Highlights

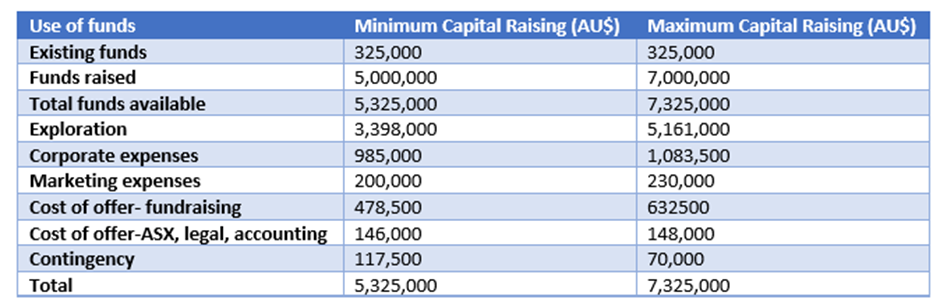

- Aeramentum Resources is planning to raise AU$5 million to AU$7 million through its IPO at an issue price of AU$0.2 per share.

- The proceeds from the IPO will be used to fund the drilling program at its battery mineral project in Cyprus.

- Aeromentum is targeting the European battery market, which is on fire

Battery mineral explorer and developer Aeramentum Resources Limited is all set to get listed on the Australian Securities Exchange (ASX), with the ASX ticker code AEN. The Company’s initial public offering (IPO) is out and is offering 25-35 million shares @ AU$0.2 to raise AU$5-7 million in proceeds. On completion of the offer, Aeramentum’s indicative market capitalisation would be in the range of AU$11.75-13.75 million.

The proceeds from the offer will help the Company to fast-track its exploration endeavours on its flagship Treasure Project, located in the Republic of Cyprus.

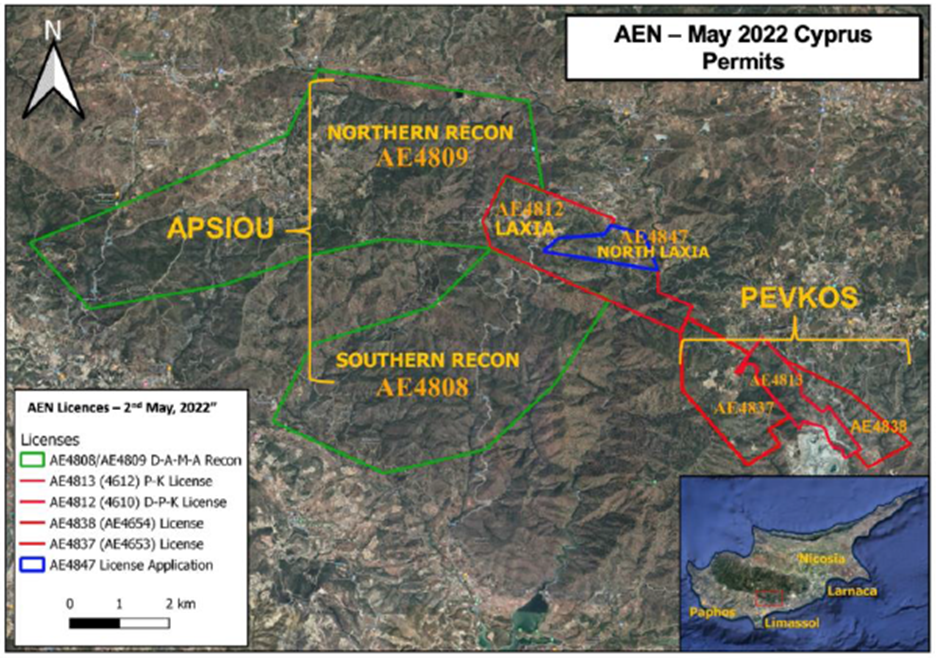

The Company has interests in seven permits in Cyprus, some of which are in the application phase. The project is prospective for gold and battery metals like nickel, copper, and cobalt – which are highly sought-after metals catering to the burgeoning battery industry.

Key insights on Aeramentum’s IPO

Aeramentum Resources was incorporated on 3 June 2021 with a vision to acquire, explore and develop the Treasure Project. The Company made its first acquisition in Cyprus through the purchase of PR Ploutonic Resources Ltd.

Aeramentum commenced its exploration activities on the project through Ploutonic and is planning to commence maiden drilling campaign soon after listing.

Image source: Company Prospectus

Image source: Company Prospectus

Aeramentum's primary objective is to focus on mineral exploration opportunities across Cyprus and Europe that have the potential to deliver growth to shareholders. The Company is concentrating its efforts on areas with previous drilling and mining operations to avoid delays with prospecting in greenfield areas.

Following the completion of the IPO offer, Aeramentum intends to explore the overall project area to establish a gold and base metals resource inventory. Also, the explorer plans to commence preliminary mine planning and feasibility work to develop mining operations. Moreover, the Company is on the lookout to acquire additional exploration areas in Cyprus and other prolific mining jurisdictions.

Experienced Board and Management

Image source: Company website

Aeramentum's Cyprus team currently employs up to five geologists. The Cyprus-based team is highly experienced across mining and exploration projects. The Board consists of individuals who have working experience with major mining companies across Europe, North America and Asia.

Cyprus: A copper-rich nation

Cyprus was once a copper and gold mining hub of Europe. The country had produced well over 70Mt of copper and gold ore until 1970s, which was disrupted due to political upheavals.

Mining operations have been subdued since then. Cyprus was ranked fifth in copper endowments; Aeramentum believes there could be a potential of another 70Mt discovery in the vicinity of past open-cut and UG mines.

Aeramentum plans to focus its exploration on the underground potential within its tenements as it provides a favourable structurally controlled mineralisation setting and will also help to lower the environmental footprint.

Flagship project: Treasure

Prospecting and Reconnaissance Permits of Aeramentum (Image source: Company prospectus)

The Treasure Project includes three tenements comprising seven permits. The tenements are:

- Laxia- Includes one prospecting permit and one permit application

- Pevkos- Includes three prospecting permits

- Apsiou- Comprises two reconnaissance permits

After the completion of the IPO offer, the Company intends to commence diamond drilling with up to two rigs. The Company has identified three walk-up drill targets on each of its projects for its maiden drilling campaign in 2022.

Aeramentum reported a cash balance of AU$325,000, as at 1 May 2022. It has already drawn a plan to use the existing funds and the proceeds from the IPO to cover the future exploration and corporate expenses.

Data source: Company Prospectus

Bottom line

The burgeoning European battery mineral market provides a significant opportunity for companies catering to this market segment. Brownfield deposits of the Treasure Project will save considerable time in starting exploration, as against, starting from scratch. Also, pre-existing drilling and exploration data will help in defining targets for future drilling operations.

For more details on the IPO prospectus, please refer to this link.