Highlights

The ASX 200 opened marginally higher on Thursday.

The benchmark index rose 4.30 points, or 0.062% to 6,920 at the open.

The ASX All Ordinaries index rose 0.06%.

The Australian share market opened marginally higher on Thursday following strong cues from Wall Street which rallied in overnight trade boosted by major tech stocks. The benchmark ASX 200 index also rose due to gains made by domestic tech stocks.

The ASX 200 index rose 4.30 points, or 0.062% to 6,980.20 at the open. The ASX All Ordinaries index rose 0.06% to 7,207.2, while the A-VIX fell 1.37% to 15.984 at the open.

The benchmark index was trading at 7,011, up 35.30 points or 0.51% in the first ten minutes of trade. The index has gained 1.31% in the past five days but has declined 6.24% on a year-to-date (YTD) basis.

On Wednesday, the benchmark index declined 0.3% to 6,975.9 points.

Global equity indices

Wall Street gained in overnight trade on strong US economic data and positive corporate guidance. As a result, the Dow Jones rose 1.3%, the S&P 500 gained 1.6%, and the NASDAQ ended 2.6% higher.

The US reported an increased services activity and a robust surge in factory orders in July. Meanwhile, US House of Representatives Speaker Nancy Pelosi has wrapped up her Taiwan visit.

Pelosi’s visit to Taiwan raised further uncertainty in the global market, boosting havens like the dollar and yen and weighing on stocks.

In Europe, the Stoxx 50 rose 1.3%, the FTSE gained 0.5%, the CAC surged 1%, and the DAX ended 1% higher.

Market action

US Treasury yields surged following the release of strong economic data. The bond yields hit their two-week highs, with the yield on benchmark 10-year notes rose to 2.798%.

The US dollar index fell to 0.13%, while the euro rose 0.04% to US$1.0168.

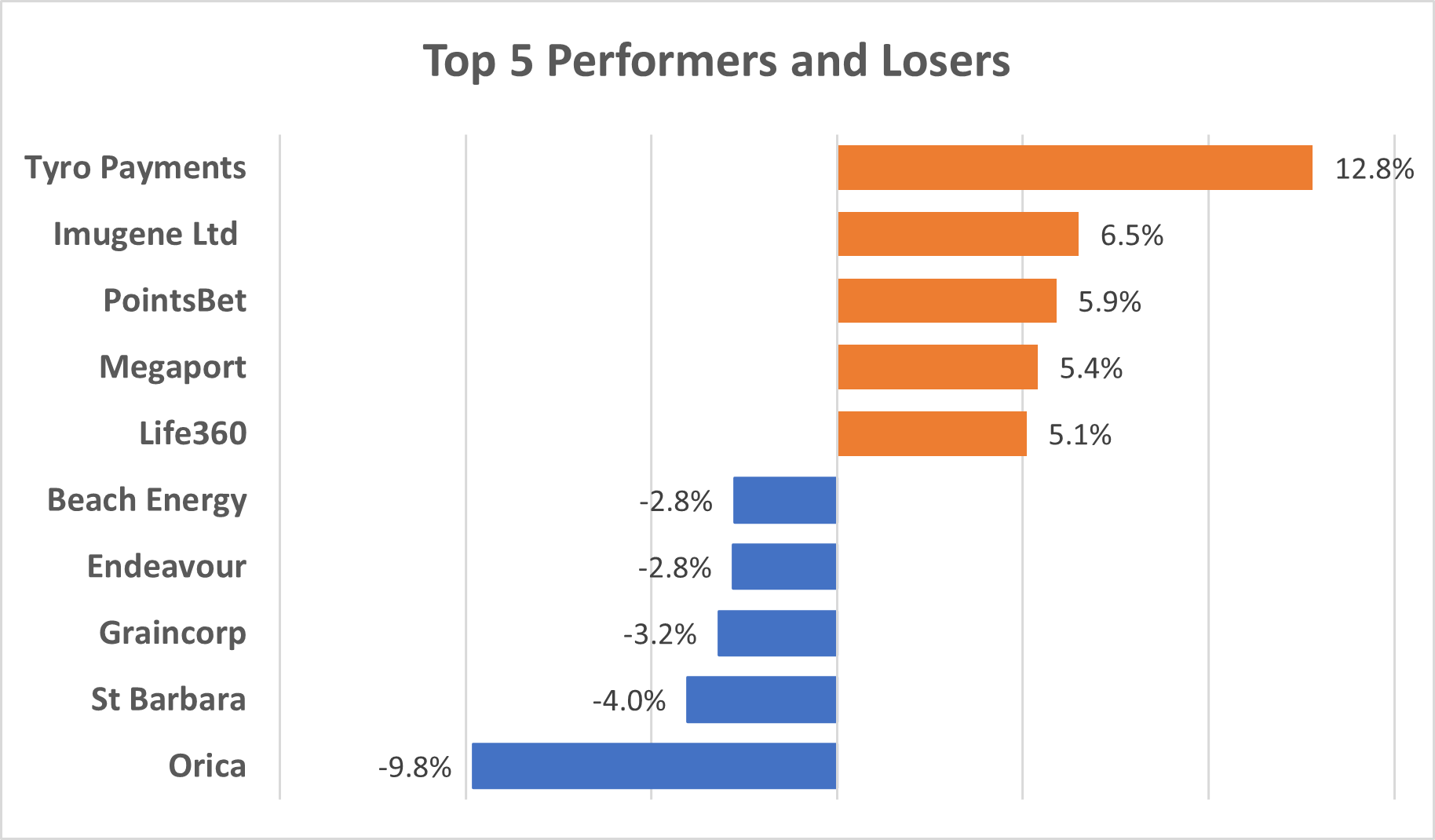

Data Source: ASX (as of 4 August 2022, 10:35 AM AEST)

Image Source: © 2022 Kalkine Media®

Tyro Payments (ASX:TYR) was the top performing stock, while Orica (ASX:ORI) was the top laggard.

Meanwhile, on the ASX , six of 11 sectors were trading higher. Information Technology was the best performing sector with over 3% gains.

Newsmakers

- Magellan Financial Group reported a AU$1.1 billion decline in its funds under management (FUM), which fell to AU$60.2 billion in July.

- NRW Holdings upgraded its guidance ahead of its financial results for FY22.

- Biotech Mesoblast announced that it would undertake a private placement to raise cash.

- Centuria Industrial real estate investment trust’s net profit fell 40% to AU$367.5 million in FY22.