Highlights

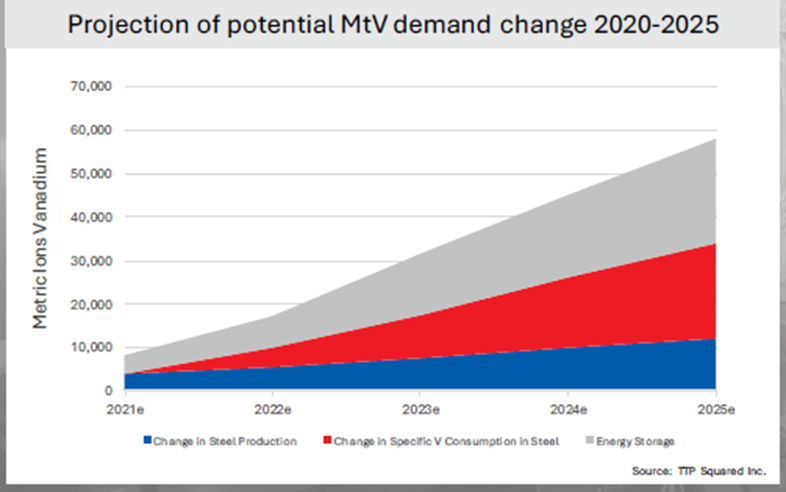

- According to market estimates, battery storage units using vanadium will contribute 15-25% in the energy storage market by 2025.

- An additional 10,000Mt of vanadium will be required to meet the surging demand for vanadium in the energy storage industry.

- VR8 is advancing well to unlock one of the world’s largest and highest-grade vanadium deposits in South Africa.

- The Steelpoortdrift DFS completion is expected in Q3 2022.

Vanadium Resources Limited (ASX:VR8) is engaged in developing the Steelpoortdrift Vanadium Project located in the Bushveld Complex in South Africa.

The project holds a global mineral resource of 662Mt @ 0.77% V2O5, making Steelpoortdrift one of the world's largest and highest-grade vanadium deposits.

Related read: Vanadium Resources (ASX:VR8) ends busy March quarter with Steelpoortdrift DFS on track

VR8 is currently finalising a definitive feasibility study (DFS) on the project. The Company remains well-funded to carry out development works on the project to the final investment decision (FID) stage.

The Steelpoortdrift preliminary feasibility study (PFS) has indicated strong financial outcomes with an internal rate of return (IRR) of 45% and post-tax NPV8 of US$1.2 billion.

With this backdrop, let us look at five factors that place VR8 in a sweet spot and contribute to its impressive growth.

- Hot vanadium market

The steel industry consumes most of the vanadium produced worldwide, nearly 90%. The battery industry currently accounts for nearly 3%-5% of vanadium demand, while the aircraft industry consumes 3%.

The market forecasters estimate that the vanadium redox flow battery (VRFB) space could control 15-25% of battery capacity by 2025. This is expected to add up to 10,000Mt of vanadium demand into an already undersupplied market.

Image source: Company update, 5 April 2022

Related read: Vanadium Resources (ASX:VR8) shares soar 16% on Frankfurt exchange listing

- PFS indicating robust financial metrics

The PFS on the Steelpoortdrift Project indicated encouraging financial outcomes. The study highlighted that the project would require US$200 million as CAPEX to build a 12.5ktpa V2O5 mining and processing capacity.

The project is estimated to have a payback period of 25 months, generating a free cash flow of US$139 million annually. The annual EBIDTA is expected to be around US$231 million, and the project is expected to generate US$5.8 billion EBIDTA during the life of mine (LOM) period.

- Opportune location offering competitive advantage

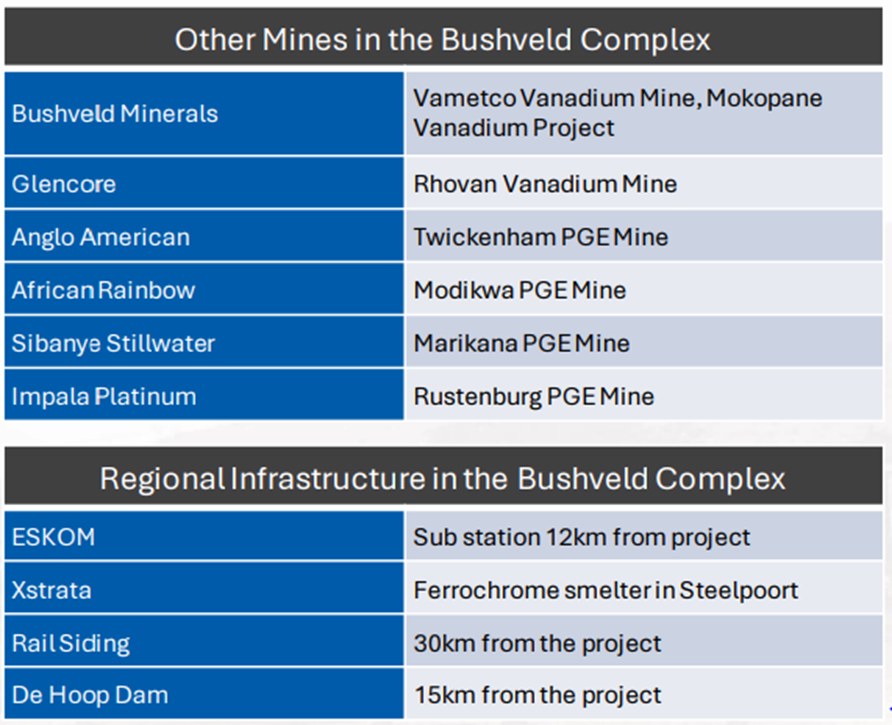

The Bushveld Complex is a world-renowned mining location hosting several

mining operations. Multiple major mining companies are active in the area.

Image source: company update

Moreover, the project lies close to existing operating processing plants, power and water supply. The project is well connected with proven road and rail options to the port.

The project lies close to the town of Steelpoortdrift in the Limpopo Province of South Africa and is well connected with national highways.

Related read: Vanadium Resources (ASX:VR8) shares tick higher on DFS update

- Peer comparison indicating upside potential

The Steelpoortdrift Vanadium Project sits within one of the most studied geological provinces of the world - Bushveld Complex. The vanadium mineralisation in the complex is typically higher grade than global peers.

Image source: Company update, 5 April 2022

On financial metrics, the Steelpoortdrift Project looks at a stronger position. Based on the data provided by the Company, it will have the highest IRR and post-tax NPV among its peers.

- Strong leadership team

VR8 has an experienced and competent leadership team. Chairman Jurie Wessels and Director Nico van der Hoven have hands-on, local expertise in exploration, mining, beneficiation, and export shipping, which will be important in moving the project forward.

CEO Mr Eugene Nel has a strong background in metallurgical and process engineering. Non-Executive Director Mr John Ciganek is another stalwart in the Board with more than three decades of mining experience. Mr Michael Davy, Non-Executive Director, is an experienced Australian executive and accountant with over 18 years of experience.

Related read: Vanadium Resources (ASX:VR8) advances on pilot plant test work post bulk sampling completion

The DFS is expected to get completed by the September quarter of 2022. The Company is already in discussions with debt financiers and investors for the project. The FID is expected by the end of 2023, and in the meantime, the Company would also engage with interested parties for offtake agreements.

VR8 shares were trading at AU$0.095 in the early hours of 3 June 2022.