Australian-headquartered fertilizer developer, Parkway Minerals NL (ASX: PWN) controls substantial quantities of raw materials near to mature and emerging markets including 'greensand' deposits located in the Dandaragan Trough, only 150 kilometres north of Perth and close to the coast of Western Australia. Besides, the Dandaragan Trough is known for hosting one of the largest known greensand deposits of the world.

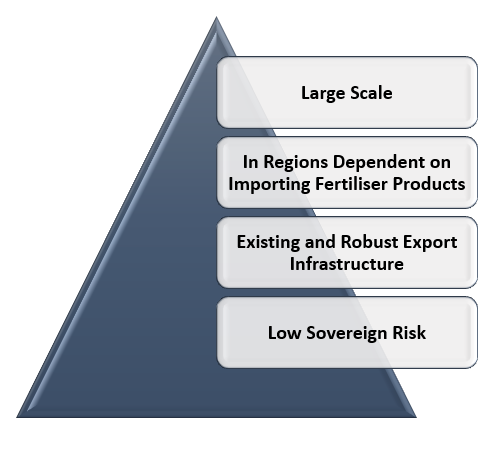

The company focuses on fertiliser projects that fulfil the following requirements:

Initially, Parkway holds 100 per cent interest in Lake Seabrook Project and Dandaragan Trough Project (DTP), located in Western Australia. Besides this, the company has strategic investments in two ASX-listed firms, Lithium Australia NL (ASX: LIT) and Davenport Resources Limited (ASX: DAV). The company possesses ~44 million shares and ~6.5 million shares in Davenport and Lithium Australia NL, respectively. In August this year, the company also entered into binding term sheets to acquire 97.79 per cent of CPC or Consolidated Potash Corporation, with an intention to acquire the remaining 2.21 per cent post the completion of 97.79 per cent acquisition.

In a recent update on the ASX, Parkway informed about the completion of CPC acquisition following the overwhelming support (more than 99 per cent of cast votes) received from the companyâs shareholders.

Details of Final Acquisition

Parkway has finalized the acquisition of CPC by issuing 98.83 per cent of the consideration shares and appointing Mr Bahay Ozcakmak and Mr Patrick Power as Executive Director and Non-Executive Director, respectively.

The company notified about the issue of ~121.8 million partly paid shares and ~484.9 million fully paid ordinary shares to the vendors of CPC as consideration for 98.83 per cent of CPC. The company is eyeing to acquire the remaining 1.17 per cent of CPC by issuing a further ~1.44 million partly paid shares and ~5.6 million fully paid ordinary shares.

As consideration for the extinguishment of an outstanding loan to CPC, the company has also transferred 10 million shares in Davenport to Lions Bay Capital and issued 6 million fully paid ordinary shares to Victoria University.

Terms of Engagement Agreement

Subsequent to the ratification of Resolution 7 at Parkwayâs recently held General Meeting, two new directors have been appointed with the following terms of engagement:

Mr Bahay Ozcakmak (Executive Director)

- Annual fee of $245,000 including GST

- Two-years duration period

- Mr Ozcakmak or Parkway holds the right to terminate the engagement agreement with 3 months or 12 monthsâ notice, respectively.

Mr Ozcakmak is the CEO of Consolidated Potash Corp. and the founder of Activated Water Technologies or AWT. He holds about 20 years of successful technology commercialisation experience as well as extensive corporate development experience, particularly in the energy and mining sectors.

Mr Patrick Power (Non-Executive Director)

- Annual fee of $48,000 excluding GST

- Two-years duration period

- Mr Power or Parkway holds the right to terminate the engagement agreement with 6 monthsâ notice.

Mr Power is the founder of Western Potash and has played a key role in the advancing the Milestone project (under construction) in Saskatchewan and securing substantial investment for the company. He holds more than 25 years of experience in management, mining finance and venture capital.

Parkway also informed that both the newly appointed directors have agreed to join the Director and Senior Management Fee and Remuneration Sacrifice Share Plan. Under the plan, a significant amount of fees is paid in the form of companyâs shares on a half yearly basis.

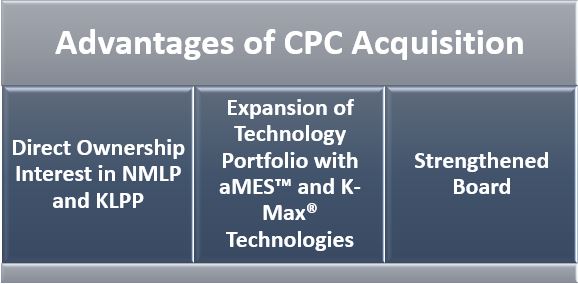

Advantages of CPC Acquisition

With the acquisition of CPC, the company now holds direct ownership interests in two highly prospective brine projects:

- New Mexico Lithium Project (NMLP) - CPC initially has 50 per cent interest, with a right to acquire up to 100 per cent through a staged investment.

- Karinga Lakes Potash Project (KLPP) â Initially, CPC has 15 per cent interest with a right to acquire up to 40 per cent through staged investment of a further $2 million. CPC also holds a conditional option to acquire an additional 10.1 per cent.

Besides project portfolio, Parkwayâs technology portfolio has also expanded with the acquisition of CPC. Together with its K-Max® technology, the company now also holds direct ownership of CPCâs aMES⢠technology, which is appropriate for brine processing and the production of potash and lithium.

Parkwayâs board has also strengthened with the appointment of two highly skilled and experienced directors. The merger of Parkway and CPC provides the company with a pathway to create substantial value.

In order to support the merged group, Parkway has recently issued 90 million fully paid ordinary shares at an issue price of $0.005 per share to raise $450,000 capital. The company will use the proceeds from the capital raising to advance Karinga Lakes Potash Project, advance the acquisition of 70 per cent interest in the New Mexico Lithium Project and support the general working capital requirements.

According to the newly appointed Executive Director, Mr Bahay Ozcakmak, Parkway and CPC have achieved a remarkable milestone with the completion of CPC acquisition. He believes that CPCâs technology and project portfolio offers Parkway with a pipeline of superior business development opportunities which are in the process of being assessed to ascertain near-term priorities. Parkway is holding discussions with multiple potential collaborators, investors and/or strategic partners that could help the company to capitalise on these considerable commercial opportunities.

Stock Performance:

As at 3:11 AM AEST, PWN is trading higher at AUD 0.007 with a massive rise of 40 per cent relative to the last closed price. The stock has delivered a return of 25 per cent in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.