Australian exploration company, Pacifico Minerals Ltd (ASX:PMY) has been making solid progress in unearthing lead-silver-zinc deposit in Western Australia. Since the acquisition of Sorby Hills Lead Silver Zinc Project (75% interest, remaining 25% interest held by Henan Yuguang Gold & Lead Co. Ltd) in October 2018, the company has made outstanding progress in the development of this project.

From its Phase I metallurgical testwork program, the company has already produced highly positive and encouraging results, confirming the potential for the project to produce a high-quality lead concentrate containing appreciable silver credits. During the Phase I drill program, the company noted significant uptick in the Indicated Resources included in the Pre-Feasibility Study (PFS) completed in the first half of 2019.

In an announcement made on 24th July 2019, the company confirmed that it has now completed the Phase II infill and extension drilling program for 75 drill holes for 5,959m at the Sorby Hills Project. During the Phase II program that began in May 2019, the company is focused on combining an updated Mineral Resource Estimate (MRE) with the recently improved metallurgical testwork outcomes and the mining studies which are currently ongoing.

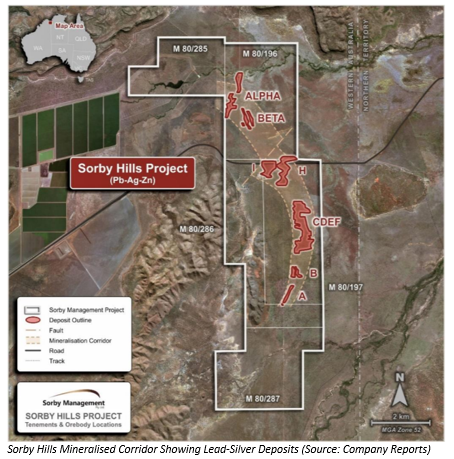

The drilling program was designed to obtain higher confidence Indicated Mineral Resources from Inferred Mineral Resources, standing at 10.9Mt of 5.0% Pb equivalent (46g/t Ag and 3.9% Pb). The program is focused on shallow mineralisation, which may be operable by open pit, at CDEF and B deposits (refer to below figure).

Phase II infill and extension drilling program consisted of 75 drill holes, including 30 reverse circulation (RC) holes and 45 HQ3 diamond holes. It is expected that the assay results will flow from early August.

Strong visible lead mineralisation, galena (lead sulphide) in mineralised intersections and significant amounts of sphalerite (zinc sulphide) have been observed in drill core.

With regards to the CDEF deposit, it is expected that if combined with the 2019 drill program infill results, a significant portion of the current Inferred Resource at the northern part of the CDEF deposit may be convertible to Indicated Resource.

During the Phase II program, zinc mineralisation was commonly observed. Although zinc mineralisation has not yet been considered in the project economics, the companyâs technical team believes that there is a great potential for the delineation of further zinc resources to add significant value and enhance project economics.

Along with mining studies, the company is also planning to conduct additional drilling next year in order to expand the Indicated Mineral Resource of the CDEF and B and, and convert Inferred Mineral Resources at the A, I, H, Beta and Alpha deposits to Indicated Mineral Resources. The drilling and addition of the extensions and other targets outside of the main defined deposits company is expected to further enhance the deposit size at Sorby Hills.

The company is currently in the process of assessment and compilation of the current and historical drill holes, which will provide a sound mineralisation and geological model upon which a revised MRE can be based. It is expected that the revised MRE will be completed in September.

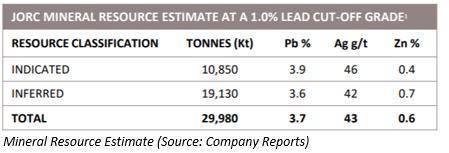

About Sorby Hills: Located around 50 kilometres north-east from the regional centre of Kununurra, the Sorby Hills Project has access to the outstanding Infrastructure. The project has a total Indicated Resource of 10.85 million tonnes and total Inferred Resource of 19.13 million tonnes, taking the total resource to 29.98 million tonnes @3.7%Pb,0.6% Zn and 43 g/t Ag.

With an updated Mineral Resource Estimate and a deeper geological understanding of the deposits, the company believes that there is a significant potential for Sorby Hills deposit to grow.

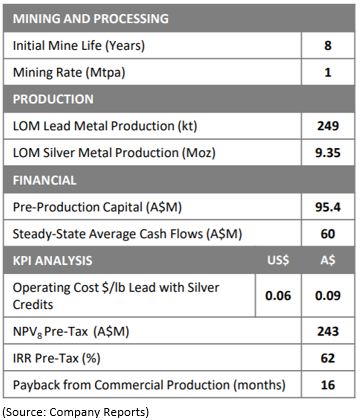

The Pre-Feasibility Study conducted at the Sorby Hills has confirmed strong financials for the project with NPV8 of $243 million, IRR of 62%, CapEx of $95.4 million and average cash flow of $60 million.

Quarterly Updates: In 2019 March quarter, the company spent $511,000 on exploration and evaluation activities, $95,000 on staff costs and $67,000 on administration and corporate costs. The net cash used for operating activities in March quarter amounted to $667,000. At the end of March quarter, the company reported cash and cash equivalents of $1.62 million.

In the March quarter cash flow report, the company had anticipated an exploration and evaluation expenditure of around $1.275 million in the June quarter. It is to be noted that, Henan Yuguang, as a Joint Venture Partner of Sorby Hills Project, contributes 25% of all spend on the Sorby Hills Joint Venture.

Management details: The company is currently operating with the well experienced management team with a diverse international experience. The companyâs management team include well-seasoned industry veterans like Richard Monti (Chairman), Simon Noon (MD), Peter Harold (Non-Executive Director), Andrew Parker (Non-Executive Director), Aaron King (Project Manager).

Stock Performance: PMYâs stock is riding high with a year-to-date return of 125%. In the past three months, the stock price has increased by 50%.

The stock was trading at a price of $0.009 with a market capitalisation of circa $20.82 million by the end of trading session on 24 July 2019.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.