At the close of the trading session on 28th July 2020, equity market of Australia ended in red. The benchmark index S&P/ASX200 moved down by 23.7 points to 6020.5. Most of the sectors on ASX closed in red including S&P/ASX 200 Consumer Discretionary (Sector), which went down by 25.3 points to 2,494.2 and S&P/ASX 200 HealthCare (Sector) experienced a decline of 376.1 points to 40,773.7. All Ordinaries ended the session at 6146.8 with a fall of 22.8 points.

On ASX, the share price of Credit Corp Group Limited (ASX: CCP) settled at $18.370 per share. The stock of Nufarm Limited (ASX: NUF) inched up by 8.06% to $4.290 per share.

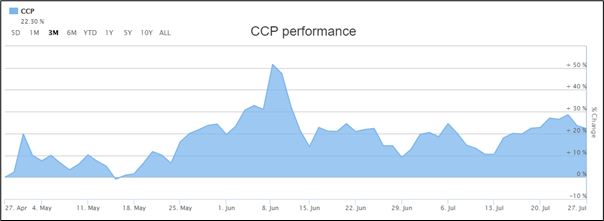

Stock Performance (Source: ASX)

At the end of the same trading session, S&P/NZX50 witnessed a fall of 0.06% to 11,578. The stock of Cavalier Corporation Limited (NZX: CAV) rose by 11.11% to NZ$0.300 per share. On the other hand, the share price of Ascension Capital Limited (NZX: ACE) plunged by 33.33% and settled the day at NZ$0.002 per share.

Recently, we have written an article on Wingara AG Limited (ASX:WNR), and the readers can click here to view the content.

Credit Corp Group Limited Reported Growth in Net Profit After Tax

Credit Corp Group Limited (ASX:CCP) recently released its FY20 results, wherein, it reported net profit after tax amounting to $79.6 million, reflecting growth of 13% over pcp. CCP generated free cash flow of $110 million during 2H FY20, which was supplemented with a $152 million equity raising. The company has cemented its balance sheet to facilitate continued purchasing and lending over an extended period of uncertainty. The company possesses a strong balance sheet comprising of cash and undrawn lines of $400 million. CCP has decided not to pay a final dividend for FY20. However, it is expecting to resume dividend payments in 2021. For FY21, the company anticipates NPAT in the range of $60 million - $75 million and earnings per share of between 89 cents - 112 cents.

Nufarm Limited Ended in Green on 28th July 2020

Nufarm Limited (ASX:NUF) recently advised the market that it has decided to change its financial year- end from 31 July to 30 September to better align the half-year reporting period with its key sales periods and enable improved comparison with industry peers. In another update, the company notified the market about its decision to stop manufacturing of insecticides and fungicides at its Raymond Road site in Laverton, Australia and curtail herbicide manufacturing at its operations in Linz, Austria. During Q3 FY20, revenues, gross profit and underlying EBITDA of the company were up as compared to prior year. This was due to strong demand in Australia and North America as weather conditions returned to more normal patterns in these regions.