Highlights:

- Electric vehicle (EV) sales are increasing globally due to government policy in Europe, Asia, and North America.

- According to ARENA’s report, EVs are anticipated to become equal to petrol vehicles in terms of price and range by the mid-2020s.

The world’s transport sector is witnessing a major transformation because of electric vehicles (EVs). As per the Parliament of Australia, global EV sales are increasing swiftly, driven by government policy in North America, Asia, and Europe. The transition is led by vehicle manufacturers who are investing heavily to improve the EV driving range and expand their EV offerings.

EV uptake in Australia is currently lower than it is in other developed nations; however, it is expected to increase as cost-effective models are introduced, and more charging infrastructure is established, said the Australian Renewable Energy Agency (ARENA).

According to ARENA’s Australian Electric Vehicle Market Study report, EVs are anticipated to become equal to petrol vehicles in terms of price and range by the mid-2020s. ARENA said that once this parity is achieved, sales of EVs are expected to shoot up.

In line with this, let us have a look at the performance of some ASX-listed minerals companies that deal with EVs. The EV stocks discussed in this article are Novonix Limited, Piedmont Lithium Inc., Pilbara Minerals Limited, and Magnis Energy Technologies Limited.

Meanwhile, the Australian stock market index, ASX 200, closed 1.65% higher at 6,976.90 points on 1 November 2022. With this, the index gained 8.05% in one month and fell by 4.74% in a year. All 11 sectors closed in red, along with the benchmark index. Utilities marked the highest gain of 2.18%. The Materials sector closed 2.08% higher.

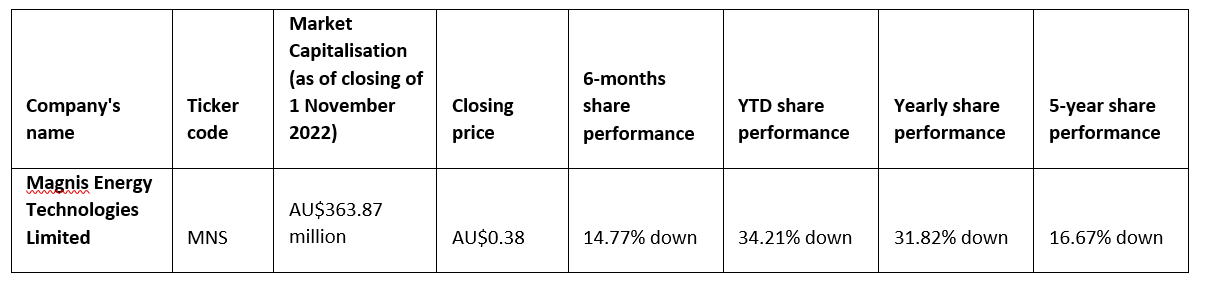

Novonix Limited (ASX:NVX)

NOVONIX delivers smart battery technology and materials for the lithium-ion battery industry. The company operates in Canada and the United States.. The company is dual-listed on the ASX and NASDAQ.

In a recent ASX filing, the company shared that its Anode Materials division has been selected to enter a negotiation to get a US$150 million grant from the US Department of Energy (DOE). The projects will be funded by the president’s bipartisan Infrastructure Law to increase the domestic manufacturing of electric grids, batteries for EVs, materials and components that are imported from other countries.

In its recently released quarterly activities report, the company stated that the grant funding will be employed to expand the company’s domestic production of synthetic graphite anode materials.

NOVONIX mentioned in the ASX release that it is on track to reach an annual production capacity of 10,000 tonnes per annum of synthetic graphite in 2023.

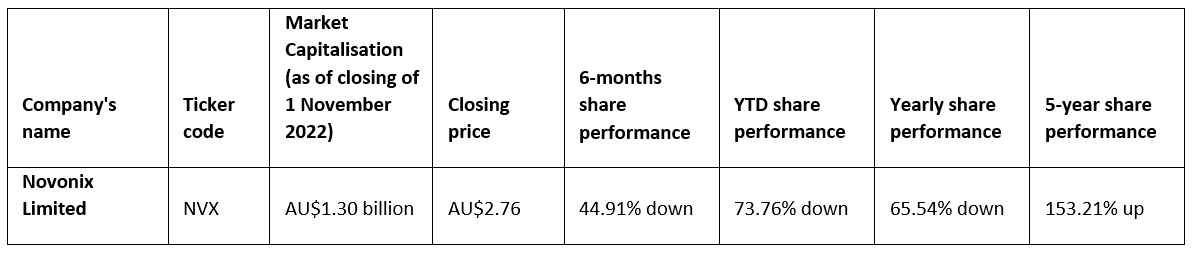

Piedmont Lithium Inc. (ASX:PLL)

_11_02_2022_00_12_09_099896.jpg)

Image source: © Radius06 | Megapixl.com

Piedmont is a dual-listed company with listing on NASDAQ and the ASX. The company develops lithium resources critical to the EV supply chain of the United States.

On 19 October 202, the company shared that it had been selected for US$141.7 million of grant funding by the DOE. The funding will assist in developing the company’s Tennessee lithium project. The aim of the project is to increase the supply of lithium hydroxide in the United States by 30,000 metric tonnes per year.

Lithium hydroxide is a crucial component of long-range, high-density EV batteries. Keith Phillips, the CEO and president of the company, stated that 80% of the lithium hydroxide production currently happens in China.

Construction at the project is estimated to commence in 2023, and production is estimated to begin in 2025, subject to project financing timelines.

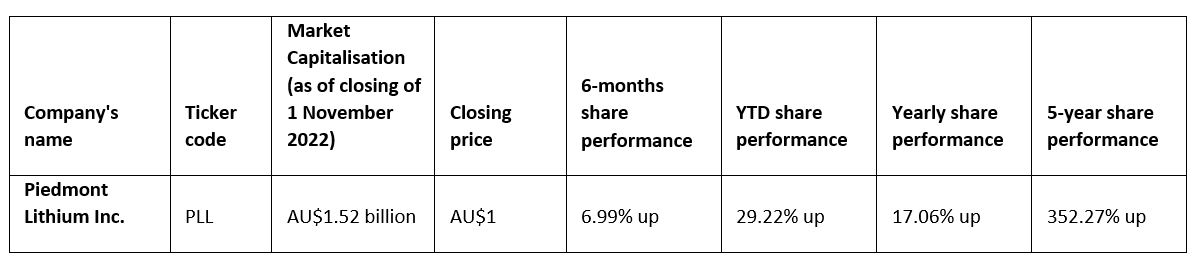

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals is a lithium company that claims to own 100% of the world’s largest lithium operation, the Pilgangoora Project, located in Western Australia. The company produces tantalite and spodumene concentrate. Pilbara states that the quality and scale of operations have attracted many global partners, like Yibin Tianyi, CATL, POSCO, General Lithium, and Ganfeng Lithium.

Pilbara’s September quarterly activity report indicates that spodumene concentrate production increased by 16% over the June quarter of 2022.

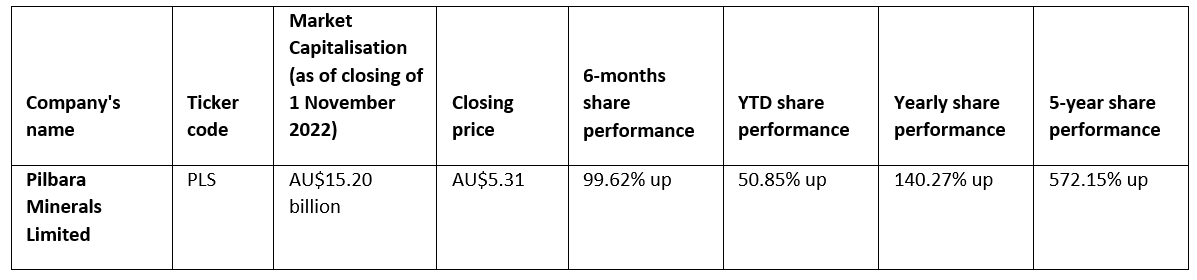

Magnis Energy Technologies Limited (ASX:MNS)

A vertically integrated lithium-ion battery materials and technology company, Magnis’ vision is to accelerate, support, and enable the mass adoption of renewable energy storage and electric vehicles. The company, with its minority stake and consolidated subsidiaries, has projects and operations in Australia, Tanzania, and the United States.

Through an ASX filing, the company informed the market that the lithium-ion battery manufacturing facility of Magnis, which is operated by Imperium3 New York Inc., had commenced commercial production. iM3NY is estimated to produce around 15,000 cells on daily basis. In addition to this, the company shared that the bankable feasibility study update has confirmed the technical and financial viability of the Nachu Graphite Project.