CVCheck Limited (ASX:CV1), incorporated in 2004 and based in Australia, is a young and dynamic IT player operating a technology platform as a service business. The company provides reliable and secure people screening and verification services to a myriad of clients including corporates, small and medium enterprises (SMEs) as well as individual consumers across Australia and New Zealand. Since the launch of the platform in 2006, the company has progressively modified and enhanced its technology, incorporating several changes based on latest innovations and client feedback so as to optimise customer experience and, ensuring that the services stay relevant in a rapidly evolving world.

CVCheck has an extensive suite of checks that comprise National Police Checking Service (NPCS); Employment and Qualification Checks; Employment Reference Checks; Credit Financial and Business Checks; Predictive Psychometric Assessments; International Checks; and Traffic Checks. Meanwhile, the company keeps striving for expanding its revenue streams.

Every year, over 300,000 clients including private and government organisations, employers and individuals sign up for verification services offered by the company, which is backed by a locally based team. Additionally, with its world-class online platform, the delivery of the comprehensive range of checks is seamless across the globe.

CVCheckâs highly motivated management team has some of the leading business minds with extensive in-depth knowledge and experience in all aspects of the business. Moreover, the team has successfully scaled large-scale projects on both national and international front.

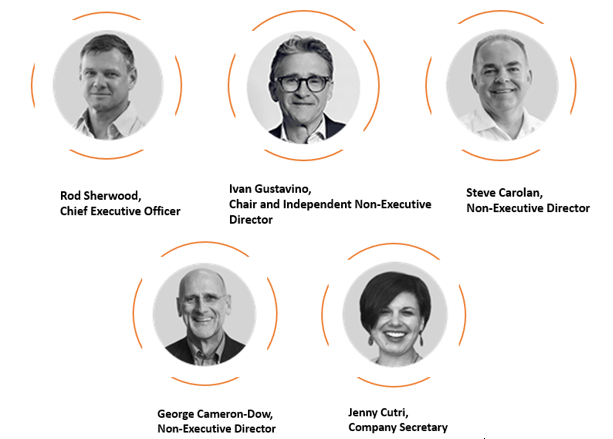

CVCheck - Key Personnel

(Image Source: Companyâs Website)

- Rod Sherwood, Chief Executive Officer

Rod Sherwood (BBus Accounting) was appointed as the CEO of CVCheck in 2016, after having headed the companyâs corporate finance function since 2011. During his tenure with CVCheck so far, Mr Sherwood successfully managed a couple of seed investment rounds, commercialisation of Australia grants, and also led the companyâs IPO and debut on the Australian Securities Exchange (ASX) while also looking after CVCheckâs accounting and tax.

He began his career with National Australia Bank Limited (ASX:NAB) in the early 1980s before moving to Europe where he was instrumental in the advance of Elsevier Finance SA, which later turned into Reed Elsevierâs global principle corporate treasury centre with assets worth over eleven billion dollars.

In 2009, Mr Sherwood resigned from his duties at Rod left Elsevier Finance SA and went on to found his own consulting firm, Hamelin34.

- Ivan Gustavino, Chair and Independent Non-Executive Director

Ivan Gustavino (BBus Information Processing) was appointed to the role of non-executive director and chair at CVCheck in August 2018. He brought a wealth of experience of 25 years spent mostly working with technology companies, where he was actively engaged in cracking deals and advising technology investors and businesses at the board level on different business aspects like business strategy, growth and Merger and Acquisition transactions.

- Steve Carolan, Non-Executive Director

CVCheck was the brainchild of Steve Carolan, who founded the company in 2004 and served as the Managing Director until 2016. Over his course of career, Mr Carolan established extensive expertise in setting up successful businesses, technology, pioneering innovation and establishing strategic partnerships.

In his earlier roles, Mr Carolan served as one of the directors of Access Home Loans, a forerunner in the Australian mortgage broking industry, with offices in New Zealand and across the nation.

- George Cameron-Dow, Non-Executive Director

George Cameron-Dow holds Master of Management from the University of the Witwatersrand and the Stanford Executive Program. His career span, stretching across different types of companies from both public and private sectors, including industrials, pharmaceutical, health care, biosciences, as well as funds management financial services.

Moreover, he has experience across emerging growth companies as well as large corporations in the listed space.

- Jenny Cutri, Company Secretary

Jenny Cutri, an experienced compliance specialist and lawyer, took to the role of CVCheckâs Company Secretary in March 2016. She has around two decades of extensive experience of working within both the public and private sectors and serves as In-House Legal Counsel at CV1. She completed her Graduate Diploma in Executive MBA from Mt Eliza Business School, Bachelor of Commerce in Accounting as well as went on to study LLB and B Juris at the University of WA.

Recent Developments

- The company recently released its financial results for the year to 30 June 2019 (FY19), posting revenue of $ 12.36 million (B2B business contribution: 70%). Besides, the rise in sales across the product range boosted the gross margin to expand by 300 bps to 54%. More on CVCheckâs consolidated financials and business updates can be READ

- On 16 August 2019, CVCheck announced the receipt of commitments from institutional, sophisticated and professional investors to raise $ 3 million before costs via placement of 18.8 million shares at $ 0.16 each.

With a strong start to FY20, CVCheck is looking forward for rapid expansion in the upcoming year through continued focus on capitalising on sector tailwinds, further advancing B2B business growth and identifying revenue diversification streams.

Stock Performance

CVCheck has a market capitalisation of around $ 46.74 million and approximately 292.1 million shares outstanding. On 13 September 2019, the CV1 stock closed the dayâs trade at $ 0.145.

In addition, the CV1 stock has delivered stellar positive returns of 10.34% in the last three months, 122.22% in the last six months, and 220.00% year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.