Summary

- Wingara Ag Limited witnessed continuous improvement in overall revenue profile amid the COVID-19 pandemic.

- Cash receipts marked an uptick of 31.3% to $10.02 million (vs Q1 FY20)

- JC Tanloden continues to deliver growing output, up 45% to 12KT as compared to Q1FY20

- David Christie was appointed as a Non-executive Director, upon the resignation of Mark Hardgrave.

- WNR is well-positioned for the next five years to capitalise on expected increased customer demand.

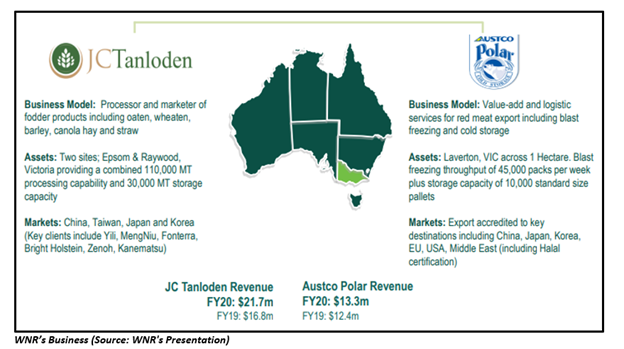

Owner and operator of value-add, mid-stream assets engaged in the processing, storage and marketing of agriculture produce for export markets, Wingara AG Limited (ASX:WNR) is engaged in developing the protein supply chain. It aims to be the leader in the sale of agricultural products to the local and foreign markets, particularly focusing on the export of hay products to Asia.

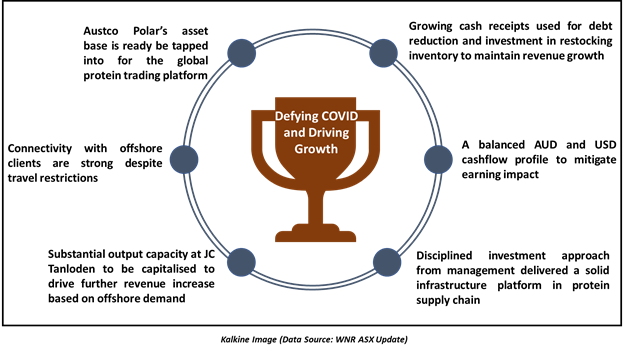

WNR has maintained its growth momentum from Q4 FY20 during the first quarter FY21. The diversified asset investment model of Wingara produced a solid result amid the volatile global economic environment that has been impacted by COVID-19.

Following the announcement of the quarterly results, WNR stock increased by 4% intraday to $0.260. The stock settled day’s trading at $0.250 on 28 July 2020.

Growth of 81% in inventory from Q1 FY20

The Company’s overall performance continued to be supported by its fodder export volume. A growth of 81% from Q1 FY20 in the hay inventory volume is empowered by quarterly revenue consistency. The redeployment of profits from the sale and lease back of Austco Polar which yield ROE of over 100% allowed fodder export to capitalise its un-utilised capacity.

Growth Driven by Rising Cash Receipts and Investment In Working Capital

By the end of the quarter, WNR’s customer receipts stood at $10.02 million, up by 31.3% as compared to $7.63 million during Q1 FY2020, indicating enhanced fodder output. More importantly, WNR has not received any support related to COVID-19 from the Government, like JobKeeper. The 6-month to June 2020 revenue is just over $20m which is significant in terms of growth when compared to the full year revenue of $10.76m in FY18.

Moreover, operating net cash outflow for the quarter of $0.02 million compared to an inflow of $1.93 million in Q1 FY2020 was primarily influenced by inventory building, with $6.6 million outflow in working capital mainly relating hay purchases.

These product manufacturing and hay purchases increased by 116% as the Company scaled up its operations to take advantage of its purchasing power of fodder and solid export market demand for fodder.

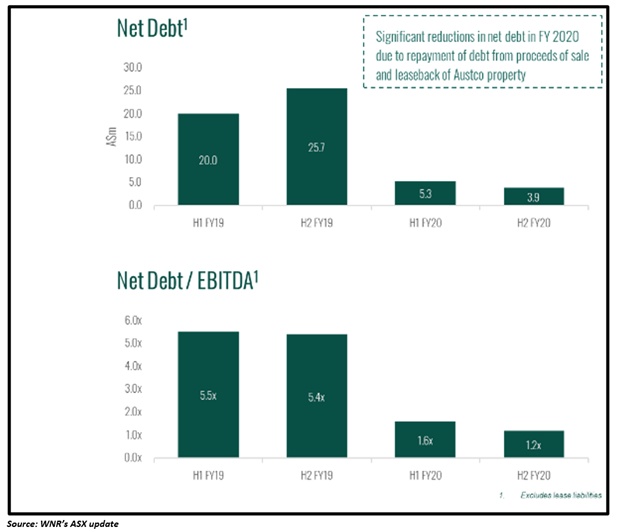

Debt Reduction Allows Freedom to Capitalise on Opportunity

The rapid accumulation of debt in the economy due to the effects of COVID-19 has rendered many businesses unable to take advantage of exciting opportunities that are now arising. Last year’s timely deleveraging has meant that WNR now enjoys freedom to allocate resources and make the best of the unique circumstances.

The rapid accumulation of debt in the economy due to the effects of COVID-19 has rendered many businesses unable to take advantage of exciting opportunities that are now arising. Last year’s timely deleveraging has meant that WNR now enjoys freedom to allocate resources and make the best of the unique circumstances.

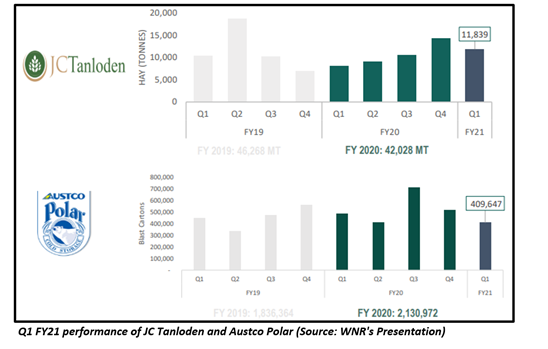

Continued Delivery of Output by JC Tanloden, up 45% to 12KT

The output of JC Tanloden in any given month depends upon the availability of hay inventory and purchase capability at harvest every year, which translates to maintain a base inventory of approximately 3-4 months to meet forward production.

This has facilitated an average monthly 4,000 to 5,000 MT production WNR has witnessed over 1H CY2020.

WNR’s focus was not limited to meet production targets but was extended to take delivery of sufficient hay volume for the next quarter to diminish potential risks caused by COVID-19 in the coming quarters.

WNR has the opportunity of overall solid export demand, particularly with China exhibiting signs of recovery post-re-opening of the economy after COVID-19. Moreover, WNR is well underway with business planning and hay accumulation for next season, with the aim to enhance capacity utilisation from the existing 50% to 75% based on the processing capacity of 110,000 MT.

Austco Polar Cold Storage

Austco Polar Cold Storage

There has been a drop in blast volume by 16% to 410K (vs Q1FY20) for Austco Polar Cold Storage, driven by the economic impact of COVID-19. However, the investment and capital work completed over FY20 has enhanced efficiency and reduced average variable cost.

Moreover, WNR expects Q2 FY21 to have similar blast volumes due to the closure of various processing facilities in Victoria. Positive signs of a strong lamb season post-re-stocking have emerged in Victoria and WNR is engaged with key clients to plan for the upcoming season.

David Christie Appointed as a Non-executive Director

Another significant event for WNR during the quarter was the appointment of David Christie (GAICD) to Wingara’s Board as a Non-executive Director after Mark Hardgrave stepped down from his role as a Non-executive Director.

David has a proven record in building successful businesses and has a significant governance background. David’s skills and experience further enhance the skill set of WNR’s Board.

Proactively Responded To Potential Delays Caused By COVID-19

Strict risk management procedures have been implemented by Wingara to minimise business disruption and a continuous proactive approach has been implemented to tackle COVID-19.

The Company has managed to keep its employees and their families unaffected by COVID-19 so far, and there has been no severe impact on operations, with WNR not receiving any JobKeeper allowance.

WNR has witnessed dislocation in international shipping services due to the reduction and/or rescheduling of services. WNR believes that its export team has proactively responded to manage potential delays due to the COVID-19.

WNR Well Positioned To Capitalise On Anticipated Growth In Customer Demand

Moving ahead, WNR expects to produce a consistent output from JC Tanloden in Q2 FY21 before the new harvest season arrives.

The Company believes that it has a clear outlook on numerous opportunities to augment its organic growth trajectory and leverage the agricultural infrastructure platform built based on a tolling style revenue model. WNR believes itself to be well-positioned to capitalise on anticipated growth in customer demand over the coming five years.