Summary

- FYI Resources Limited (ASX:FYI) has achieved extraordinary results in its inaugural ESG rating.

- ESG rating analysis for FYI has been conducted by the independent ESG rating service firm, Sustainalytics.

- The Company intends to efficiently grow its business under a defined ESG framework.

FYI Resources Limited (ASX:FYI, OTC:FYIRF) has received an outstanding result for its inaugural Environmental, Social, and Governance (ESG) rating. The rating complements the initiatives taken by the management of FYI towards building and promoting the Company as a sustainable business model.

FYI is advancing to become a significant player in the high purity alumina (HPA) market to capitalise on the surging demand for HPA in the growing LED and electric vehicle market.

Interesting Read: FYI Resources Limited (ASX:FYI) in fine fettle to cash in on HPA market boom

The ESG rating received by FYI reflects the three central criteria of sustainability and societal impact of the Company. According to some experts, analysis of these ESG criteria helps to better determine the future financial performance and potential investment merit in a firm. Besides, such analysis is believed to promote a sustainable business model and assist with the Company’s contribution in fundamentally reshaping the global economy.

The importance of ESG for sustainable development has increased substantially over recent months due to an improved focus on environmental emission concerns. Additionally, ESG has come to the forefront amid an increased investors’ demand to intensify attention towards ESG related matters.

Good Read: FYI Resources (ASX:FYI) embraces ESG metrics developed by World Economic Forum

FYI’s incredible scorecard

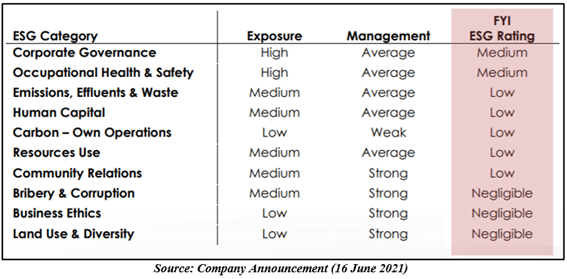

FYI has attained an excellent overall rating of 28 out of 100 and a ranking of 9th out of 153 peers, which positions the Company in the top sixth percentile of total peers. Furthermore, FYI was the leading scorer in three categories and top five rank holder in additional five categories.

The ESG rating analysis for FYI was conducted by the independent ESG rating service firm, Sustainalytics, which is a Morningstar Inc firm. Sustainalytics is a pioneer in providing a best-in-class analysis and methodology to measure a firm’s exposure to industry-specific ESG risks and its performance in managing those risks across its peers and subindustries.

Sustainalytics has calculated the HPA producer’s initial ESG rating while measuring it against nearly 14,000 global industry participants, including 153 direct peer and competitor firms under a sub-industry category.

The ranking achieved by FYI equates to an adjusted “Medium” score. However, it must be noted that no firm in the group attained a “Low” score due to Sustainalytic’s stringent analysis methodology.

The performance of FYI across various ESG categories is described in the table below:

Why has FYI adopted ESG framework?

The environment in which the Company conducts its business is consistently evolving through variations in climate impact, environmental restrictions, and several regulatory, safety, and social issues. The dynamic global operating environment is challenging the traditional expectations of firms while impacting the redirection of investment capital.

To manage the change in ESG requirements, FYI has made a strong commitment towards its sustainability objectives. FYI is initiating an ESG platform developed by World Economic Forum in an effort to drive the Company's growth by long-term sustainable and responsible operations, underpinning shareholders' value.

FYI’s ESG framework is not limited to providing transparency to the Company’s ESG management and activities. The framework also holds the capability to trace the entire integrated supply chain, enabling confident verification of quality and ethical origins of the Company’s HPA.

FYI shares closed the trading session at AU$0.595 on 16 June 2021.

Must Read: FYI Resources (ASX:FYI) earns a place on the MSCI Australia Micro Cap Index

_05_02_2023_11_39_05_949694.jpg)