Summary

- Ophir High Conviction Fund’s ASX listing produced a considerable return of 7.7 per cent in June 2020 despite an emerging second wave of infections in Australia.

- Portfolio holdings, Afterpay and ResMed, drove fund’s June 2020 performance.

- Afterpay added a little more than $13 in June 2020 to close the financial year at $60.99.

- ResMed continued to benefit from being a structural growth business in a defensive industry in June 2020.

- With a number of defensive companies and some growth companies in its portfolio, Ophir High Conviction Fund expects to perform well irrespective of reopening status.

While the world is at the risk of deeper global recession amid looming virus threat, the equity markets’ performance in recovering from March 2020 crash has caught many by surprise. Despite stringent restrictions on the movement of goods and people, most of the world stock indices have revived by over 30 per cent since March lows.

S&P/ASX 200 is no exception! The index has resurrected by ~31 per cent since 23rd March 2020 (as on 13th July 2020), backed by economic recovery hopes and dedicated fiscal and monetary push.

The equity market resurgence seems to be working in favor of fund managers like Ophir Asset Management - an Investment Manager of ASX-listed Ophir High Conviction Fund.

Ophir High Conviction Fund (ASX:OPH) generally invests in 15 to 30 firms listed outside the S&P/ASX 50, offering investors with intensive exposure to a portfolio of high-grade listed businesses. As a concentrated portfolio, the fund seeks to ascertain the best opportunities to ensure each portfolio position presents a significant impact on overall portfolio returns.

Ophir’s stock has delivered a return of over 50 per cent since March crash. Besides, the fund’s ASX listing produced a considerable return of 7.7 per cent in June 2020 despite an emerging second wave of infections in Australia. Notably, Afterpay Limited (ASX: APT) and ResMed Inc (ASX:RMD) were two of the strongest contributors.

Ophir High Conviction Fund’s June 2020 Performance

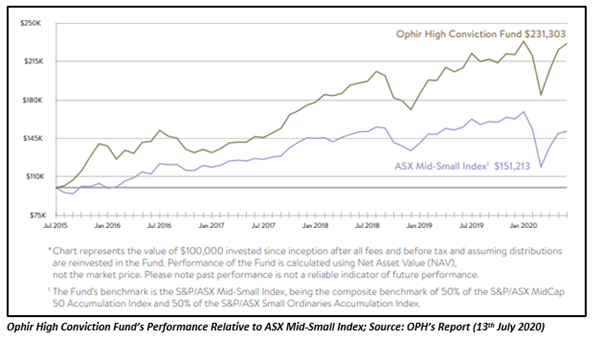

In a latest ASX update, Ophir High Conviction Fund notified that its investment portfolio improved by 2.5 per cent (net of fees) in June 2020, against S&P/ASX Mid-Small Index which rose 1.1 per cent. Moreover, the fund has returned 18.6 per cent p.a. (net of fees) since its inception in August 2015, in comparison to index’s return of 8.8 per cent p.a.

The fund’s size valued at $574.8 million as at 30th June 2020, with its Net Asset Value (NAV) per unit at $2.88. The fund’s top five portfolio holdings had an average market capitalisation of $7.8 billion as at 30th June 2020. These holdings comprise The A2 Milk Company (ASX:A2M), NEXTDC Limited (ASX:NXT), ResMed Inc. (ASX:RMD), Domino's Pizza Enterprises Limited (ASX:DMP) and Appen Limited (ASX:APX).

Fund’s 2020 Outlook

Ophir continues to take a balanced approach to portfolio positioning and is not making any significant calls on whether reopening of economies post coronavirus shutdowns will progress slower or faster than is usually expected.

With a number of defensive companies and some growth companies in its portfolio, the fund expects to perform well irrespective of reopening status. Besides, the fund is closely eyeing the Australian government’s move on any further targeted stimulus, with JobKeeper program approaching its end.

How Afterpay Aided Fund’s June Performance?

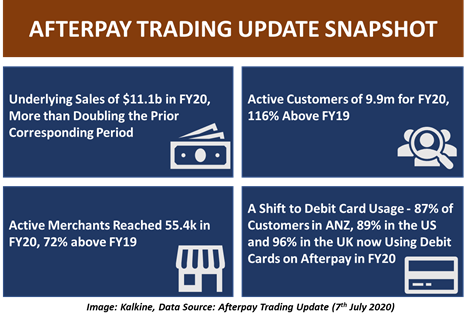

Ophir High Conviction Fund mentioned that its portfolio holding Afterpay Limited (ASX:APT) added a little more than $13 in June 2020 to close the financial year at $60.99, close to its all-time high levels. APT delivered a return of over 27 per cent in June 2020.

During June 2020, Afterpay announced it had signed up over 1 million active customers in the UK via its Clearpay brand. Afterpay reported that the customer purchasing frequency in the U.K was over eight times within the first year relative to the US, that was at six times during its first year.

Clearpay observed a robust customer adoption rate during coronavirus period, with over 3 million app and site visits in May 2020. Moreover, Clearpay’s Shop Directory contributed more than 1.5 million lead referrals to its retail partners during May.

A substantial shift of consumers towards online shopping under coronavirus shutdown also enabled Afterpay to reach about 9 million US customers in May this year. Out of these customers, over one million enrolled between March and early May 2020.

Following the end of financial year 2020, Afterpay inked a deal with Qantas Airways Limited (ASX:QAN) to enable Qantas Frequent Flyers to earn Qantas Points when they make use of the Afterpay platform.

The Buy Now Pay Later (BNPL) player also announced a capital raising worth $800 million in July, comprising a fully underwritten institutional Placement to raise $650 million and non-underwritten Share Purchase Plan to raise $150 million. Recently, the Company has successfully completed the Placement activity, that was strongly supported by current and new shareholders.

Afterpay’s Outlook

Afterpay expects its merchant revenue margins for FY20 to stay in line with or better than FY19 and H1 FY20. The Company also anticipates the Net Transaction Loss (NTL) to be up to 55 basis points while Net Transaction Margin to be ~2 per cent in FY20. Moreover, the Company foresees rollout of in-store in the US and expansion into Canada in Q1 FY21.

ResMed’s Contribution to Fund’s Performance

According to Ophir High Conviction Fund, ResMed Inc (ASX:RMD) continued to benefit from being a structural growth business in a defensive industry in June 2020. RMD generated a return of over 15 per cent in June 2020.

The Company observed the benefits of burgeoning demand for its ventilators to aid in coronavirus treatment regardless of a fall in its core revenue from sleep apnoea treatment as patients postpone doctor visits. The Company is focussed on combating coronavirus pandemic via increased ventilator production and continuing support and partnership of key global shareholders.

ResMed reported robust third quarter 2020 results in April this year, highlighting a surge of 16 per cent in its revenue to $769.5 million. The Company’s revenue grew by 12 per cent in the US, Latin America and Canada (excluding Software as a Service), owing to solid sales across its mask and device product portfolios.

While ResMed’s income from operations rose by 39 per cent, its non-GAAP income from operations surged by 31 per cent. The Company also declared a quarterly cash dividend of $0.39 per share, payable on 18th June 2020.

ResMed’s Outlook

As per ResMed, it remains thoughtful and vigilant about the outlook for its business as it continues to serve its customers and successfully ride through the coronavirus crisis. The Company believes its strong foundation will fast-track the adoption of much-needed digital health solutions in the arena of respiratory medicine over the long run.

With physical distancing becoming a new normal in coronavirus age, BNPL players like Afterpay appear to be harnessing the fruits of digital transformation and heightened cashless transactions. Besides, healthcare sector seems to be sitting on gold mine amid a race to develop a treatment or vaccine for coronavirus. ResMed is one such player tapping increased demand for ventilators in COVID-19 era.