Highlights

- Manganese presents a significant opportunity for explorers due to its wider usage with baseload demand from the 2bt pa steel manufacturing industry and the expanding battery mineral space.

- Manganese is classified as a Critical Mineral in Australia and the USA.

- Black Canyon (ASX:BCA) aims to emerge as a manganese-focused explorer/developer in the Pilbara region.

- The company is currently advancing exploration work across the Flanagan Bore Project to upgrade mineral resource confidence classification and completed metallurgical testwork to support a Scoping Level economic evaluation.

- Black Canyon has many exciting exploration activities on the cards in the near future.

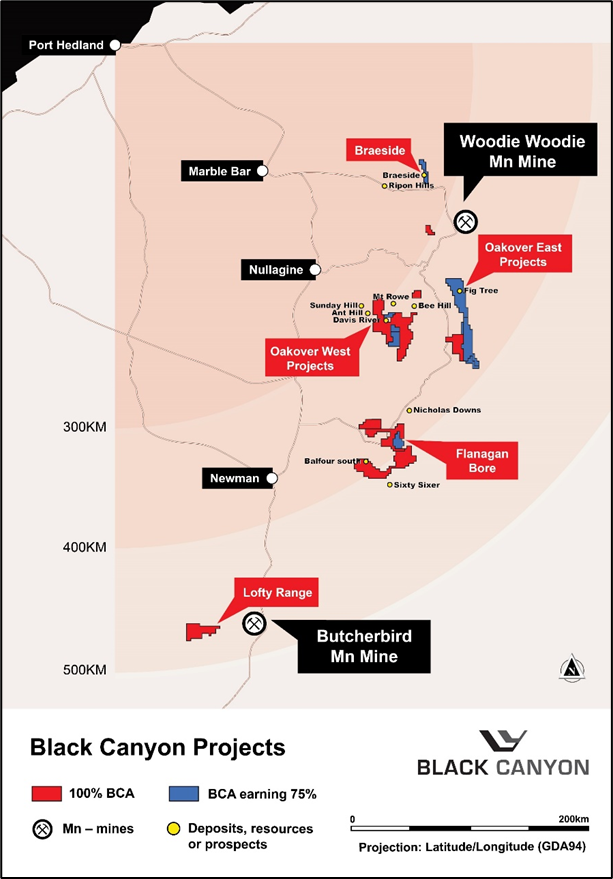

Black Canyon Ltd (ASX:BCA) is a manganese (Mn) focussed explorer with projects located in the East Pilbara region of Western Australia. The region has existing manganese mines of Woodie Woodie and Butcherbird styles of mineralisation and export infrastructure at Port Hedland.

Manganese has attractive fundamentals with growing usage in the battery mineral sector amid limited supply. The mineral is used as a essential and non-substitutable component in the steel industry.

Increasing manganese demand fuelling prospects for Black Canyon

One of the most consumed metals across the globe (4th by tonnage), manganese has wide applicability in vital industries. Around 90% of manganese is used in the steel manufacturing process, with manganese ore used to produce ferro or silico manganese alloys which are added to steel to prevent corrosion, resist abrasion, and improve hardenability. Approximately every tonne of steel produced contains 8 to 10kg of manganese.

.Thanks to the global shift to Electric Vehicles (EVs), there is a growing demand for manganese in the developing EV battery market as Nickel-Cobalt-Manganese (NCM), which is the dominant cathode material, is used in lithium-ion batteries. Every NCM battery has around 10 to 30% Mn, which translates to 10 to 90kg depending on cathode chemistry.

Source: BCA

Industry experts and associations predict strong growth in EV sales in the coming years. This is driven by strict emission norms imposed by nations, including China and Europe, on fuel-powered engines. The International Energy Agency’s (IEA) Global EV Outlook 2021 projects a strong decade of growth for the EV market.

In light of such a tremendous growth potential, Black Canyon looks to emerge as a dominant ASX-listed manganese-focused explorer/developer in the Pilbara region.

Prolific projects of Black Canyon in Pilbara

The project portfolio of BCA offers a large exploration footprint that is prospective for manganese. The project portfolio comprises 100%-owned tenures as well as a package of tenements held under a joint venture (JV) with Carawine Resources Limited (ASX:CWX).

Black Canyon’s manganese projects in the Pilbara Region (Source: BCA)

Flanagan Bore Project - Presently, BCA has been channelising its exploration efforts on its highly prospective Flanagan Bore Project, located about 400km southeast of Port Hedland.

Recently, the company completed 7,534m of RC drilling at the project, to infill and extend the existing Indicated Mineral Resource of 104Mt @ 10.5% (11Mt of contained manganese) at the FB3 and LR1 deposits. The company expects the results to enable an upgrade in mineral resource confidence classification from the current Indicated to Measured status, which can be used for detailed feasibility studies.

The assay results are expected over the next 2-3 months.

Meanwhile, the company is advancing metallurgical studies with acid leaching testwork applied to manganese concentrates derived from the Flanagan Bore deposit.

Optimism surrounds BCA projects

BCA’s projects are prospective for both Woodie Woodie (hydrothermal) as well as Butcherbird (supergene) styles of mineralisation.

The company remains optimistic that its project portfolio offers opportunities for developing minerals that are used as an essential component in the steel industry and the evolving energy storage space.

Way forward

BCA is continuing major work programs and has planned various works to be executed across the projects in the current year. These include infill/extension drilling, MRE updates, heritage surveys, GAIP on selected targets and follow-up drill programs.

The company remains well funded to fast-track exploration activities. The goal is to produce a manganese ore concentrate to feed into the enormous global steel market and to understand the downstream valuation in producing manganese sulphate – a critical precursor material for nickel-cobalt-manganese cathodes used in Li-ion batteries.

BCA shares traded at AU$0.20 on 18 July 2022.

_07_04_2025_07_17_24_352003.jpg)