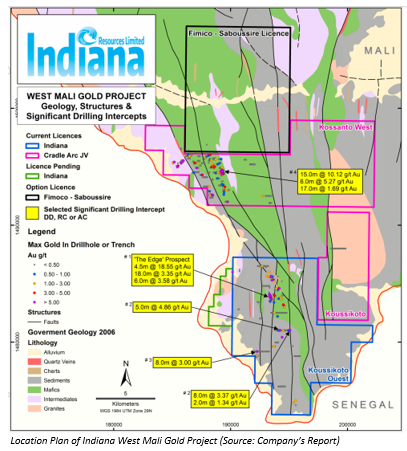

Today, on 14th May 2019, Indiana Resources Limited (ASX:IDA) announced that it has completed a comprehensive data review of the West Mali Gold Project, including an assessment of geological mapping and structural interpretation. The initial review was conducted over the Koussikoto Ouest License at the southern end of West Mali Gold Project. The review of historic soil geochemistry in the southern zone of the West Mali Project area has identified multiple anomalies. It included assessment of mapping and structural interpretation completed by the Mali Government in 2006, and soil geochemistry finished post-2013 on a 200 by 50-metre spacing over an area of about 50 km2 and analysed for gold.

At least 10 distinct anomalies or anomalous trends (A1 to A10) have been identified with the two anomalies at A4 and A9 reporting peak values of >10,000 ppb, which was the maximum limit for the low-level assay technique used for the assaying of soil samples. Only one of the anomalies identified during the review has been partially drill tested to-date at âThe Edgeâ prospect (A1), where results from the previous drilling included 18 meters @ 3.35g/t Au, from 26 meters (MOKRC0032); and 4.5 meter @ 18.55g/t Au, from 98.8 meter (MOKDD0040). The new anomalies range in length from 1,000 to 5,000 metres and width from 250 to 1,000 metres. The review highlights that the A1 soil anomaly at The Edge Prospect is not the strongest or largest anomaly identified by the survey, and the company is encouraged by the scale and scope of the additional anomalies, particularly A2.

The company is planning to follow up drill testing of the anomalies identified by the geochemistry programme, with emphasis on those areas coincident with the structural interpretation. The anomalies identified to date appear related to the north-south and northwest-southeast trending structures within The Main Transcurrent Zone (MTZ). The MTZ is interpreted to be one of the structures, which control mineralisation in Eastern Senegal and Western Mali. This is considered to be an excellent structural and geological location, within the highly prospective Kenieba Inlier of Western Mali, which is known to host several substantial gold deposits, including the Loulou 12.5 Moz deposit (Barrick Gold) and the Sabodala 6 Moz deposit (Teranga Gold).

Bronwyn Barnes, Indianaâs Chair stated that their technical teams in Mali and Australia are to be congratulated for their work on reviewing and collating historical data and strongly supports Indianaâs approach to the Mali strategy. The teamâs initiative has resulted in significant anomalies being identified in the southern zone, with the geochemistry indicating strong potential for the geochemical trends to extend further north. The Mali exploration team is now mobilising to undertake additional geochemistry in the coming days in the southern zone before moving north. The company intends to immediately commence infill soil geochemistry at 100 by 50 metre spacing on selected anomalies within the southern zone and complete an extensive rock chip sampling programme across the tenement area. Besides, the company has applied for the tenement immediately west of the southern tenement to ensure it can expand exploration of this high priority zone in due course. The company looks forward to providing further information on its Mali exploration activities in due course.

On the stock information front, at the time of writing (on 14th May 2019, AEST 02:30 PM), the stock of Indiana Resources was trading at $0.030, down 3.226% with a market capitalisation of ~$3.29 million. Today, it touched dayâs high at $0.034 and dayâs low at $0.030, with an average daily volume of 151,674. Its 52 weeks high price stands at $0.080 and 52 weeks low price at $0.030, with an average volume of 45,556 (yearly). Its absolute returns for the past one year, six months and three months are -51.73%, -42.59%, and -31.11%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.