Summary

- Healius reported FY20 results which were in line with the guidance provided. Underlying EBIT and underlying NPAT were A$102.7 million and A$55.4 million, respectively.

- Resilience in Healius’ Pathology division continued into July & August 2020 and witnessed significantly elevated levels of COVID-19 testing.

- Mayne Pharma’s revenue was reported at A$457.0 million during FY20, down 13% on pcp. The Company is planning commercialisation of novel oral contraceptive NEXTSTELLIS™ during FY21.

The healthcare sector index is moving higher in August with impressive financials posted by several companies. However, not every healthcare company has had the same fate. In this article, we will acquaint you with two ASX healthcare stories of who reported their full-year results on 21 August 2020.

ASX 200 share Healius Limited (ASX:HLS) reported its FY20 results in-line with the provided guidance, reporting NPAT loss (including discontinued operations) of nearly A$70.5 million. Another healthcare company, Mayne Pharma Group Limited (ASX:MYX), a former constituent of ASX 200, posted a loss in FY20, and reported revenue of A$457.0 million, down by 13%.

Let us zoom lens on Healius, Mayne Pharma.

Healius Limited Reported FY20 Results; In-line With Guidance

ASX-listed market-leading company Healius Limited working with a network of multi-disciplinary medical centres, diagnostic imaging centres and pathology laboratories. Healius provides an excellent facility to the general practitioners, radiologists, including other health care specialists to offer superior quality care to patients.

On 21 August 2020, Healius announced its FY20 results trading update including growth initiatives. The Company reported FY20 results in line with its guidance update on 27 July 2020.

Highlights from the financial front: Healius reported NPAT Loss (including discontinued operations) of A$70.5 million

- Underlying EBIT and underlying NPAT reported at A$102.7 million and A$55.4 million, respectively for the FY20, in line with its trading update on 27 July 2020.

- Reported EBIT was almost A$76.0 million and reported NPAT was a loss of nearly A$70.5 million.

- Overall, in FY20, Healius achieved revenue growth of 2.2% underpinned by a robust trading performance in Pathology and Montserrat outside of the COVID-related restrictions in combination with some initiatives taken by management.

- Healius also reported a A$142.5 million loss relating to the in-year impart of its Healius Primary Care business, mostly relating to goodwill.

Highlights from the operational front, Resilience in Pathology continued into July & August 2020

- Healius disclosed that the resilience in Pathology has continued into July and August 2020.

- The Company witnessed significantly elevated levels of COVID-19 testing, up to 16k in a day, in response to the latest state-based outbreaks.

Commenting on the results, Dr Malcolm Parmenter Managing Director and Chief Executive Officer-

Trading Update for FY21- The financial year 2021 of Healius commenced very strongly.

- In Pathology revenues were up by 25% in July 2020 on pcp, with further significant increases in community COVID testing.

- Pathology has commercial contracts for COVID screening with, for example, the Federal Government and the AFL, with growth expected as organisations endeavour to operate in a safe environment while COVID-19 remains in the community.

- In Imaging, revenues were down by 4% in July on pcp with further declines into August impacted by the Victorian Stage 4 lock-down and cessation of elective surgery in that state.

- In Healius Primary Care, July revenues were up 7.5% on pcp, and costs have been managed well.

Notably, the Company is well-placed to grow in Pathology and Imaging with its leading market positions and will have a streamlined portfolio.

Healius stated that elevated COVID-19 testing supports a positive outlook for FY21. Given the robust FY21 outlook the Board anticipates regular dividends to re-commence in the 1H 2021.

Stock Information: On 21 August 2020, the share price of HLS was A$3.280 at the end of the trading session, up by 0.306%, with a market capitalisation of nearly A$2.04 billion.

DID YOU KNOW: Healius Healthcare Inked Strategic Deal with BGH Capital, Stock Zoomed Up 19%

Mayne Pharma Group Posts A$95.3 Million Loss in FY20

ASX-listed specialty pharmaceutical company Mayne Pharma Group Limited is into applying its drug delivery expertise for commercialisation of generic as well as branded products. Mayne offers patients better and more accessible medicines.

Mayne has two facilities established in Greenville, the US and Salisbury, Australia with expertise in the development of complex oral and topical dose forms comprising poorly soluble compounds, modified-release products, and potent compounds.

On 21 August 2020, Mayne Pharma releases its full-year results for FY20 (ended 30 June 2020).

Highlights from the financial front, revenue down by 13%

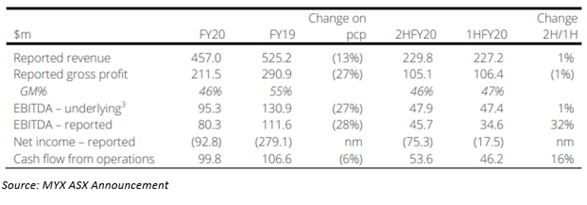

- During FY20, Mayne Pharma’s revenues reported at A$457.0 million down by 13% on pcp.

- Underlying earnings before interest taxes and amortisation (EBITDA) reported at A$95.3 million, down 27% on FY19.

- Net operating cash flow of A$100 million down 6% on FY19; in the second half of FY20 rose by 16% on 1HFY20.

- Net loss after tax reported at A$92.8 million led by intangible asset impairment linked mainly with the generic business.

- Generic Products performance stabilised in the second half of FY20 and metrics contract services delivered robust revenue growth.

- The generic products division (GPD) operating segment’s sales were A$253.0 million, down 21% on pcp and gross profit was A$95.7 million, down 42% on pcp.

- Sales in the specialty brands division (SBD) operating segment were A$78.8 million, down 14% on pcp and gross profit reported at A$65.4 million down 18% on FY19.

Highlights from the operational front, Prescription hit by COVID-19

- During FY20, COVID-19 substantially impacted sales with a lower patient start due to a decline in patient visits to doctors.

- GPD performance impacted in FY20 by competition on the key products, including dofetilide, butalbital, and liothyronine.

- In the US, Mayne received US FDA filing acceptance for NEXTSTELLIS™ (E4/DRSP).

- In April and May 2020, prescriptions dwindled by ~15% across the dermatology portfolio as compared to pcp.

- Prescriptions of TOLSURA® also dropped during FY20 after increasing consistently across the first nine months of FY20.

Outlook & milestone for FY21

- The commercialisation of novel oral contraceptive NEXTSTELLIS™, FDA approval and successful launch of NEXTSTELLIS™ in the US.

- In Australia, Mayne Pharma anticipates filing NEXTSTELLIS with the Therapeutic Goods Administration (TGA) this half with a potential launch in the 2H of CY21.

- Develop dermatology and women’s health portfolio as well as advance key pipeline products.

- Specialty Brands anticipated gaining profit from its restructured dermatology cost base, a return to more normalised patterns of prescription and further growth of TOLSURA that was adversely impacted by COVID-19 pandemic.

- Contract services likely to benefit from the pipeline of committed development business and growing manufacturing revenues.

ALSO READ: Mayne Pharma Share Price Under Discussion: 3 Things You Might have Missed

Stock Information:

On 21 August 2020, the share price of MYX closed at A$0.340, down by 2.857%. With a market capitalisation of ~A$587.67 million, the Company has almost 1.68 billion outstanding shares trading on ASX.