled at A$3.330, down 0.597% from the last close.

Zip Co Limited (ASX:Z1P)

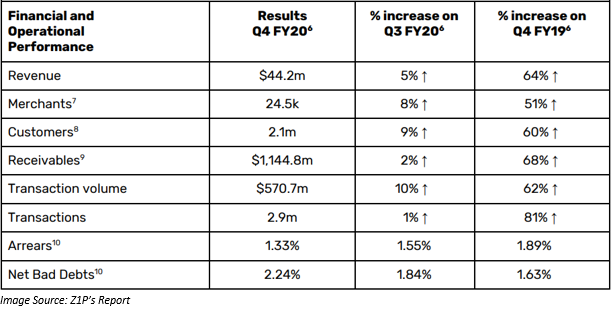

A leading player in the digital retail finance and payments industry, Zip Co Limited has delivered strong revenue growth of 64% in the Q4 FY2020 ended 30 June 2020 as compared to Q3 FY2020.

The Company, during the period, completed the acquisition of US-based BNPL Company QuadPay along with an investment of up to A$200 million from Susquehanna Investment Group to fast-track its global expansion strategy and drive growth.

Signed Merchant Services Agreement with Respiri Limited:

On 20 July 2020, Respiri Limited entered into a merchant services agreement with the Company’s 100% subsidiary Zip Money Payments Pty Ltd. In Australia, the BNPL services are growing at a faster pace. One out of every ten people in Australia uses such payment options.

Stock Information:

By the end of the day’s trade on 24 July, Z1P shares settled at A$6.380, down 2.595% from the last close. Z1P has delivered impressive returns of 232.29% and 56.37% in the previous three and six months, respectively.

GOOD READ: Global Growth - How it plays a role for BNPL Stock Z1P

FlexiGroup Limited (ASX:FXL)

FlexiGroup Limited is a diversified full-service payments company with leading offerings in BNPL services.

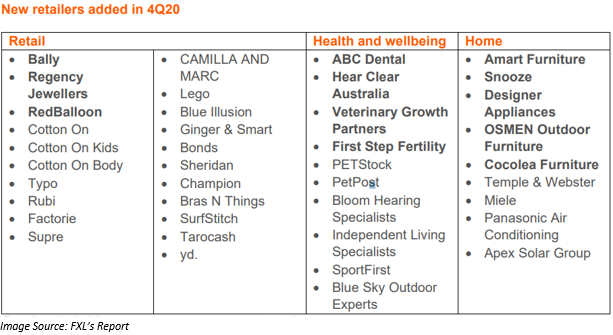

In a market release on 20 July 2020, FXL provided a humm retail partner update for the quarter ended 30 June 2020. FXL noted a strong online growth with 315% rise in the volume and 447% in the total transaction during the fourth quarter of 2020 as compared to the previous corresponding period.

The robust performance was due to the record e-commerce and instore additions during the fourth quarter. Another feature BPAY was introduced during the period to enable the customer to pay for bills in controllable interest-free instalments with humm at various service providers.

A Glance at the new Retailers in Q4 FY2020:

Stock Information:

FXL shares in the last six months delivered a negative return of 36.68%. However, the performance of the shares in the previous three months grew 84.35%. By the end of the day’s trade on 24 July, FXL shares settled at A$1.355, down 2.518% from the last close.

Newcrest Mining Limited (ASX:NCM)

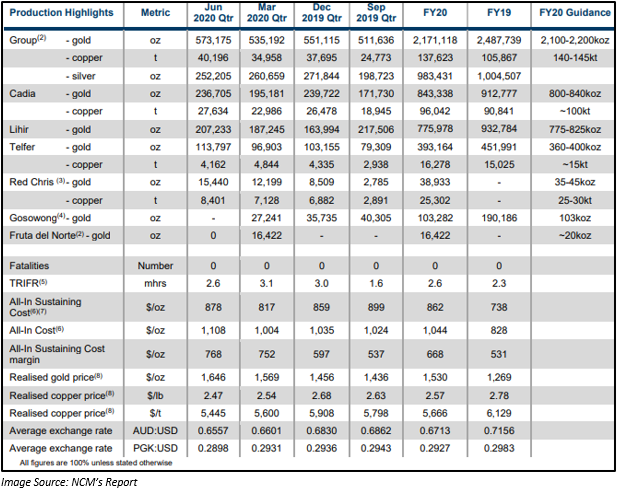

Newcrest Mining Limited, a Company from metals and mining sector engaged in exploration, development, mining, and sale of gold, was successful in achieving FY2020 production guidance with Cadia surpassing the upper end of its guidance range.

The gold production during the period was 573koz, up 7% as compared to the previous quarter. The period witnessed a record annualised mined ore plus mill output for the Q4 at Cadia.

During the fourth quarter, the Company bolstered the balance sheet via equity raising. The exposure to the cash flows generated via Tier 1 Fruta del Norte mine.

The Company also noted a 15% growth in the Quarterly copper production to 40kt as compared to the Q3 FY2020.

Stock Information:

By the end of the day’s trade on 24 July, NCM shares settled at A$34.600, down 0.546% from the last close. NCM has delivered returns of 21.28% and 8.19% in the previous three and six months, respectively.

Catapult Group International Limited (ASX:CAT)

Catapult Group International Limited helps athletes and teams build and improve their respective performances.

On 20 July 2020, the Company announced that it generated net free cash of US$9 million in FY2020. The value represents a growth of US$24.1 million as compared to FY2019.

Group revenues and EBITDA showed continued improvement despite many professional sporting leagues were deferred globally. The increase was due to the subscription nature of most of the Company’s revenue, along with the scalability of its business model.

Key Achievements During FY2020:

- Free cash flow for FY2020 was US$9 million.

- The position of cash by the end of FY2020 was US$27.5 million.

- Revenue for FY2020 is projected to range from US$100 million to US$101 million.

- EBITDA is expected to lie in between US$11.5 million and US$12.5 million.

Catapult announced a change in FY-end and reporting currency from FY 2021 onwards. The financial yearend would be 31 March with US$ as the Company’s presentation currency.

Stock Information:

CAT shares in the last six months delivered a negative return of 20.97%. However, the performance improved in the previous three months with a growth of ~80%. By the end of the day’s trade on 24 July, CAT shares settled at A$1.715, up 3.313% from the last close.