Highlights

- Surefire Resource is engaged in exciting exploration activities across its three key projects.

- On the Yidby Gold Project, the company has completed a 23-hole RC drilling campaign and a diamond drilling operation is on the cards.

- SRN has wrapped up one diamond hole over its 100%-owned Victory Bore Vanadium Project.

- At the Perenjori Iron Ore Project, the company plans to undertake an RC and a diamond drilling program.

Diversified mineral explorer Surefire Resources NL (ASX:SRN) is witnessing a spate of exciting exploration activities across its three wholly owned projects in Australia.

The company has already carried out drilling operations across the Yidby Gold and Victory Bore Vanadium projects. Moreover, it plans an RC and a diamond drilling campaign over its Perenjori Iron Ore Project.

Data source: Company update, 27 June 2022

Related read: Surefire Resources NL (ASX:SRN) provides updates on portfolio projects, shares zoom 23%

Exploration progress at Yidby Gold Project

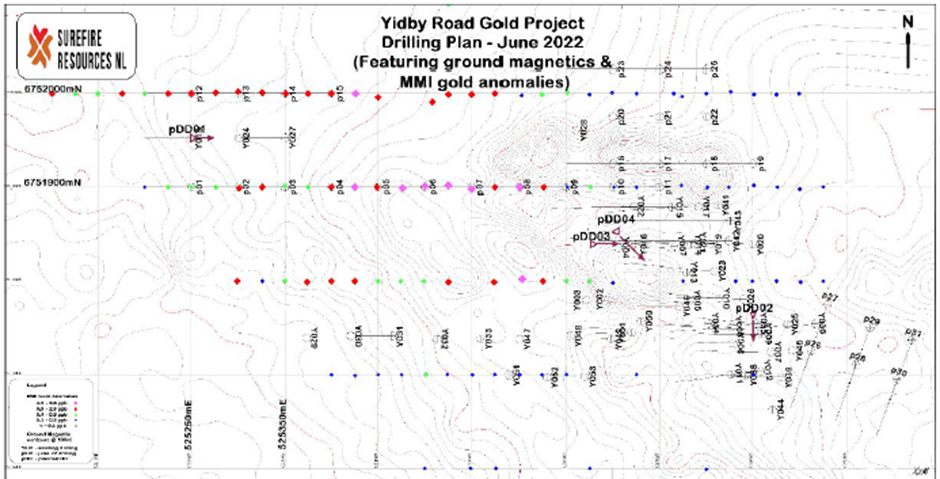

Surefire drilled 23 RC holes for a total depth of 2,754m on its Yidby Gold Deposit. The objective of the program was to extend the footprint of known gold mineralisation and to test additional MMI surface geochemistry anomalies.

The samples from the drilling program have been submitted to a lab in Perth for assaying. The Company expects a turnaround time of 10-12 weeks to get the assay results.

The survey and lithology data gathered during the drilling operation is being uploaded to the database.

The Company has hired a Perth-based consultant for reprocessing the open-file high-resolution airborne magnetic data. This will help in integrating the drill hole data with regional geology, structural setting and identification of multiple phases of deformation.

Additional six diamond holes are being planned at Yidby. The aim is to collect a high level of structural, alteration and lithological data, which will be corroborated with the structural interpretation of the prospect.

Based on the outcomes, further RC drilling campaigns will be planned for the project.

Related read: Surefire Resources (ASX:SRN) intersects broad intersections with visible gold at Yidby gold project

Planned RC & drilling holes on Yidby Road Gold Project (Image source: Company update, 27 June 2022)

RC drilling to commence on Victory Bore Vanadium Project

Surefire has wrapped up drilling a diamond cored hole to 150m on the Victory Bore Vanadium Project. The objective is to deliver data for geotechnical and metallurgical test work in advance of an open-pit optimisation. The hole intersected vanadium horizon as expected. Further, core from the footwall and hanging wall rocks was obtained.

The Company has mobilised an RC drilling rig on the project to commence a 4,000m closed-spaced resource infill drilling operation targeting two main vanadium lodes.

The project has an Inferred Resource of 237Mt @ 4.3% V2O5, 24.9% Fe and 5.9% TiO2. Surefire has submitted an application for a mining licence for the Victory Bore exploration licence area.

Also read: Beneficiation study confirms economic viability for Surefire Resources’ (ASX:SRN) Victory Bore Vanadium Project

Perenjori Iron Ore Project to undergo infill drilling

Surefire is planning an infill RC drilling operation of up to 5,000m on the Perenjori Iron Ore Project. The plan is to infill the current 200m spaced drilling lines to 100m spacings. The drilling program will target an area known to have a wide and consistent grade of magnetite defined by diamond drilling.

The Perenjori Project has an Inferred Resource of 191.7Mt @ 36.61% Fe. Additionally, the project holds an exploration target of 870-1,240Mt at a grade of 29-41% Fe, exclusive of the existing Inferred Resources.

Related read: Surefire Resources (ASX:SRN) delineates high priority targets at Perenjori West

SRN shares were trading at AU$0.022 apiece on the ASX midday on 27 June 2022. The company has a market cap of AU$32.01 million.