Highlights

- The unprecedented rise in the demand for electric vehicles is putting immense pressure on the supply chain of battery metals, including lithium.

- Lithium explorers are buoyed by recent record concentrate price and long-term demand.

- Australasian Metals is committed to developing its two highly prospective lithium projects.

- The company received an exploration grant from the Northern Territory government for its Mt Peake Lithium Project.

The electric vehicle (EV) market has been growing at a fast pace in recent years amid increasing awareness about carbon emissions. Now, the demand is growing even faster due to soaring fuel prices. However, EV manufacturers are facing hard times in keeping up with the skyrocketing demand.

The rise in demand for EVs is leading to a surge in demand for battery metals. Lithium has become one of the hottest commodities today. As the demand for lithium is expected to grow multi-fold over the coming years, lithium explorers and producers are working round the clock to tapping this lucrative market opportunity.

Australia has the world’s largest reserve of lithium and is expected to play a dominant role in the future supply chain of battery metals, including nickel, cobalt, zinc and alumina.

Related read: A snapshot of Australasian Metals’ (ASX:A8G) rich portfolio of gold & lithium projects

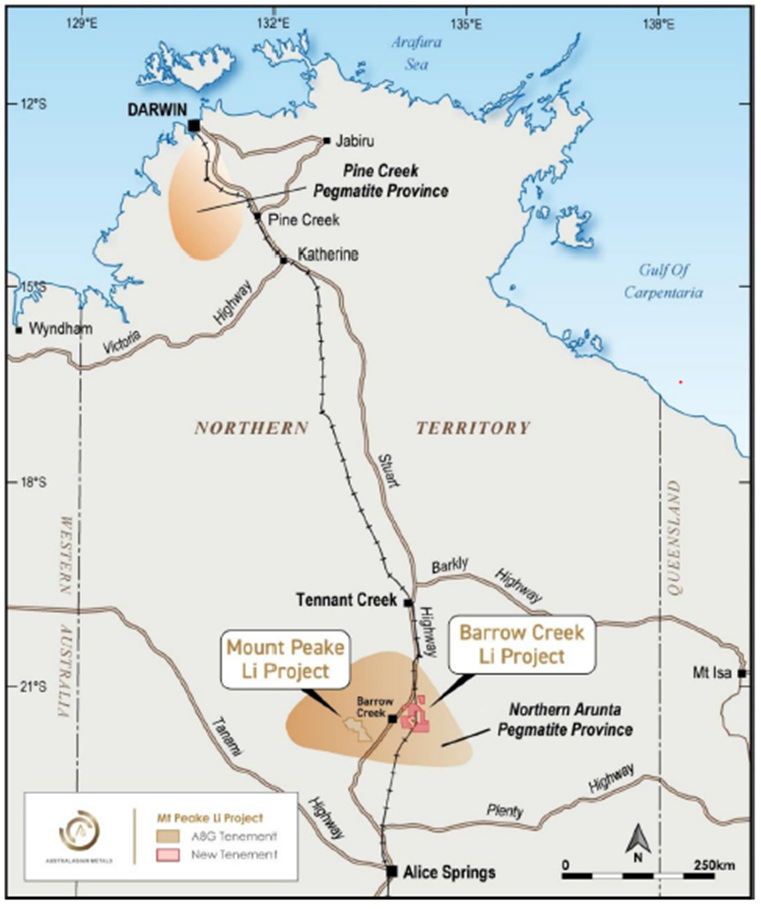

Amidst the encouraging lithium market dynamics, Australasian Metals Limited (ASX:A8G) is advancing the development of its lithium assets in the Northern Territory. The gold and lithium exploration focused company currently operates two lithium projects in the region- Mt Peake and Barrow Creek.

Australasian Metals’ Lithium Projects

The Mt Peake Lithium Project presents an exciting lithium exploration opportunity. The project sits within one of the two major pegmatite provinces in Northern Territory, the Northern Arunta pegmatite province. The area is considered highly prospective for hard rock lithium mineralisation.

A rock and soil sampling program at the project tenement has indicated significant lithium potential, with one of the samples returning up to 1.61% Li2O and 223ppm tantalum (Ta).

The company has collaborated with the CSIRO to carry out exploration activities at the project using the latter’s state-of-the-art optical, thermal, remote sensing data analysis and interpretation and equipment.

Moreover, A8G recently secured a government grant of AU$160,000 under Round 15 of the NT’s Geophysics and Drilling Collaborations Program. The award of the grant validates the potential of the Mt Peake Project. The funding will support a maiden drilling program, expected to commence in Q3 of 2022.

Location of lithium projects (Image source: Company update, 28 April 2022)

Also read: Eye on lithium and gold, Australasian Metals (ASX:A8G) sees action-packed March quarter

To increase its lithium footprint in the region, the company has acquired a 90% interest in the Barrow Creek Lithium Project.

The project has historical Ta-Sn mineral occurrence records. Mapping operations by previous explorers and government geologists had mapped pegmatite rocks on the tenement package.

Related read: Meet the leadership team behind Australasian Metals’ (ASX:A8G) terrific progress

A8G is well funded and reported a net cash balance of AU$6.1 million at the end of 31 March 2022. The company has approximately 52 million shares on issue, representing its tight capital structure.

Share price movement: Shares of A8G were trading at AU$0.200 apiece midday on 22 June 2022.