- Heavy Mineral Sands player MGR Metals Limited announced promising Scoping Study results, demonstrating a very robust project.

- Mining consultant Royal IHC was appointed to conduct an Engineering Scoping Study and the Preliminary Economic Assessment (PEA) for the Koko Massava, Nhacutse and Poiombo deposits of the Corridor Sands Project.

- The Company’s exploration discovery costs (to Inferred Resource) of under AUD2 cents a tonne is the lowest in the industry.

ASX-listed Heavy Mineral Sands (HMS) explorer MRG Metals Limited (ASX:MRQ) announced a significant update regarding its Corridor Sands Project, which includes the Corridor Central (6620L) and Corridor South (6621L) Projects. The Company announced the completion of an Engineering Scoping Study while the Preliminary Economic Assessment (PEA) is on the verge of completion.

(Source: Corridor Projects Scoping Study Update, 23 August 2022)

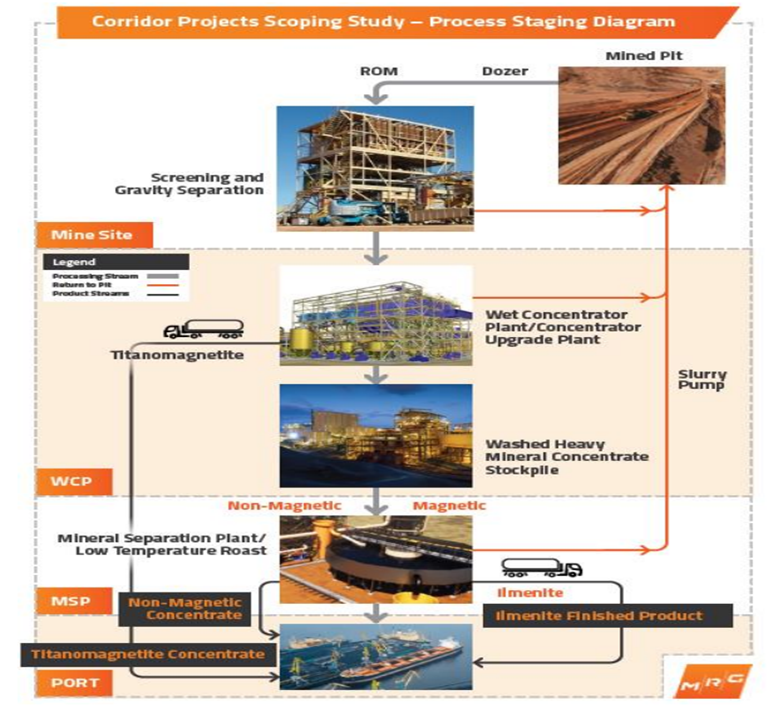

The Scoping Study was aimed at enabling MRG to identify a clear path toward the project execution. The Scoping Study includes plans to mine and process Run of Mine (ROM) material by establishing Mining Unit Plants (MUP) and a Wet Concentrator Plant (WCP) initially capable of processing 20.1 mtpa.

The only result left in the PEA is the final assay results from bulk sample testwork completed in August. Royal IHC (mining consultant) is responsible for the testing results.

Must read: Decoding latest developments at MRG Metals (ASX:MRQ)

Key outputs and the Scoping Study Scenario are:

- 513 million tonnes of mining inventory.

- The Capex would be US$239 Million, which includes a 15% contingency.

- The resulting products would be Ilmenite (47-50% TiO2) finished product, Titanomagnetite concentrate, and Non-Magnetic concentrate.

- The Average annual production (over 25 years) would be: 383 kt Ilmenite finished product, 273 kt Titanomagnetite concentrate, and 50 kt Non-Magnetic concentrate.

- The product pricing estimation from the final product specifications will complete the PEA Financial model.

- The completion of PEA would confirm the market value of products.

Engineering Scoping Study’s results:

The results demonstrate an exceptionally favourable operating cost structure because of the following reasons:

- The project's cost can reduce substantially because of the strongly homogeneous resource indicating favourable heavy mineral sands (HMS) grain size and easy clay fines removal characteristics.

- A low level of impurities in the sand throughput will require simple HMS processing.

- Easy access to human resources and proximity to port, road and infrastructure will also benefit the project.

Corridor projects’ Project Staging diagram based on the Scoping Study is shown below:

(Source: Corridor Projects Scoping Study Update, 23 August 2022)

The Company’s stock is trading at AU$0.008. The Company's market capitalisation stood at AU$13.97 million.