Highlights

- Ora Banda’s gold production during the March quarter was 15,197 oz while processing plant performance continued to stabilise.

- OBM raised ~AU$20 million for exploration work, drilling to progress resource development, operational enhancements and working capital needs.

- OBM’s FY22 gold production guidance remains in the range of 62,000 oz to 68,000 oz and had AU$28.2 million in cash at previous quarter-end.

Ora Banda Mining Limited (ASX:OBM) has reported strong progress for the quarter ended 31 March 2022. During the quarter, OBM had taken steps to strengthen its balance sheet and later resolved to a new, streamlined mining plan with an intention to maximise cash generation in the short term.

Some of the key highlights for the quarter include open-cut operations at its Riverina and Missouri mines, capital raising worth ~AU$20 million, etc. Let us look at these developments in detail.

RELATED ARTICLE: Why is Ora Banda (ASX:OBM) undertaking a strategic review of Davyhurst operations?

Gold production & processing plant performance

During the quarter, OBM reported gold production of 15,197 oz, with gold sales of 13,540 oz at an average gold sales price of $2,581/oz, C1 cash costs of AU$2,200/oz and an AISC of AU$2,868/oz.

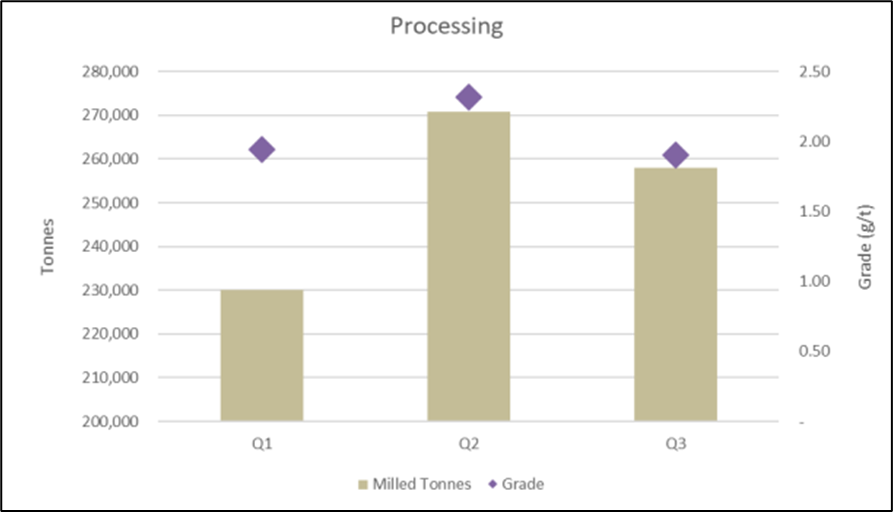

OBM’s ore milled for the quarter stood at [email protected]/t for 15,759 ounces, with plant throughput remaining below the nameplate capacity. OBM has incorporated further maintenance management expertise into the plant’s organisational structure, and work has now begun on improving the preventive maintenance program.

Quarterly processing plant throughput for FY22 (Source: OBM Announcement 29/04/2022)

Quarterly processing plant throughput for FY22 (Source: OBM Announcement 29/04/2022)

OBM reported the continued stabilising of the processing plant performance as enhancement measures remain on foot to ramp up the operations of its 1.2Mtpa nameplate capacity.

Moreover, OBM’s ore stockpiles grew to 665,613 tonnes, and have reached the threshold level, where they offer a short-term cash generation opportunity for the Company.

RELATED ARTICLE: Ora Banda (ASX:OBM) closes AU$20 million equity raising

Mining operations

OBM concluded the mining of the Golden Eagle underground mine in early January while operations continued at the Riverina Stage 1 open pit mine, entering into fresh rock and mining, about to be completed by the period end.

Source: OBM Announcement 29/04/22

Source: OBM Announcement 29/04/22

In Missouri, OBM’s progressive operations focused on Stage 1 ore mining, with mining also in the Stage 2 area. OBM’s focus remains on additional productivity gains and cost mitigation measures as part of the ORP.

Moreover, the preliminary singular management focus on Missouri shall assist and combines with the redeployment of the Riverina workforce to Missouri to resolve current challenges.

RELATED ARTICLE: Ora Banda (ASX:OBM) on fast track with recent capital raising and exploration progress

Exploration work

In recent quarters, OBM focussed on process plant commissioning with exploration and drilling on the back seat. This shall change under OBM’s ORP, and the Company has made a preliminary allocation of AU$15 million for a fresh set of exploration and resource development drilling activities.

OBM’s exploration expenditure shall target fresh discoveries and follow up on substantial first-pass AC results, including the Sky Prospect, Greater Pacific and the Sunraysia North trend. Moreover, the focus of resource development activities shall be on next mine targets, comprising Riverina Underground and the Iguana deposit.

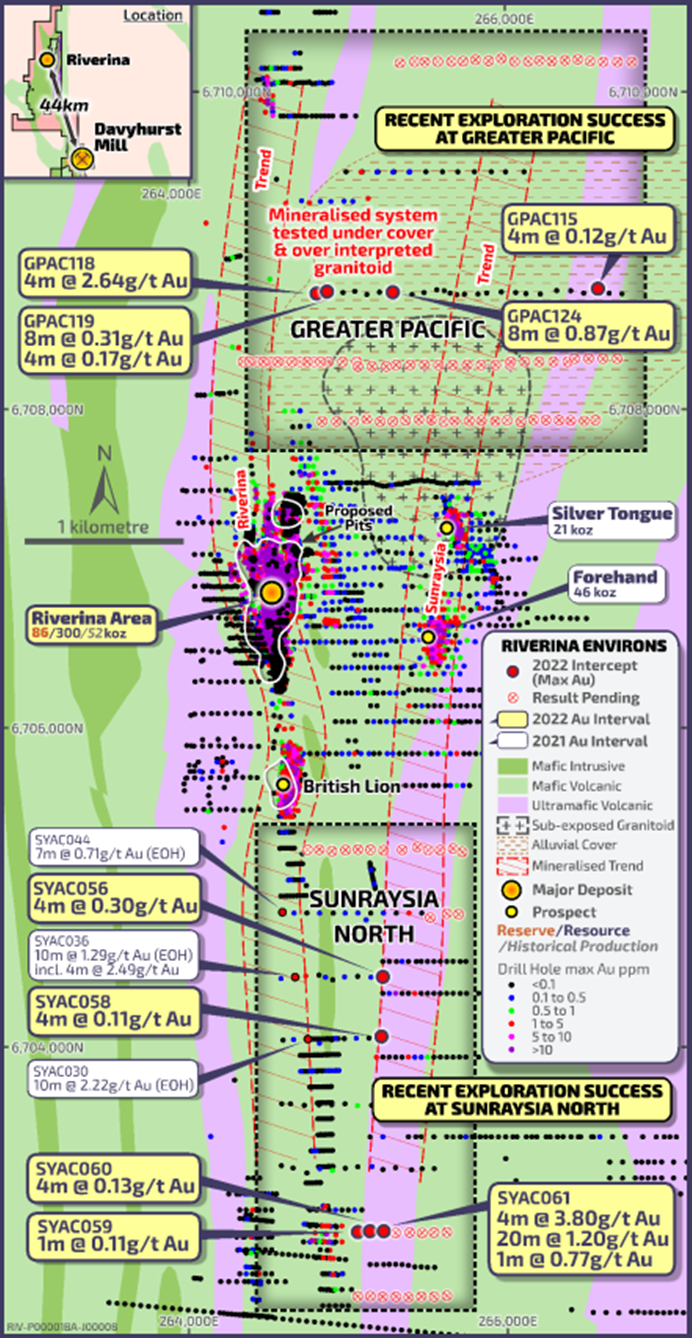

AC drilling completed on the Greater Pacific Prospect

OBM has completed 1,475 metres of exploration air core (AC) drilling on the Greater Pacific Prospect. OBM’s additional follow-up drilling efforts shall focus on the Sky, Greater Pacific and Sunraysia North prospects.

During the quarter, OBM received some of results for the programme for the Greater Pacific, Sunraysia North and the Kangaroo prospect, with the following significant highlights from first-pass AC drilling:

- 0m @ 2.64 g/t (Greater Pacific)

- 0m @ 0.87 g/t (Greater Pacific)

- 0m @ 3.80 g/t (Sunraysia North)

- 0m @ 1.20 g/t (Sunraysia North)

- 0m @ 0.33 g/t EOH (Kangaroo)

- 0m @ 0.60 g/t (Kangaroo)

For the Sunraysia North Prospect, OBM received results for six of the 35 air core holes drilled, which confirmed and strengthened the interpretation for the continuation of mineralised structures across this part of the belt.

Recent AC drilling results at Greater Pacific and Sunraysia (Source: OBM Announcement 29/04/2022)

RELATED ARTICLE: Ora Banda (ASX:OBM) clocks revenue of AU$79.60 million in half-year FY2022

Lithium exploration activities

As a result of gold exploration, OBM has discovered several pegmatite-hosted lithium occurrences across areas identified within the Riverina region, Davyhurst Central and Gila. OBM has observed abundant unclassified pegmatite occurrences across extensive areas in outcrop and drilling.

OBM collected a total of 35 samples during initial lithium exploration work at the tenure. The assay results confirmed several elevated concentrations of lithium within the outcrop and core, including the following major lithium assays:

- Regional Riverina (Golden Horn Prospect) surface sample 1.24% Li2O

- Regional Riverina (Sunraysia Prospect) surface sample 1.04% Li2O

- Regional Riverina surface sample (Golden Horn Prospect) 0.95% Li2O

- Gila diamond core 0.75% Li2O

Moreover, lepidolite dominant pegmatites have been identified as the principal source of lithium within OBM’s tenure through the XRD analysis on the initial set of samples.

OBM looks to continue its activities to assess lithium potential as part of a wider exploration strategy for highly prospective Davyhurst tenements.

Capital raising worth ~AU$20 million

During the quarter, OBM raised ~AU$20 million in totality, which included ~AU$5 million raised through a placement ~AU$15 million (before costs) through an entitlement offer.

OBM plans to utilise these funds towards exploration and drilling to progress resource development and operational enhancements and meet working capital requirements.

At the quarter-end, OBM held a cash balance of AU$28.2 million, 1,657 oz of bullion on hand and remained debt-free.

RELATED ARTICLE: Ora Banda (ASX:OBM) looks to raise AU$20 million under equity raising

FY22 guidance and strategic reset of Davyhurst operations

OBM’s gold production guidance for FY22 remains in the range of 62,000 to 68,000 ounces of gold.

Post the March quarter, OBM declared a strategic reset of Davyhurst operations, wherein the focus was to maximise short-term cash returns a couple of years ahead by streamlining the operations and a targeted cost review process.

OBM plans to redeploy the cash generated towards advancing exploration and near-mine resource development opportunities.

Bottom Line

OBM believes that a good news for its stakeholders is that while the Company continues to build a cash position, OBM also plans to get the boots on the ground with some intensive drilling programmes targeting high-priority exploration and near-mine development targets.

OBM has a range of exploration and resource development prospects that warrant drilling.

OBM’s stock was noted at AU$0.037, up by 5.714% on 05 May 2022.