Summary

- Sydney-headquartered Hearts and Minds Investments has remained resilient during the COVID-19 pandemic generating an outstanding investment performance during FY20.

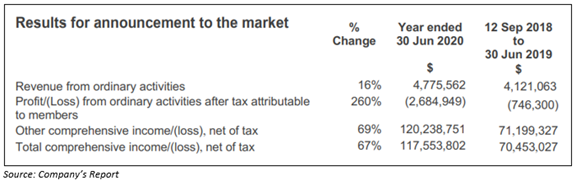

- The revenue from ordinary activities was reported at A$4.77 million, increasing by 16% during FY20. The Company generated a pre-tax investment return of 26.1%.

- The Board shall consider a dividend payment after the December 2020 half-year, contingent on the realised profits from the 2019 Conference Portfolio disposal.

This current reporting season has been extremely harsh on also every sector because of the medical emergency posed by COVID-19 pandemic. ASX players are trying to overcome the challenges emerging from the measures taken to avoid the spread of coronavirus infection. The pandemic has shaken every aspect of life and impacted many businesses. During this time of uncertainty, companies are not providing any guidance as well as are not able to pay dividends or slashing their dividends.

However, one ASX-listed investment company is contemplating becoming a dividend payer amidst the ongoing pandemic. Hearts and Minds Investments Limited (ASX:HM1) revealed in its annual report that the Company would consider a dividend payment after the realisation of the 2019 Conference Portfolio.

DO READ: Is it a Carnage? Dividend Dynasty for Income Stocks and a Peek into Present Dividend Stalwarts

Let us now discuss in detail about Hearts and Minds Investments-

About the Company:

Hearts and Minds Investments Limited is engaged in the business of improving the concentrated portfolio indicating fund managers’ highest conviction ideas. The investment firm has two core objectives- one is to maximise long-term returns for its shareholders by investing in high conviction ideas, and the other is to offer critical financial support to leading medical research institutes.

Hearts and Minds’ outstanding investment performance during FY20-

On 26 August 2020, Hearts and Minds released its annual results for FY20 (year ended on 30 June 2020) and stated that the Company performance was resilient during the COVID-19 pandemic. HM1 has generated an outstanding investment performance during the financial year 2020.

After the announcement of FY20 results, the share price of HM1 ended the day’s trading session at A$3.590, up by 0.279% from its previous close. With a market capitalisation of A$805.5 million, HM1 has approximately 225 million shares trading on the ASX. Shares of HM1 have delivered a positive return of 15.11% and 20.54% in the last six and three months, respectively.

Highlights from the financial year 2020-

- During the FY2020, revenue from ordinary activities was reported at A$4.78 million, up by 16%.

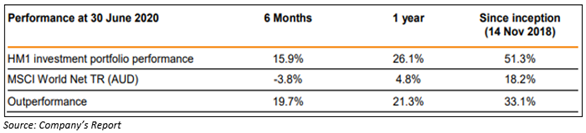

- Since the inception of HM1 in November 2018, the Company has generated a pre-tax investment return of 51.3% compared to the MSCI World Net TR (AUD) return of 18.2% for the same period.

- During the year, Hearts and Minds recorded total comprehensive income after tax of A$117.55 million.

- The net tangible assets (NTA) of HM1 have risen from A$570.44 million on 30 June 2019 to A$750.51 million as of 30 June 2020.

HM1 Portfolio Performance

- HM1 posted a pre-tax investment return of 26.1% for the year ended 30 June 2020.

- This return during FY20 was significantly outperforming the global equity benchmark, the MSCI World Net TR (AUD) index, which increased 4.8% over the same period.

Dividend Information

Provided the robust returns generated by Hearts and Minds since the beginning and the generation of net realised gains, the Board would consider a dividend payment after the realisation of the 2019 Conference Portfolio which will take place at the end of 2020.

The HM1 Board has not declared a dividend for the fiscal year 2020 so far. However, the Board shall consider a dividend payment subsequent the December 2020 half-year, conditional on the quantum of realised profits from the disposal of the 2019 Conference Portfolio.

ALSO READ: How Dividends Will Pan-Out for Listed Investment Companies in 2020?

HM1 Provides Financial Support to Medical Research Organisations

In line with HM1’s charitable purpose, the Company provides financial support to leading Australian medical research organisations. Through this financial support, the Company help the development of innovative treatments and medicines and drive the next generation of medical research across the country.

- Hearts and Minds with its participating fund managers forego any investment fees and instead donate an amount equivalent to 1.5% of net tangible assets per annum to designated charities.

- During the year ended 30 June 2020, HM1 paid A$4.1 million to its designated charities and made provision for a further A$5.1 million which will be paid at the end of August 2020.

- These donated funds shall be used by the medical research organisations to fund necessary research & development into the prevention and treatment of chronic diseases and mental health issues.

- The ongoing COVID-19 pandemic highlights the critical importance of medical research to global health outcomes and economic prosperity.

Future Developments

The future performance of HM1 depends on the performance of its investment portfolio, which, in turn, is impacted by investee company-specific factors and prevailing industry circumstances.

Moreover, several external factors, such as economic growth rates, interest rates, exchange rates and macro-economic conditions, impact the overall equity market.

However, currently, it is not possible or appropriate for the Company to accurately predict the performance of HM1’s investment portfolio as well as its performance in the future.

GOOD READ: Investors are looking at WMI, RFF for Dividends - Did you miss the Boat?