Highlights

- Platina Resources (ASX:PGM) has shared an action-packed quarterly report for the three-month period ended March 2022.

- The Company identified drill targets with potential for gold – sulphide mineralisation at depth at its Xanadu Gold project.

- Platina commenced a master alloy development program at its scandium project.

- At the quarter-end, PGM held a decent cash position of AU$1.5 million and investments valued at AU$8.4 million.

- The Company has planned drill testing across its gold projects in the current year.

Platina Resources Limited (ASX:PGM) has shed light on its progress across various fronts of the last quarter ended 31 March 2022. The Company reported an array of developments across its key projects, namely – the Xanadu Gold Project, the Challa Gold Project, and the Platina Scandium Project.

During the quarter, the mineral explorer identified a number of attractive drill targets at the Xanadu gold project and commenced a master alloy development program for its scandium project. Moreover, the Company closed the sale of its stake in the Western Australia-based Munni Munni project.

Let us skim through the Company’s key developments across various fronts during the March quarter.

ALSO READ: Platina Resources’ December quarter packed with actions across projects

New drilling targets at Xanadu Gold Project

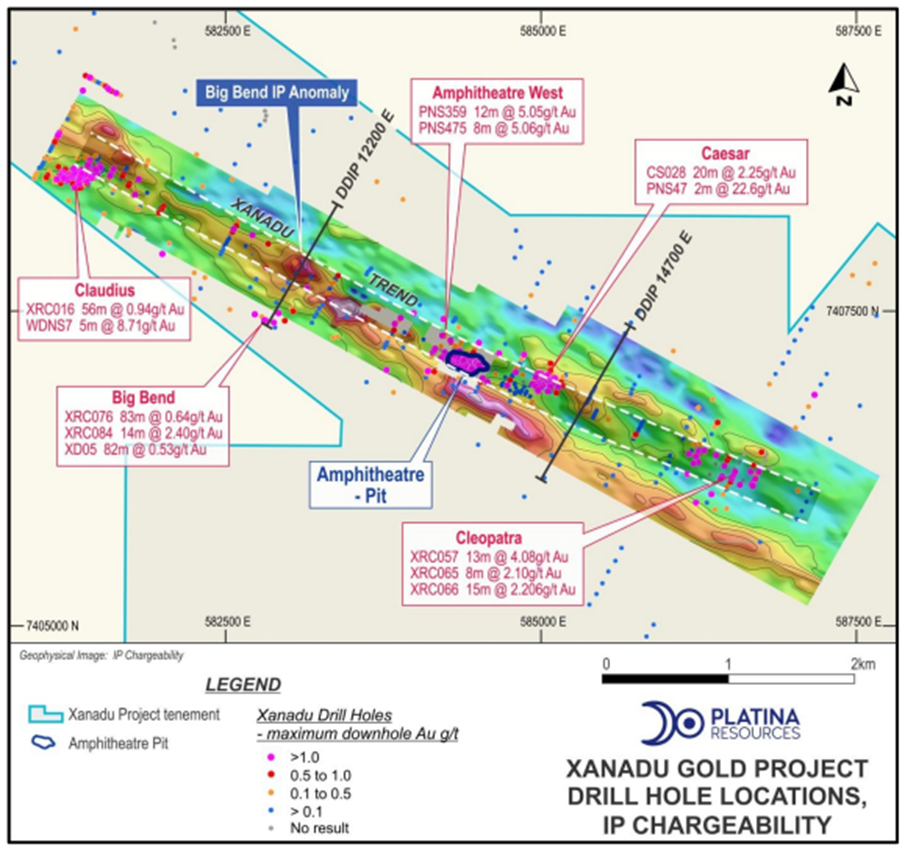

During the last quarter, results from a geophysics program highlighted a number of strong anomalies for drill testing. The program included an Induced Polarisation (IP) survey, covering a 7-kilometer target section of the Xanadu gold trend distinguished by historic gold occurrences drilled within the Duck Creek Dolomite.

Source: Company Announcement (29 April 2022)

The survey included a 100-meter line spacing gradient array IP survey, which identified a linear zone, defined by the margin of conductive and resistive features mapping out a 6km strike length target zone.

Additionally, the Company has identified several chargeable anomalies, potentially representing sulphides with associated gold mineralisation, along the same target area.

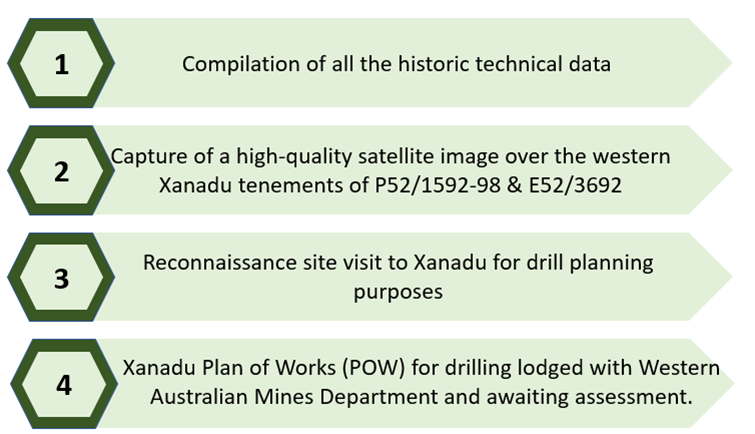

PGM has also commenced drilling preparatory work for heritage surveying and other statutory requirements including:

Data Source: Company Announcement (29 April 2022)

Related Read: Platina Resources (ASX:PGM) closes H1 with major strides at gold and scandium projects

Cultural heritage program at Challa Gold

The quarter saw the delay of a planned cultural heritage survey program due to wet weather. It is now expected that the program will take place in May, which will further be followed by an air core drilling program to test targets identified through the extensive soil testing program.

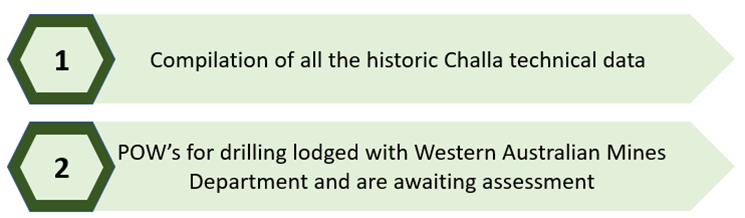

PGM has commenced preparatory work for heritage surveying and other statutory requirements for drilling covering:

Data Source: Company Announcement (29 April 2022

Master Alloy development and permitting at PSP

Under the Master Alloy Development Program, Platina wrapped up the first phase in some new trials to produce a new high-grade, aluminum-scandium master alloy, which is believed to be attractive to end-users.

Furthermore, the Company is working to refine the process methodology on a larger scale.

Additionally, PGM commenced a stakeholder engagement program during the quarter as part of its renewed focus on securing operating permits at both the Condobolin and the Red Heart Mine sites.

Sale of stake in Munni Munni Project

PGM completed the sale of its 30% stake in the Munni Munni project to Alien Metals Ltd for AU$0.25 million in cash and AU$1.98 million worth of Alien shares.

Alien’s acquisition of the 100% interest in Munni Munni consolidates the Elizabeth Hill and Munni Munni districts, which are prospective for precious and platinum group metals.

Awaited grant of exploration licence at Mt Narryer

At My Narryer, Platina awaits the grant of Exploration Licence (E 09/2423) by the Western Australian Mines Department. A soil sampling program is planned after the grant of the licence.

Read More: Eye on IP, Platina Resources (ASX:PGM) produces high-grade aluminum-scandium master alloy

Appointment of new exploration manager

In the last quarter, the Company appointed experienced gold geologist Rohan Deshpande as its Perth-based Exploration Manager to advance Western Australia’s portfolio of gold projects.

Mr Deshpande would be a great asset to the Company's gold strategy as he holds significant experience in all facets of gold exploration and mining.

Financial footing

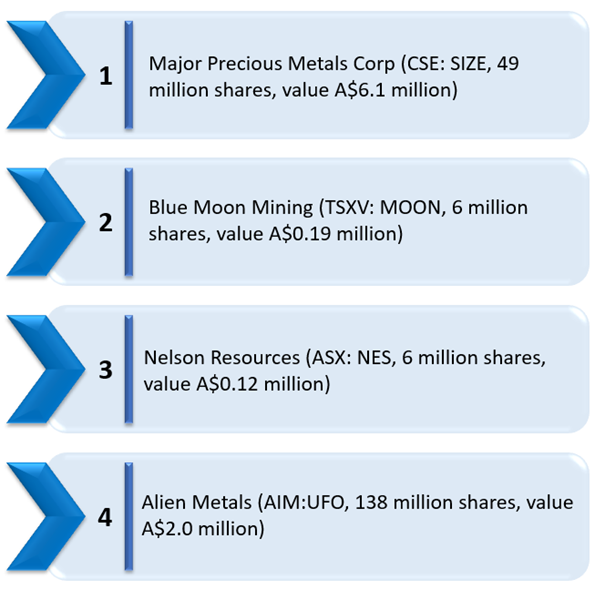

At the end of the last quarter, Platina held a decent cash position of AU$1.5 million and investments valued at AU$8.4 million, including:

Data Source: Company Announcement (29 April 2022)

PGM shares were trading at AU$0.049 midday on 2 May 2022.