Highlights

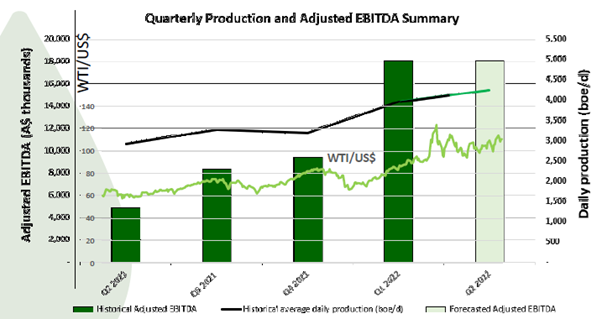

- Calima Energy recorded all-time high oil & gas production levels during the March quarter.

- The Company enjoys a higher free cash flow and increased operating profit as crude oil prices have remained strong so far in 2022.

- CE1 is all set to commence a half-yearly dividend program with AU$2.5 million expected to be distributed in initial dividend.

- The Company plans a share buyback scheme to purchase up to 10% of the issued capital from the open market.

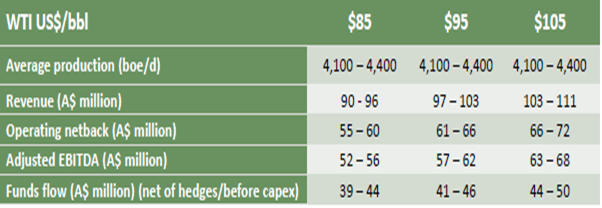

- If the current WTI price retains its momentum till September, the Company estimates to generate a revenue of around AU$100 million.

The oil & gas market is on fire with WTI crude prices hovering well above US$100 per barrel. The prolonged conflict in Eastern Europe and trade disruptions have catalysed oil & gas price movements as investors rush towards the energy market.

In this current upbeat scenario, conventional oil & gas producer Calima Energy Limited (ASX:CE1|OTCQB:CLMEF) is taking giant strides at its top-tier assets in Western Canada.

The year 2022 has been phenomenal so far for energy producers in terms of returns. During the March 2022 quarter, the Company recorded an all-time high oil & gas production of 4,300boe/d. With WTI crude prices above US$100/bbl, high netback production is driving higher operating profit for the Company.

Stable, low-decline base production

Calima operates stable and low-declining petroleum assets in Canada. The Company has producing fields in the Brooks and Thorsby areas in the Alberta region along with the ‘sleeping’ natural gas giant Montney.

Asset portfolio of CE1 in Canada (Image source: Company update, 24 May 2022)

The Brooks and Thorsby fields have more than 82 producing wells, and the Company plans to start drilling four new wells in June 2022.

The March 2022 quarter saw the drilling of seven wells across these two fields and construction of a nearly 19km pipeline connecting the wells in the Brooks region to the main production line.

Image source: Company update, 24 May 2022

Calima to commence dividend program

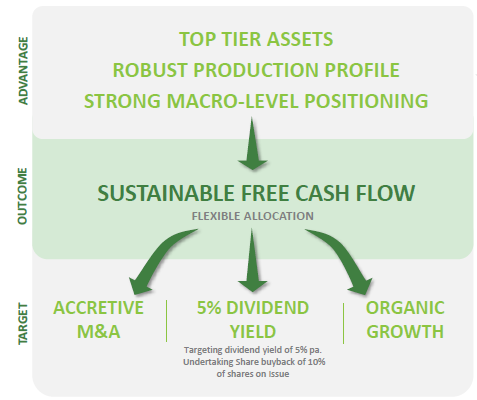

Backed by the continued strong performance of its producing assets and strong energy prices that have positively impacted the Company’s cash flows, Calima intends to begin a half yearly dividend program in the second half of 2022. The development drilling program carried out in 2021 and 2022 played a key role in reaching this decision.

At the current share price, initial dividend will be AU$2.5 million, representing a half-yearly yield of 2.4%.

Share buyback on the cards

Calima plans to undertake a buyback of ordinary shares from the open market. The development represents the Board and management’s strong confidence in the Company.

The Board believes that the current share price does not reflect the fundamental value of the Company appropriately.

Calima could buy back up to 10% of the total issued capital in any 12-month period without shareholders’ approval as per the listing rules.

De-risked asset base signifies high-growth potential for Calima

Brooks and Thorsby are two producing assets with over 5.1mmboe of proved, developed reserves. The Company is confident that from these producing assets, it can well maintain the average daily production of 4,100-4,400 boe through the September 2022 quarter.

More than 65 wells have been drilled on approximately 40,500 acres of oil & gas assets in Brooks. In April, Calima produced roughly 2,700boe/d from the asset.

From the Thorsby area, the Company produced ~1,700boe/d in April. Since 2014, the field has seen drilling of 15 wells, and multiple wells are being drilled from a single pad to reduce overall capital costs.

The Montney is essentially a gas asset with 160.5mmboe of 2C contingent resources. The Montney asset or the sleeping giant, as Calima likes to call it, has several features which make it a low-cost development project. The development-ready project has an existing facility capacity of more than 11,000boe/d.

Calima has already secured drilling rights and approvals to construct and operate a multi-well production facility at the project. Moreover, the Company holds permit to construct pipeline to connect the Calima well-pad with regional pipeline and processing infrastructure.

The above-mentioned factors combined with the corporate strategy of the Company, are likely to help Calima to drive long-term value. The key essence of Calima’s strategy is depicted well in the infographics below.

Image source: Company update, 24 December 2022

What to expect in September quarter

Calima has also put forward corporate guidance for the 9 months ending 30 September 2022 period, which is as below:

Image source: Company update, 24 December 2022

Calima is well-positioned to deal with macro-pressures with market exposure on a strategic level. Multiple oil pools have been located, defined, and developed in the Western Canadian region. New volumes are expected to create a stable commodity environment.

CE1 shares traded at AU$0.2 on 27 May 2022.