Artificial Intelligence (AI) and e-Commerce marketing company, RooLife Group Ltd (ASX:RLG), formerly OpenDNA Limited, informed the market on 10 December 2019 that the capital raising with the acceptance of subscriptions under a placement of securities to sophisticated and professional investors to raise $ 1.5 million before costs has been closed.

Under the Placement, the Company will issue a total of 42,857,143 new fully paid ordinary shares (Shares) at $ 0.035 each, along with one free attaching listed option for every two Shares, with each Option having an exercise price of $ 0.05 per share and an expiry date of 31 October 2021.

Since the placement received strong support, the company has informed that all applications would be accepted, requiring the company to undertake the placement in two tranches, with the second tranche consisting of the issue of Options subject to shareholdersâ approval.

First Tranche: RooLife Group will issue a total of 27,935,950 new fully paid ordinary shares at an issue price of $ 0.035 per Share this week utilising the companyâs existing placement capacity under ASX Listing Rules 7.1 and 14,921,193 Shares will be issued under ASX Listing Rule 7.1A in tranche 1.

Second Tranche: The second tranche of the Placement would comprise 21,428,571 associated Options. However, RooLife Group will be seeking shareholder approval for tranche two Placement Options at the general meeting of shareholders scheduled to be held in January 2019.

The funds raised from the Placement have been indicated to be directed towards building on the strong growth that RooLife Group achieved through 2019, with the general working capital funding to be applied to expanding the RooLife business including:

- Marketing of the companyâs online products and services in China;

- Expansion of the companyâs new WMall online sales channel and additional brand acquisition (as announced 4 December 2019);

- Marketing and promotion of the companyâs service to prospective clients in Australia.

Joint Lead Managers and Corporate Advisors: RooLife Group has agreed to issue around 3,000,000 Options to the Joint Lead Managers, Triple C Consulting Pty Ltd and Red Leaf Securities Pty Ltd, as part of the fees associated with the Placement, which will be a part of tranche two Placement Options.

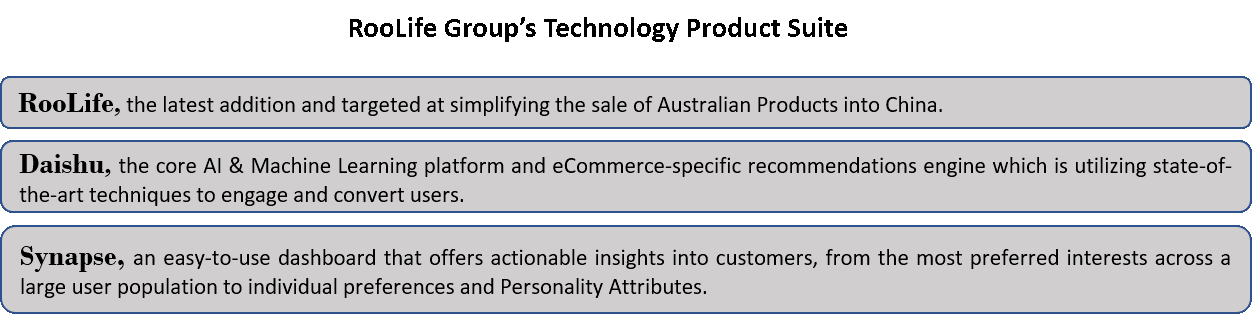

RooLife Groupâs business strategy for the financial year 2019-20 (FY20) is to develop and grow its customer base across multiple industry verticals, primarily Tourism & Airports, Diagou and Student channels and Online and Retail sales; expand high-quality customer base for its digital services in Australia as well as China; and help Australian businesses and brands to successfully enter the China market.

Stock Performance: RooLife Groupâs market capitalisation stands at around $ 10.85 million with ~ 285.44 million shares outstanding. On 10 December 2019, the RLG stock settled the dayâs trading at $ 0.035. RLG has delivered positive returns of 15.15% in the last one month and 8.57% Year-to-date.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.