Highlights

- Saunders delivered an improved financial performance in FY22.

- The company started FY23 on a solid foundation of a substantial order book of A$193 million.

- The PlantWeave integration is contributing to the company’s broader capabilities with clients receiving access to industrial automation and cyber security solutions.

- Saunders expects growth in larger project activity to continue into FY23 with cash reserves gradually strengthening due to margin realisation.

Saunders International Limited (ASX:SND) has once again demonstrated its’ resilience in the construction industry. The multi-disciplined engineering and construction company has delivered a strong performance in FY22, with record revenue, increased earnings, and a robust order book.

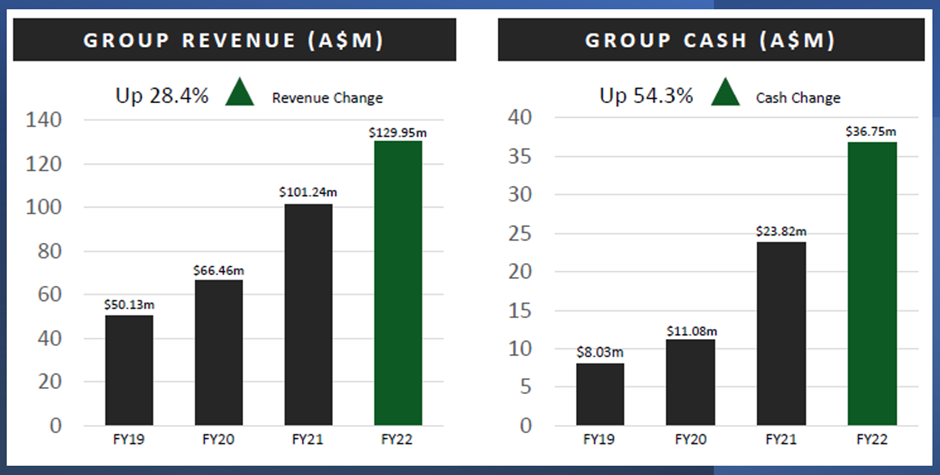

For FY22, Saunders registered a record revenue of A$129.95 million, up by 28.4% with respect to the previous corresponding period. The strong revenue growth was accompanied by a strong cash balance of A$36.75 million, reflecting 54.3% year-on-year growth, at June 2022 end.

Meanwhile, the company’s EBIT increased by A$1.3 million to A$9.4 million.

To know more about SND, click here.

Image source: SND update

The strong performance of Saunders over the years can be seen in the growth of its earnings per share (“EPS”). The company has seen its EPS grow from (-2.26) cents in FY19 to 5.36 cents in FY21 and then 6.24 cents at the end of FY22.

Saunders’ business outlook for FY23

Saunders is performing well with a wide number of projects in its order book. On-time delivery of the projects is one of the main highlights of the company’s business model.

The company has revised its strategic plan to direct its’ focus on defence, oil & gas, infrastructure, and the new energy sector.

The company expects to continue its momentum into the current financial year, underpinned by a record order book, tenders in pipeline and the strength of its balance sheet.

At the end of 30 June 2022, the company had work-in-hand projects worth A$192.89 million, more than double the amount at the end of the last financial year. The company is working on live tenders valued at A$482 million while pipeline opportunities yet to be tendered is worth A$827 million.

Robust order book contributing to revenue beyond FY23

For FY22-24, Saunders estimates there are projects worth A$400+ million yet to be awarded as part of the Federal Government’s ‘Boosting Australia Diesel Storage Program’.

Saunders is working on a project for the US defence department, entailing the design and construction of fuel storage tanks in Darwin. This A$165 million contract secured from Crowley in FY22 is the largest single order project in the company’s history. Moreover, the company undertook several substantial projects at Australian defence facilities during FY22. These projects in the defence sector, highlight the company’s capability and capacity to expeditiously deliver on projects across new defence infrastructure and the upgrade of existing defence fuel facilities.

Under the ‘Fixing Country Bridges Program’, a government initiative to boost infrastructure development, Saunders’ forecasts projects worth ~A$300 million yet to be allocated. The infrastructure boom in the New South Wales region has increased demand for complex precast components.

To learn more about Saunders’ FY22 projects, click here

Saunders has been successful in becoming a preferred contractor for several projects, which are in the final stages of commercial negotiations.

Saunders expects to deliver another year of continued revenue and earnings growth, backed by the current record levels of its order book and the pipeline of new opportunities.

SND shares traded at A$1.06 on 21 October 2022.

Read more about Saunders’ services here