Australia-based Platina Resources Limited (ASX: PGM), boasting a project portfolio focused on speciality, precious and base metals, is considering a new and promising extraction technology for scandium at its Platina Scandium Project located in central New South Wales. The Company plans to advance the trial of vat leaching for the scandium extraction following its potential highlighted by initial tests as a cheaper alternative to high pressure acid leaching (HPAL).

It is to be noted that Platina Scandium Project is believed to host one of the largest and highest-grade deposits of scandium, globally. Moreover, the project seems to hold the potential to become the first scandium producer in Australia with cobalt, platinum and nickel credits.

Initial Vat Leaching Trial Outcomes Promising

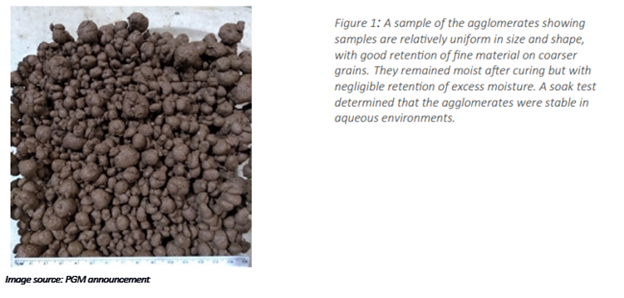

Initial agglomeration tests of ore from Platina Scandium Project (PSP) were carried out in bottle rolls, where the right environment for vat leaching was created with the right measure of acid, chemical binder, and water for the dry ore sample.

A leach column test in a 144 mm diameter column with a bed depth of 1.4 m highlighted that after an initial slump, the agglomerates were stable in the leach bed. This allowed the leach solution to percolate through the ore. After 31 days, the scandium extraction was found to be 22 per cent with acid consumption of just over 100 kg acid per tonne of ore. Based on these findings, 50 per cent of scandium extraction could be achieved in nearly 24 weeks.

Furthermore, acid consumption was found to be linear after the first few days of leaching. The estimated acid consumption for 50 per cent scandium extraction is 477 kg per tonne of ore. The vat leaching system (counter current) would reduce the acid consumption.

First test results are encouraging, and PGM has confirmed that it will advance its trial of vat leaching for scandium extraction at the project.

Vat leaching is traditionally used for oxide gold and copper ores, and occasionally for nickel laterite ores. At PSP, the initial trials of vat leaching are assuring for delivering a smaller, lower-cost project better aligned to low volumes of scandium in the current market.

The conventional HPAL is likely to recover more metal, but the technology is complex, which requires larger scale and more capital than vat leaching.

Platina Planning Second Phase of Testwork for Confirming Results

After encouraging outcomes from the initial analysis, PGM intends to conduct the second phase of testwork to validate the preliminary outcomes and to also get leach solutions for further processing.

The objective is to find if scandium could be recovered using a solvent extraction process as it is used in titanium dioxide pigment plants to extract scandium from used acid. The findings will aid in the initial economic evaluation of the process to discover its feasibility.

Management Commentary

Platina Managing Director Corey Nolan highlighted that the Company has been targeting potential clients in various regions and countries including the US, Europe, Asia and Australia as part of its international campaign to facilitate financing and secure production offtake deals for the project. The key to unlock a deal could be lower prices for scandium oxide, capable of competing with other aluminium alloys in the market.

Mr Nolan added that the establishment of a cheaper, western world supply source of scandium would support PGM in its efforts towards unlocking the deal.

Platina Resources has been evaluating various small-scale development alternatives to the HPAL process that established the foundation of its 2018 Definitive Feasibility Study. The Company has also been examining different processing options to scale up production if demand grows.

Platina Assessing Viability of Battery Materials Processing Plant

PGM has also been evaluating the technical and economic feasibility of building a battery materials processing plant to extract nickel, cobalt, high purity alumina (HPA) and scandium from ores sourced from Australia/Pacific region and mixed with Platina Scandium Project ore.

The idea is to design the plant size to reduce the expenses and get a more attractive return from investors. When compared with large-scale HPAL projects, such small-size plant is expected to minimise financial and technical risks.

Based on historical testwork and published information, initial modelling of the process option highlights that a processing operation based on a blend of 90 per cent imported limonite rich nickel/cobalt laterite ore and 10 per cent scandium-rich PSP ore at nearly 250 t/d could be feasible.

The potential other products that could be extracted include nickel/cobalt mixed hydroxide, scandium oxide and HPA. Sources for imported high-quality nickel/cobalt laterite ores have been fixed, and now state development areas on the eastern seaboard with proper shipping logistics and access to natural gas and power are being reviewed.

PGM has begun a process of exploring possible developments partners for the concept that includes working with Traxys.

Do Read: Platina Resources Extends MoU with Traxys to Advance Scandium Project in NSW

Stock Information - PGM stock was inching upward by 2 per cent to trade at AU$0.051 on 22 July 2020 (AEST 12:16 PM). The last three-month return of the stock was noted at 233.33 per cent.