Highlights

- Australasian Metals operates lithium and gold projects across three mining jurisdictions of Australia.

- The Company is executing field activities to delineate the resource potential of the projects.

- Initial work at its 100%-owned NT lithium project has proven the presence of favourable lithium mineralisation.

- Drilling operations are underway across the Company’s two gold assets.

Thanks to booming demand for battery minerals in light of EV (electric vehicle) revolution, lithium is being dubbed as the new ‘oil’. The burgeoning demand for lithium is driving investments in the exploration and development of lithium assets.

Meanwhile, gold has a proven track record of acting as a ‘safe haven’ for investors. The yellow metal acts as a hedge to shield portfolios when the equity market becomes volatile or is under stress.

One player that is engaged in developing a number of exploration and mining opportunities related to gold and lithium is Australasian Metals Limited (ASX:A8G). Cashed up and led by a professional and very experienced team, Australasian Metals is committed to advancing its lithium and gold project portfolio to create significant shareholder value.

Founded in 2018, the company aims to become a prominent gold and lithium explorer in the Australian mining space. The ASX-listed explorer holds close to 1,000km2 exploration ground in premier mining jurisdictions of Australia, including Queensland, the Northern Territory and Western Australia.

Significant developments have taken place across the Company’s four gold projects and two lithium projects.

Australasian makes headway at high-grade lithium projects in

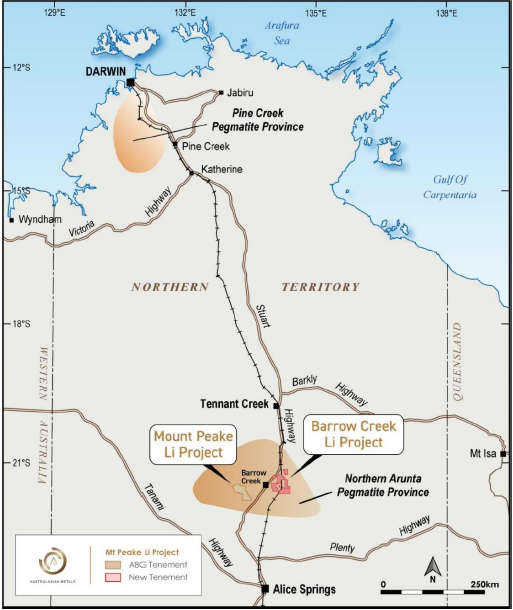

Australasian operates two lithium exploration projects in the Northern Territory – Mt Peake and Barrow Creek. In the recently acquired Barrow Creek Li Project, the company controls a 90% interest.

Australasian is currently undertaking a sampling and mapping program over its fully owned Mt Peake Lithium Project. The ongoing program has confirmed lithium mineralisation on the surface. One of the samples has returned 1.15% Li2O and 226ppm. The geologists have delineated lithium mineralisation on every sampling survey to date. The highly encouraging sample results have boosted the company’s confidence in lithium enrichment within the tenement.

A8G has also partnered with CSIRO, Australia’s national science agency, to undertake exploration activity using state-of-the-art optical, thermal and geophysical remote sensing data analysis and interpretation workflows. Under the CSIRO Kick-Start Program to research ‘Lithium Exploration in the Mt Peake Pegmatite Field’, the Company has also received instrumental equipment to identify potential key features of Li-bearing pegmatites.

Location of A8G lithium projects (Image source: Company update, 9 March 2022)

Giant strides at gold project portfolio

Australasian enjoys significant exposure to yellow metal through its four gold projects. The Fairview Gold Project sits within the Western Australian region, while the remaining three projects are located in the Queensland region.

The Company recently commenced a reverse circulation (RC) drilling campaign on priority targets at the Mt Clermont and Capella projects in Central Queensland. The explorer plans to drill ~2,500m of RC holes on the projects. The drilling program is aimed at extending the mineralisation trend southwards on Mt Clermont. Moreover, drilling on Mt Clermont will also validate and infill previous drilling results, which had identified significant mineralisation.

On the Capella Project, A8G will drill seven holes to test and verify earlier drilling results. The aim of the drilling program is to add QAQC protocols and other criteria to boost confidence in the project, in order to potentially proceed toward uncovering JORC compliant mineral resources.

Drilling rig at Capella Project (Image source: Company update, 11 April 2022)

Another asset that is expected to witness drilling in 2022 is the May Queen Gold Project in Queensland. The project includes granted tenement Exploration Permits for Minerals – EPM 19419 and the neighbouring application EPM 27746. It covers free-hold land, which does not have a Native Title claim.

Last year, the Company undertook a 5-hole, 1,000m diamond drilling campaign on the May Queen Project. The drilling yielded excellent core recovery and provided significant information on the project's structure and structural controls.

The Company plans to conduct a geophysical survey in the targeted area at May Queen prior to commencing a follow-up drilling program this year.

On its Fairview Gold Project, Australasian has commenced initial fieldwork, and in-house targeting exercises are well advanced. The project lies in the prolific WA region and hosts an exploration target structurally similar to the Mt Clement deposit.

Australasian Metals’ project portfolio provides exposure to precious and battery metals, which are witnessing a boom of unprecedented dimensions. The Company is marching ahead with its strategy to build a profitable exploration and mining business amid strong tailwinds in the commodity market.

A8G shares edged up 5.319% to trade at AU$0.495 midday on 28 April 2022. The Company has a market cap of AU$24.49 million.