Australian-headquartered Parkway Minerals NL (ASX: PWN) focuses on the development of fertiliser feedstock projects. The company holds a strategic land holding over one of the worldâs renowned glauconite deposits, with applications and exploration licenses enclosing an area of more than 1,050 sq. km in the greensand deposits of the Dandaragan Trough in Perth Basin.

Besides Dandaragan Trough Project, Parkway also owns 100 per cent interest in Lake Seabrook, 31 per cent interest in Davenport Resources Limited (ASX: DAV) and 1.2 per cent share in Lithium Australia NL (ASX: LIT).

Parkway is also in the process of acquiring Consolidated Potash Corporation Ltd (CPC), aiming to expand its existing technology and project portfolio.

In a recent update on the ASX, the company notified that the last condition precedent to the completion of Consolidated Potash Corporation Ltd (CPC) acquisition transaction has been achieved and the transaction will close by 20th September 2019. The company received an overwhelming endorsement from its shareholders, with all the resolutions, that were put to the General Meeting of Shareholders, being passed by a show of hands.

On 5th August 2019, Parkway informed that it had entered into binding term sheets to acquire 97.79 per cent of the issued capital of CPC. Parkway also has a plan to compulsorily acquire the rest 2.21 per cent of CPC post the completion of 97.79 per cent acquisition.

The company mentioned that CPC acquisition will provide Parkway with interests in New Mexico Lithium Project (NMLP) and Karinga Lakes Potash Project (KLPP) along with the ownership of CPCâs wholly owned subsidiary, Activated Water Technologies (AWT) that has invested heavily in R&D of aMES⢠brine processing technology.

The acquisition is also expected to strengthen Parkwayâs board via the appointment of the managing director of CPC, Mr Bahay Ozcakmak and the founder of Western Potash, Mr Patrick Power.

Details of Acquisition Transaction

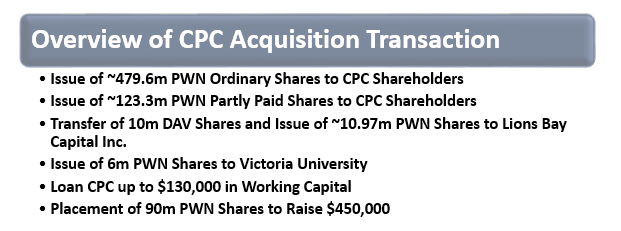

The acquisition consideration of CPC comprised of:

- Issue of ~6 million PWN ordinary shares by Parkway to CPC shareholders, equivalent to 42.4 per cent of the Parkwayâs expanded capital, prior to any capital raising.

- Issue of ~3 million PWNâs partly paid shares by Parkway to CPC shareholders.

- Transfer of 10 million DAV shares and issue of ~10.97 million PWN shares to Lions Bay Capital Inc. in consideration for the extinguishment of a loan to CPC.

On 6th August 2019, Parkway reported that Lions Bay Capital, which owns 48 per cent of the issued capital of CPC, would become a major shareholder in Davenport (10 million shares in DAV) with the completion of the transaction.

Parkway also mentioned that it will issue 6 million PWN shares to Victoria University in lieu of university exercising rights to obtain a minority interest in AWT. CPCâs subsidiary AWT holds strategic collaboration and technology licence agreement with Victoria University.

In order to primarily maintain CPCâs lithium potash project in good condition and perform initial permitting related activities, Parkway also agreed to loan up to $130,000 in working capital to CPC.

Parkway also placed 90 million PWN shares to strategic and/or sophisticated investors in order to support the merged group, at an issue price of $0.005, to raise $450,000 capital. The company issued 90 million fully paid ordinary shares in two portions by initially issuing 76 million shares and then the rest 14 million shares.

The company plans to meet the following purposes from the placement proceeds:

- Advance the acquisition of 70 per cent interest in NMLP,

- Advance the KLPP,

- Support the general working capital.

Benefits of Combined Group

Broadened Project Portfolio

Parkway initially holds interests in Dandaragan Trough Project, Lake Seabrook, Davenport Resources Limited and Lithium Australia NL. With the acquisition of CPC, Parkwayâs project portfolio will further include KLPP and NMLP. Initially, CPC will hold 15 per cent and 50 per cent interest in KLPP and NMLP, respectively. Also, it has secured a pathway to a 100 per cent interest in NMLP, which is a highly prospective project in the US.

Expanded Technology Portfolio

Parkway initially owns 100 per cent stake in K-Max®, a patented hydromet technology. The K-Max® process utilises hot sulphuric acid to leach mica-like minerals, including glauconite, to recover potassium and other elements. The acquisition of CPC will provide the company with a direct ownership of CPCâs aMES⢠technology which is appropriate for the production of lithium and potash and brine processing.

Strengthened Board

As per Parkway, CPC acquisition will strengthen Parkwayâs board via the appointment of highly skilled and experienced, Mr Patrick Power and Mr Bahay Ozcakmak.

Parkwayâs Managing Director, Mr. Patrick McManus has welcomed Mr Ozcakmak and Mr Power to the companyâs board and believes that their experience and skills are ideally fit to junior development companies. Mr McManus has also acknowledged the contribution of Dr Natalia Streltsova, who was to retire from the Parkwayâs board at completion. According to him, Dr Streltsova has provided a profound knowledge of the mineral processing industry, and valuable advice, during her tenure.

Stock Performance: PWN last traded on 13th September 2019 at AUD 0.006. The stock has generated an enormous return of 50 per cent in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.