Australia-based CVCheck Ltd (ASX:CV1), established in 2004, is a dynamic IT sector player, which operates a world-class online technology platform-as-a-service business that provides people screening and verification services to corporates, small and medium enterprises (SMEs), and consumers worldwide. CVCheck progressively modifies and enhances its technology platform by incorporating various changes for enhancing client satisfaction and optimisation of their order experience. This helps in ensuring that the services remain relevant in an ever-evolving world.

Over the last 10 years, the company has evolved with expanding revenue streams and introduced a comprehensive range of checks comprising - National Police Checking Service (NPCS); Employment Reference Checks; Employment and Qualification Checks; Credit Financial and Business Checks; Predictive Psychometric Assessments; International Checks; and Traffic Checks.

More on the complete list of checks could be READ here.

Financial Year 2019: A Transformational Period

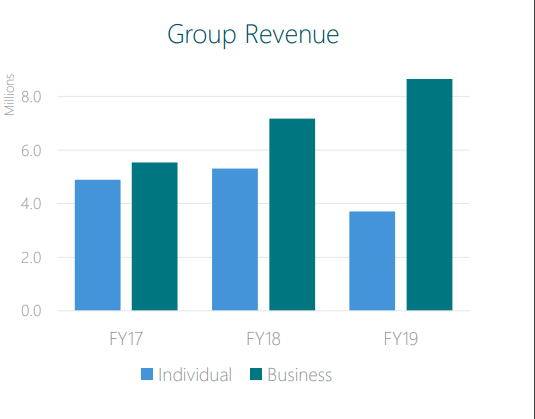

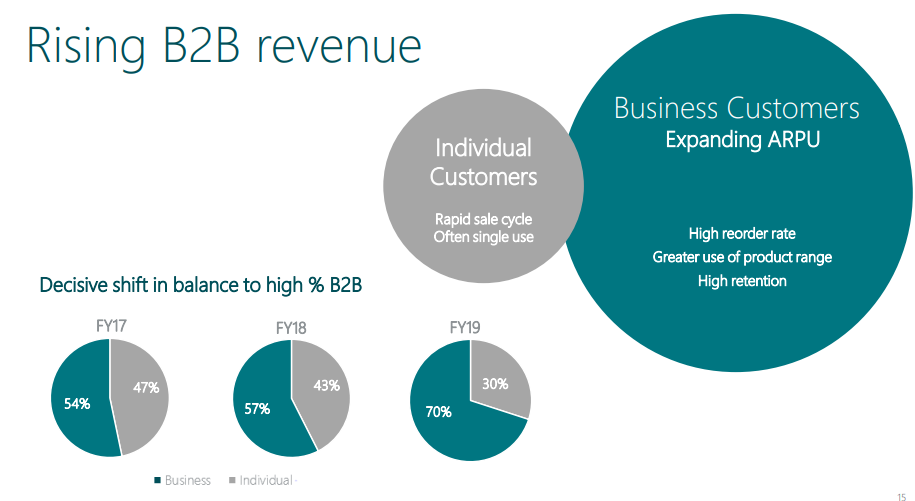

Recently on 30 June 2019, CVCheck disclosed its Preliminary Final Report for the financial year ended 30 June 2019 (FY19), posting revenue from ordinary activities at ~ $ 12.36 million, of which the B2B business accounted for 70%. The increased sales across product range helped gross margin to expand by 300 bps to 54%.

Source: CV1âS Non-deal Roadshow Presentation

Source: CV1âS Non-deal Roadshow Presentation

During FY19, CVCheck witnessed the positive results of its ongoing strategy of targeting higher quality, sustainable and recurring business customer revenue, from corporates, governments, medium and small enterprises, that would deliver a steadily increasing base of Annualised Recurring Revenue (ARR). This generated enough growth to largely offset the decrease in single transaction individual customer revenues. The Booked ARR in FY19 was $ 9.2 million, representing a Compound Annual Growth Rate (CAGR) of 30% across the past three financial years.

The major reduction in marketing expenditure on individual customers coupled with continued strict expense control led to a significant 57% reduction in net loss for the year attributable to members to around $ 1.09 million.

FY19 Segment-wise Performance:

On the basis of major product lines, CVCheckâs Police Checks product line reported $ 10.01 million in revenue, while Non-Police Checks reported a revenue of $ 2.35 million in FY19.

Additionally, the companyâs revenue based on geographical regions saw Australia contributing the major portion of revenue at $ 10.56 million, with $ 1.799 million contribution by the New Zealand region.

Financial Position:

The companyâs net tangible assets per share increased 28.6% from $ 0.49 as at 30 June 2018 to $ 0.63 as at 30 June 2019. The net assets were valued at ~ $ 4.86 million (FY18: $ 4.20 million) including cash and cash equivalents of ~$ 3.12 million (FY18: $ 2.39 million).

Cashflow:

There were $ 245,509 of cash inflows from operating activities (FY18: $ 1.82 million in cash outflows) during the period, resulting primarily from receipts from customers totaling ~ $ 12.45 million, interest received of $ 19,399, receipt of income tax refund of ~ $ 189,030, net of payments to suppliers, employees and finance cost paid. The financing activities further supplemented the cash inflow with ~ $ 1.26 million, on account of large proceeds from the issue of shares ($ 1.45 million) net of repayments of borrowings and share issue transaction costs.

On the other hand, the investing activities generated $ 813,570 of cash outflows due to significant investments in intangible assets and purchases of plant and equipment. The different strategies adopted and executed during the year, helped CVCheck to deliver three consecutive quarters of positive cashflow.

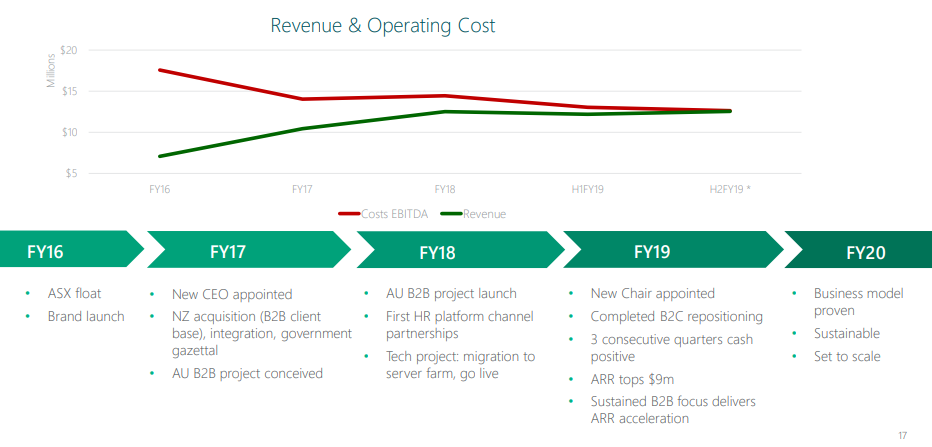

The companyâs journey since 2016 may be summarised as below-

Source: CV1âS Non-deal Roadshow Presentation

Source: CV1âS Non-deal Roadshow Presentation

Integrations and New Launches:

CVCheck recently integrated with SmartRecruiters, a leading cloud-based recruiting platform. Such collaborations with online HR and employment management platforms actively help in driving new B2B customer opportunities within Australian and New Zealand.

CV1âs platform is now connected with JobAdder, SAP SuccessFactors, WorkDay, Springboard, PageUp, SnapHire (including its talent app store), PeopleScout and SmartRecruiters.

In the last quarter of FY19, CVCheck also launched Phase 1 of its âwhite labelâ screening & verification solution and experienced immediate success by signing up Visy Industries on board, as white labelâs foundation large enterprise customer. On 5 July 2019, the company also informed that a university and a construction company were in the process of implementing its tailored white label solutions. The feature is only able to be accessed by large enterprises.

Bolstering Organic Business Customer Growth:

The company added new members to its sales team and strengthened the account management and marketing teams. In addition, the B2B large enterprise and corporate sales team was also tripled during the second half of FY19.

Recently, the Public Fundraising Regulatory Association (85 members) assigned CVCheck to provide its services and by June 2019, the company had already onboarded and was booking revenue from the Australian Red Cross, The Smith Family and the Wesley mission, amongst others.

Besides, other significant customer wins in the last quarter of FY19 comprised two divisions of Singtel Optus Pty Ltd, Bluefin Resources Pty Ltd, Bluestone Resources Inc., G4S Australia, Kennards Hire, National Hearing Care Australia and MercyCare.

With that foundation, the company is well placed to pursue promising organic growth opportunities in Australia and internationally, on the back of a thriving B2B business being the primary growth engine, B2C business as well as leveraging technology and market position via new white label initiative.

Outlook for FY20

CVCheck has had the most outstanding start to the financial year 2020 and the company is primed for rapid growth in the upcoming months. The strategy going ahead involves capitalising on sector tailwinds, accelerating B2B business growth and further diversifying revenue.

Stock Performance:

CVCheck has a market capitalisation of around $ 43.81 million with approximately 292.1 million shares outstanding. On 4 September 2019, the CV1 stock closed the dayâs trade at $ 0.145.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.