Highlights

- Lithium Australia is committed to creating an ethical, sustainable and circular battery economy.

- LIT’s wholly owned subsidiary Envirostream is establishing a nationwide network of battery collection units to boost its recycling capacity.

- The company is advancing a DFS for an LFP manufacturing facility.

Lithium Australia Limited (ASX:LIT) is committed to an ethical and sustainable future for the global lithium battery industry. The ASX-listed company is working to develop a circular battery economy through its wholly owned business divisions, which are engaged in recycling and advanced materials development for lithium batteries.

LIT operates in Australia through its three business divisions:

- Envirostream Australia Pty Ltd - Focused on the recycling of lithium batteries

- VSPC Pty Ltd - Committed to the production of lithium ferro phosphate as cathode material for lithium batteries

- Lithium Chemicals - Developing next-generation LieNa® processing technology

The company recently released its June quarter report, highlighting serious steps towards achieving its goal. Also, during the period, the company changed its name from Lithium Australia NL to Lithium Australia Limited.

At the end of 30 June 2022, LIT reported a cash balance of AU$4.8 million with no debt. Moreover, the company held investments in listed equities of AU$5.0 million.

Envirostream boosting B-cycle drop-off network

LIT acquired the remaining 10% interest in Envirostream to wholly own the battery recycling business. Envirostream is engaged in the collection, sorting and processing of spent lithium batteries.

The battery recycling process at an Envirostream facility in Melbourne (Image source: 29 July 2022)

The high demand for electric vehicles and devices running on batteries will create a huge pile of used batteries. If not treated or addressed properly, these batteries will end in landfills, where they could cause serious chemical spills, leading to environmental damage.

Envirostream is working to build end-of-life (EOL) battery supplies to recycle them and extract useful metals. This will also help in bridging the gap between the demand and supply of batteries and critical metals.

Envirostream is setting up nationwide collection points for spent batteries. The company is working under a federal government-backed B-cycle scheme, under which, there are provisions of rebates on recycling batteries.

The company has established a national network of 700 accredited B-cycle drop-off locations with its partners supplying EOL batteries. Envirostream is actively growing the network of B-cycle drop-off locations.

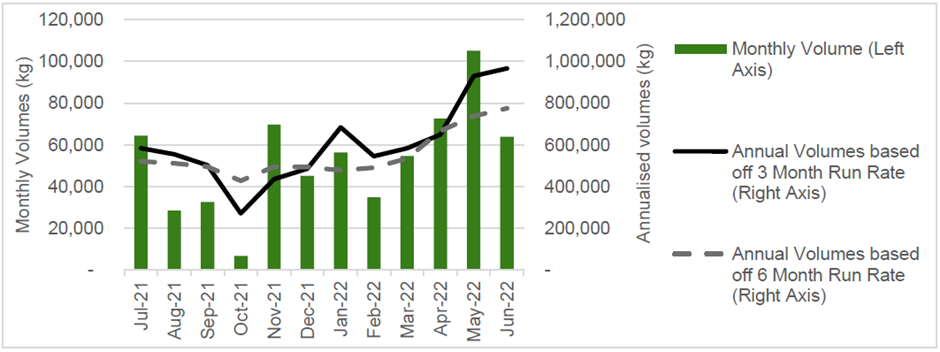

Monthly EOL battery sorting volumes (Image source: LIT update, 29 July 2022)

To further drive the recycling volume, Envirostream entered into an agreement with electric vehicle manufacturers in Australia to provide EOL solutions for their batteries.

VSPC advancing well on LFP production technology

VSPC is engaged in the production of high-purity and high-performance battery materials through its research and pilot plant in Brisbane. VSPC is working on developing a process for the production of lithium ferro phosphate and lithium manganese ferro phosphate (LMFP) powders for the cathode of batteries.

VSPC is currently progressing on a Definitive Feasibility Study (DFS) for a proposed 10,000tpa LFP production plant. The DFS is being carried out by Lycopodium on behalf of VSPC and the company is focused on making the patented RC Process for LFP cathode power production commercial with scale.

The successful completion of the DFS would pave the way for moving from the pilot plant to a commercial production facility.

Artistic impression of the proposed 10,000tpa plant (Image source: LIT update, 29 July 2022)

China is currently the major producer of LFP. Operating a production unit outside China will provide an opportunity to reduce the supply chain risk while helping in ending the Chinese monopoly in the LFP market.

The US does not have any LFP production unit as of now, even though most of the EV manufacturers are providing LFP-based EVs.

VSPC has not yet decided on the location of its proposed 10,000tpa plant, which might be based out of Australia, or maybe in the US, to cater to demands of the North American EV industry.

Next-generation LieNa® processing technology

LIT in collaboration with ANSTO is working to develop its LieNa® processing technology. The technology has the potential to refine fine or low-grade spodumene to produce high-purity lithium chemicals.

The lithium produced from the process could then be used to produce LFP powders. The technology will enable LIT to process what normal lithium processing companies think waste and throw it in tailing dams.

This will significantly help in bridging the gap between the demand and supply of lithium and will reduce the dependence on new mines for lithium production in the long run.

LIT shares traded at AU$0.078 on 5 August 2022, up over 5.4% from the last close.