Highlights

- Return on Equity (ROE) is one of the measures of financial performance that helps gauge the company's profitability and efficiency in profit generation.

- While looking for stocks, it is always advisable to target an ROE equal to or higher than the sector’s average.

- A stock with an exceedingly high ROE can be considered good if its net income is extremely large compared to equity.

- GRR, BLX, RIO, IEL, CDA, RMC, AMI, PWH, SNL, and OFX are some stocks from ASX All Ordinaries with a decent ROE demonstrating consistent growth

It is very important to have a good understanding of a company before investing your money into it. A company's stock fundamentals are key metrics that can provide good insight into a stock. One can evaluate a company's financials such as profit-loss, balance sheet, operating cost, expenses, revenue, etc. before making investment decisions.

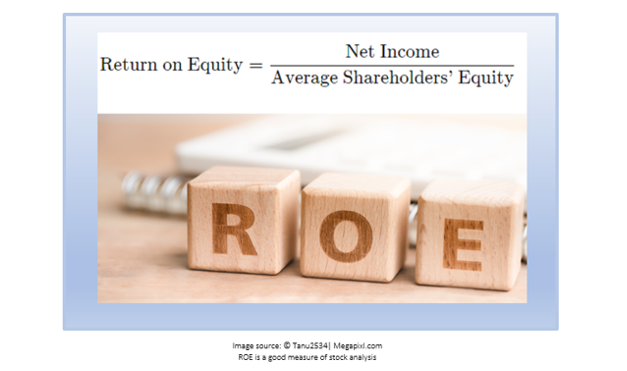

Return on Equity (ROE) is one of the measures of financial performance that helps gauge the company's profitability and efficiency in profit generation. A higher ROE demonstrates the efficiency of a company's management in generating income.

ROE is expressed as a percentage and is calculated by dividing the net income of a company by the equity of its shareholders.

A stock can be compared to its peers to decide whether its ROE is good or bad. While looking for stocks, it is always advisable to target an ROE equal to or higher than the sector’s average.

For example, suppose a company ‘XYZ’ has maintained a stable ROE of 16% over the last five years compared to its peers’ average, around 13%. This implies that ‘XYZ’ is performing above average and more efficiently creating profits using its assets.

Warren Buffett, one of the world's most successful investors, often uses ROE while making decisions on his investment.

Are stocks with higher ROE always good?

A stock with an exceedingly high ROE can be considered good if its net income is extremely large compared to equity. A high ROE, however, is mostly due to a small equity account relative to its net income, which is generally riskier.

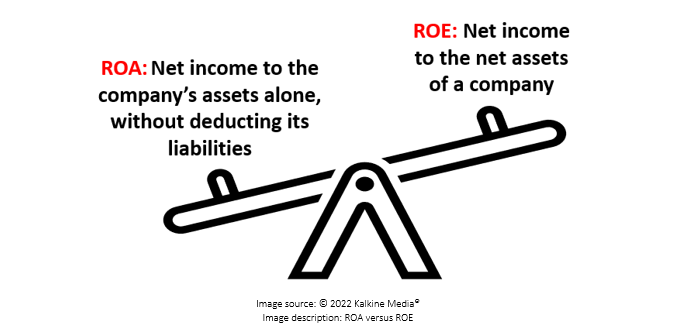

Difference between Return on Equity (ROE) and Return on Assets (ROA)

While ROE and ROA sound the same, there is a slight difference between these two. Let us have a look.

On this backdrop, let’s discuss ten stocks from ASX that have relatively higher ROE than their peers in their sector.

Grange Resources Ltd (ASX:GRR)

Grange Resources is a mining company that operates one of Australia's biggest pellet production and iron ore mining business. In the June quarter, the company's concentrate production increased by 26kt, and pellet sales increased by 226kt compared to the March quarter.

Beacon Lighting Group Ltd (ASX:BLX)

Beacon is steered by the mission to provide world-class, innovative, technologically advanced, and efficient lighting and cooling solutions. In the first half of FY22, the company's gross profit increased by 2.3%, and Earnings Before Interest Taxes and Amortisation (EBITDA) increased by 3.8%.

Rio Tinto Ltd (ASX:RIO)

Rio Tinto specialises in mining and processing mineral resources. It has its operations in about 35 countries of the world. In the first half of FY22, the company's consolidated sales revenue decreased by 10%, and underlying EBITDA decreased by 26% compared to the previous corresponding period (pcp).

IDP Education Ltd (ASX:IEL)

IDP offers free-of-cost education counseling and migration consultation to students wanting to study abroad. It also conducts language tests. Revenue of IEL surged by 47%, and adjusted EBIT went up 64% in the first half of FY22.

Codan Ltd (ASX:CDA)

Codan develops electronics solutions for different sectors. Its technologies include communications and metal detection, and its products are sold in over 150 countries. In the first half of FY22, the company's sales increased by 32%, and EBITDA surged by 20%.

Resimac Group Ltd (ASX:RMC)

Resimac Group offers residential mortgages and asset finance to a wide range of customers in New Zealand and Australia. In May, Resimac closed the first social bond provided by an Australian non-bank as part of a $1 billion Bastille Trust Series 2022-1NC dual-currency residential mortgage-backed securities transaction.

Aurelia Metals Ltd (ASX:AMI)

Aurelia Metals is a mining and exploration company based in Australia. The company has three operating gold mines in New South Wales. In the June quarter of FY22, the company's group sales revenue was AU$101.2million, and it ended the quarter with a strong cash balance of AU$76.7million.

PWR Holdings Ltd (ASX:PWH)

PWR Holdings produces world-class cooling solutions and is a prominent leader in high-performance cooling. It has a purpose-built facility for the manufacturing process. In the first half of FY22, PWR Holdings reported solid business growth of 22% and a 16.5% conversion of revenue to Net Profit after Tax (NPAT).

Supply Network Ltd (ASX:SNL)

Supply Network Limited specialises in the replacement part for road transport equipment. It is working in Australia and New Zealand under the Multispares brand. In a recent announcement of the preliminary earnings forecast for June 2022, Supply Network stated that it is expecting AU$20million as profit after income tax.

OFX Group Ltd (ASX:OFX)

OFX provides money transfer and foreign exchange services in more than 50 currencies. The company reported strong results in FY22 with a record net operating income of AU$147million and an underlying EBITDA of AU$44.5million.