On 15th June 2020, the equity market of Australia ended in red, and S&P/ASX200 witnessed a sharp decline of 128 points or 2.19% to 5719.8. S&P/ASX 200 Health Care (Sector) fell by 767.9 points to 40,359.4. S&P/ASX 200 Information Technology (Sector) stood at 1,455.5, reflecting a decline of 1.6%. At the close of the same trading session, All Ordinaries ended at 5830 with a fall of 129.9 points.

On ASX, the share price of Healius Limited (ASX: HLS) moved up by 18.972% and closed at $3.010 per share. The stock of Monadelphous Group Limited (ASX: MND) soared by 3.608% to $11.200 per share.

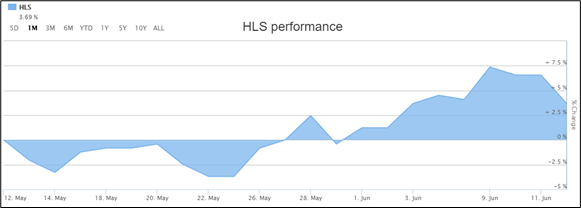

The below image shows how the stock price of HLS has trended in the period of 1 month:

Stock Performance (Source: ASX)

S&P/NZX50 ended the session at 10,864, implying a decline of 0.38%. The share price of Augusta Capital Limited (NZX: AUG) rose by 31.39% to NZ$0.900 per share. The stock of New Talisman Gold Mines Limited (NZX: NTL) inched up by 14.29% to NZ$0.008 per share. On the other hand, the stock of SeaDragon Limited (NZX: SEA) plunged by 16.00% and settled the trading session at NZ$0.042 per share.

Recently, we have written some crucial information on Podium Minerals Limited (ASX:POD), and the readers can view the article by clicking here.

Healius Limited Rose 18.972% on Australian Securities Exchange

Healius Limited (ASX:HLS) has recently inked a binding agreement with BGH Capital to sell the Healius Primary Care business for an enterprise value of $500 million on a cash and debt free basis. HLS will be receiving cash proceeds of around $470 million on the completion of sale. The proceeds from the sale would be utilised towards decreasing net debt as well as freeing up capital for investment. After completion of the sale, the company would be well-positioned to leverage the established market positions as well as scalable businesses with an objective to improve shareholder value. The company has refinanced its syndicated bank debt facility amounting to $500 Mn which was likely to mature in the month of January 2021. The facility has now increased by $70 Mn to $570 Mn and its maturity has been extended to January 2024.

Monadelphous Group Limited Ended in Green on 15th June 2020

Monadelphous Group Limited (ASX:MND) has recently announced that Pendal Group Limited has made a change to its holdings on 5th June 2020 with the current voting power of 9.33% as compared to the previous voting power of 8.23%. In another update, the company announced that it has secured numerous construction and maintenance contracts in the resources and energy sectors with the value of around $150 million. These contracts include a contract with Rio Tinto for providing minor projects and maintenance services on its Pilbara marine infrastructure for the tenure of 3 years. MND also secured a new 3-year contract at Newcrest Mining’s gold mining operations to provide minor capital project services.