Highlights

- Demand for scandium is expected to increase with growing usage of solid oxide fuel cells and aluminium-scandium alloys.

- Platina Resources’ scandium project offers an exciting opportunity in the current buoyant setting.

- The project holds high scandium grades, long-life, robust ore reserve and mineral resource positions, low capital and operating costs, and access to excellent infrastructure.

Australia-based Platina Resources Limited (ASX:PGM) has sharpened its focus on unlocking the value of its Platina Scandium Project (PSP) amid increasing demand for the critical mineral as a lightweight, high-strength alloy for various markets.

Despite being categorised as a rare earth element (REE), scandium is not uncommon. It is present in abundance with a concentration of 25 ppm in the Earth’s crust. As this concentration doesn’t support commercial mining operations, scandium is usually found as a by-product of other metals.

As per the United States Geological Survey (USGS), in recent years, scandium was produced as a by-product from the processing of a variety of ores in several countries including China, Kazakhstan, Russia, and Ukraine.

Source: © Fambros | Megapixl.com

KNOW MORE: Eye on IP, Platina Resources produces high-grade aluminium-scandium master alloy

The primary application of scandium is in the production of alloys. Aluminium-scandium alloys have been gaining traction for being lightweight and high-strength and are used in the marine, heat exchangers, aero, electric vehicle, and other markets. Additionally, the critical mineral is used in solid oxide fuel cells, lasers, ceramics, and electronics.

The demand for scandium is anticipated to rise in the future due to its high usage in solid oxide fuel cells and aluminium-scandium alloys.

Related Read: Platina Resources (ASX:PGM) closes H1 with major strides at gold and scandium projects

PSP - one of the world’s leading undeveloped scandium projects

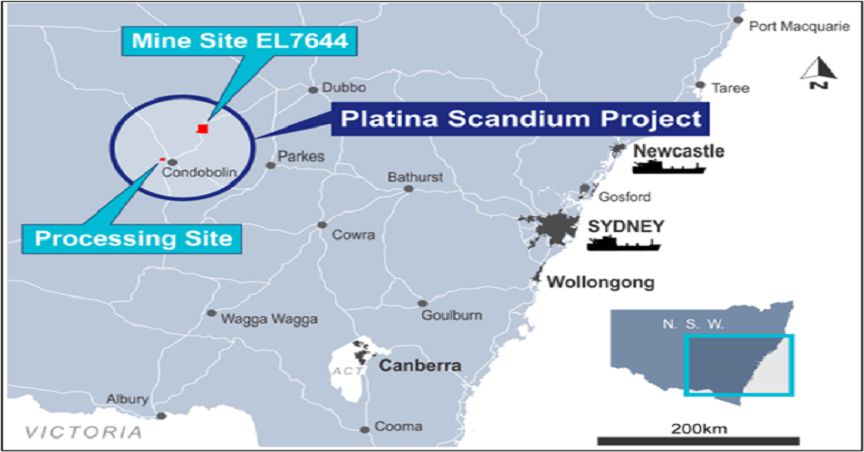

Amid this buoyant setting, Platina Resources is advancing its world-class Platina Scandium Project (PSP). Located in NSW, PSP is one of the world’s largest and highest-grade scandium deposits. The project holds the potential to become Australia’s first scandium producer with nickel and cobalt credits.

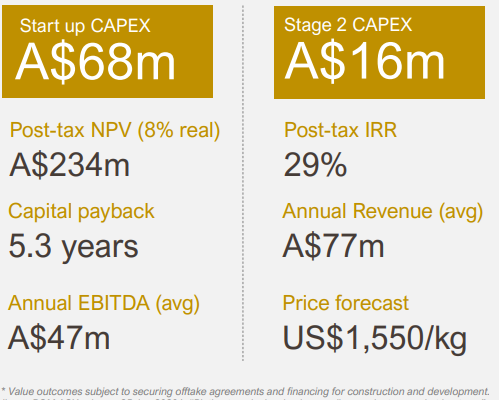

A Definitive Feasibility Study (DFS) wrapped up in 2018 demonstrated a robust financial case for the project. The project generates US$166 million with a payback period of 5.3 years and a mine life of 30 years.

Source: PGM Presentation, May 2022

Platina is currently engaged in a master alloy production and intellectual property (IP) development program, which is aimed at developing a proprietary process to produce value-added, aluminium-scandium master alloy. The company targets to produce a premium value-added product directly saleable into the market.

The company has completed the first phase in some new trials, resulting in the production of a new high-grade, aluminium-scandium master alloy.

Meanwhile, the company is finalising the project’s permitting process to secure mining licence.

Read More: Eye on IP, Platina Resources (ASX:PGM) produces high-grade aluminum-scandium master alloy

Committed to its strategy focused on moving the project forward, Platina Resources aims to become a stable western world supply source at competitive global prices that stimulate demand.

PGM shares were trading at AU$0.041 in the early hours of 30 May 2022.