Discoverer of the Red October Gold Deposit in Western Australia and three kimberlites in Namibia, ASX-listed metals and mining player Mount Burgess Mining NL (ASX: MTB) is currently focused on the development of the Kihabe - Nxuu project in Botswana, a significant dwelling of the most profitable vanadium mines. MTBâs goal revolves around unlocking the potential of its Zinc/ Lead/ Silver/ Germanium and Vanadium Project.

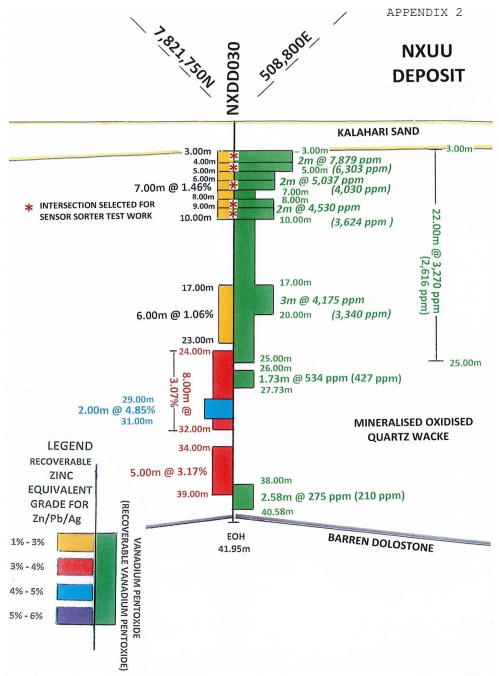

The Nxuu Deposit (Source: MTBâs Report)

Preliminary Sensor Sorter Test Work: Advancing the companyâs developments at the Nxuu Deposits, preliminary Sensor Sorter test work was conducted by STEINERT, delivering promising results. The test, undertaken on ten samples, aimed to seek improvement areas and analyse/enhance the profitability of the project, while encouraging reduction of power and water requirements as well as the impact on the environmental footprint of the project. It was initially conducted on the + 10mm size fraction separated after crushing, and involved use of contemporary measures including an x-ray transmission sensor to measure atomic density along with a 3D laser sensor to analyse the size of mineral particles with the purpose to target densely mineralised domains in the samples.

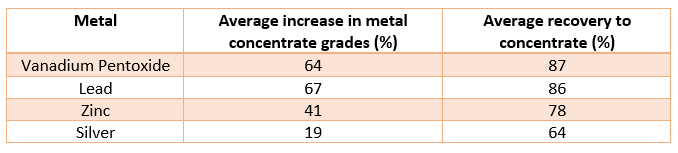

The below depiction shows the test results, after the fraction was separated by the ore sorter:

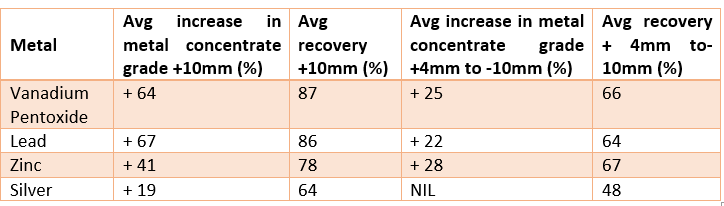

Update on the Sensor Sorter Test Work: Post the preliminary test work conducted by STEINERT on ten samples from the Nxuu Deposit, further Sensor Sorter test work was conducted on a composite of the + 4mm to - 10mm size fraction separated after crushing from the +10mm size fraction test work. On 20 August 2019, MTB provided an update on the same, stating that 55% of mineralised Quartz Wacke was available for milling and processing, after 45% of the sample mass was rejected as barren or trivially mineralised Quartz Wacke, of the combined mass of the size fractions of +10mm and +4mm to -10mm from a composite of all ten samples subjected to the test work.

Test Work Results: The 55% combined concentrate of + 4mm size fraction, which was available for milling showed an overall average increase in metal concentrate grades. This increase, an encouraging result for the development of the deposit, depicted the below described metal concentrate grade increase along with the average recovery to concentrate:

Inference of Combined Results: MTBâs preliminary and further results on the composite have been much anticipated by metals and mining enthusiasts and are believed to be vital for developments at the Nxuu deposit, which is an ocean of opportunities. The combined results have proven that through the use of STEINERTâs Sensor Sorter process, 45% of insignificantly mineralised, rather barren Quartz Wacke could be separated and further rejected post crushing. This in turn, would result in successful and significant reduction of the milling and downstream treatment processes.

The result would conform a significant reduction in capital and treatment costs, water consumption requirement and overall environmental footprint. Moreover, it is expected to result in an upgrade in pre-concentrated metal grade levels.

The recent mineralogical test work by ALS Laboratories confirmed that DESCLOIZITE is the host oxide vanadate of V2O5 in the Nxuu Deposit, which could be collected in a flotation concentrate together with Smithsonite and Cerussite

Encouraging Results of MTBâs Fourth Quarter Report: It is the much-anticipated reporting season in Australia wherein ASX-listed companies are releasing their earnings reports, guidance and vital announcements. MTB has joined the bandwagon amid this attractive phase for market enthusiasts and investors. With its focus streamlined and works progressing well, the company has been in discussions ever since it released its impressive report for the quarter ended 30 June 2019.

On 30 July 2019, MTB released its report for Q4 FY19, with the highlight being the promising results delivered by the preliminary Sensor Sorter test work conducted by STEINERT.

With 51% of mineralised Quartz Wacke available for milling and processing, after the remaining 49% of the sample mass was rejected as barren or trivially mineralised Quartz Wacke, the test results were a boon for MTB, and paved the way for a positive succession, discussed above.

The Future Seems Bright for MTB: As stated in the companyâs quarterly report, bulk test work would also be conducted on ½ HQ diamond core, to test for barren rejection and upgrade of mineralised concentrate prior to milling of average grade Zn/Pb zones, which are higher grade that the previously tested zones.

Moreover, MTB is likely to conduct a milling test work, which would be pulled off by Energy and Densification Systems (Pty) Ltd. The test, if amenable, would significantly reduce power requirements and operational costs, besides delivering other benefits like energy efficiency, reduced capital costs, smaller footprint, no civils requirement, low weight and quick installation time.

Besides this, the sighter test work program using STEINERT Ore Sorter, is an exceptional early beneficiation step that bears the potential to have a significant positive impact on project economics. Given the scope and vitality of the same, MTB strongly aspires to pursue this further, a step wherein the higher grades of Zinc, Lead and Silver would be tested. As per the company, these higher (average and more typical) domains are likely to provide a stronger signal for the Ore Sorter to deliver further improvement in pre-concentrate grades and recoveries.

Stock Performance: On 21 August 2019 (3:15 PM AEST), MTBâs stock is trading at A$0.002, with a market capitalisation of A$1.04 million.

Given the excellent test works results, it would be interesting to watch out for further developments Mount Burgess make in the days to come. Moreover, the company is likely to be a hot topic of discussion amid the investors who are looking forward to considering mining stocks which have been showing sustainable potential in a period where the mining and metal industry is being affected by the US-China trade war.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.