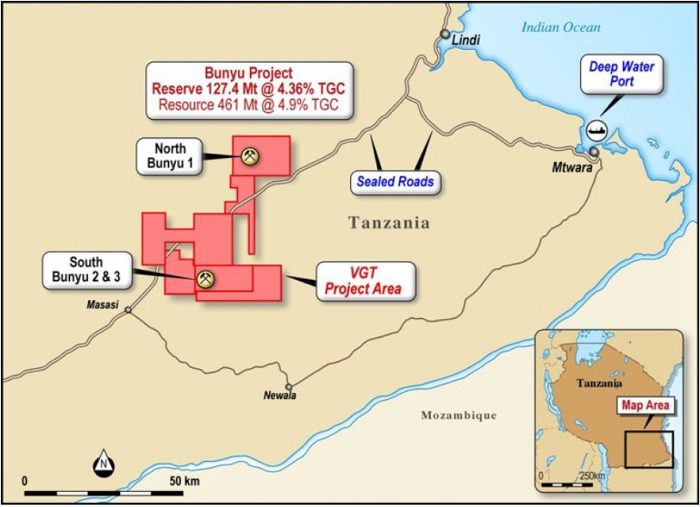

Volt Resources Limited (ASX: VRC), based in Perth, Australia, is a graphite explorer and aspiring developer currently advancing activities related to the development of its 100%-owned flagship asset Bunyu Graphite Project located in south-east Tanzania.

Read here: Volt Resourcesâ Annual Report FY19.

The Bunyu Project Pre-Feasibility Study (PFS) was completed in December 2016, demonstrating a compelling technical and financial case with a Mineral Resource Estimate (JORC 2012 compliant) of 461Mt @ 4.9% TGC. The PFS suggested two staged development for Bunyu and the Stage 1 Feasibility Study (FS) was subsequently completed in July 2018, depicting robust economic and financial viability of the project.

Stage 1 of Bunyu is primarily aimed at establishing the essential infrastructure and market position, asses the market appetite for the Graphite products and then proceed onto the significantly bigger Stage 2 expansion project.

Volt Resources September Quarter 2019 Highlights

- Bunyu Stage 1 Development Funding Update

Volt Resources and its funding advisor Exotix Capital have been diligently working to finalise the targeted funding of USD 40 million for Stage 1 with the ongoing initiatives being the Tanzanian Note Issue and Note Issue and Listing on the Stock Exchange of Mauritius (SEM). On 30 October 2019, the company released a progress update on the same.

The prospectus for Volt Graphite Tanzania Plcâs (VGT) proposed Note Issue and listing on the Development & Enterprise Market of the SEM had already been lodged with the regulator and some positive feedback lately received from SEM officials has indicated positive progress towards approval, amidst minor delays caused due to heightened IPO activity on the exchange.

With over 200 listed companies and a total market cap of ~USD 12 billion, SEM is an active and swiftly expanding capital market in the African region with ~USD 6.5 billion raised so far by listed companies for growth objectives.

Volt Resources had also lodged a Prospectus with the Tanzanian Capital Markets and Securities Authority (CMSA) and the Dar Es Salaam Stock Exchange (DSE). The advisors from the company recently met with senior officials of the Tanzanian Ministry of Minerals and discussions are advancing on a positive note. With other processes of engagement also progressing with senior government officials, Volt is quite optimistic about receiving the final approval at the earliest.

Meanwhile, discussions with other potential North American institutional investors are also underway for additional funds.

- SPP and Top Up Placement raise $ 1.65 Million

The company closed an oversubscribed Share Purchase Plan (SPP) in July 2019, raising a total of $ 1,299,000 and a further $ 350,000 was raised via a top-up placement of new shares to sophisticated and professional investors, including $ 100,000 from the Chairman, Asimwe Kabunga, for which shareholder approval will be sought at the upcoming AGM.

The funds raised have been utilised for repayment of outstanding loan notes due (14 September 2019) to Riverfort Global Capital and Yorkville Advisors, and for general working capital and corporate purposes.

- Project Engineering and Construction

During the quarter, VRC continued discussions with engineering services firms for the role of Project Management Contractor (PMC). The Contract terms & conditions are being finalised in parallel with development funding activities.

- Board Changes

On 1 July 2019, Mr Giacomo (Jack) Fazio, an experienced project, construction and contract/commercial management professional, was appointed as the Non-Executive Director at Volt Resources, following the resignation of Mr Alwyn Vorster.

- Cash Position and Mid-Term Funding

The cash balance stood at $115k as at 30 September 2019. Currently, the company is reviewing proposals to raise equity funds while it completes its Note Issue and listing approvals in Mauritius and Tanzania. In parallel, structure and expenditure commitments are also being considered while progress is made with respect to Stage 1 development funding.

Volt Resources has left no stones unturned to enter the growing graphite market and capitalise on the opportunities. Recently, the company provided exhaustive commentary regarding the latest graphite market scenario, especially developments impacting the Chinese graphite market.

Management Commentary on the Graphite Market Conditions

Stock Performance

Volt Resourcesâ market cap stands at ~ AUD 19.26 million. On 31 October 2019, the stock of VRC settled the dayâs session at AUD 0.011. VRC has delivered a positive one-month return of 25.00%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.

_09_03_2024_01_03_36_873870.jpg)